SK and Amazon Launch $5 Billion AI Data Center Deal—A New Era for Cloud and AI Infrastructure

In a bold demonstration of South Korea’s ambition to become a global hub for artificial intelligence (AI) and advanced cloud computing, the government has confirmed that SK Group and Amazon Web Services (AWS) will jointly invest a staggering $5 billion to construct the nation’s largest data centre. This monumental project, which will be situated in Ulsan, represents not only the biggest data-centre initiative in South Korea’s history but also one of the largest collaborative investments in AI infrastructure in the Asia-Pacific region. The significance of this development extends well beyond its impressive monetary value, as it is poised to reshape the digital landscape of South Korea and accelerate its transition toward an AI-driven economy.

The announcement, made public by the Ministry of Science and ICT earlier this month, underscores a new phase of strategic alignment between domestic industrial powerhouses and global technology giants. AWS, a subsidiary of Amazon and the leading global provider of cloud services, will contribute the majority of the capital—nearly $4 billion—while South Korea’s SK Group will play a pivotal role in delivering construction, management, and technological expertise. Groundbreaking is scheduled for September 2025, with the first phase aiming to deliver a 100-megawatt (MW) capacity data centre by 2029. The long-term vision, however, is even more ambitious: a hyperscale facility with up to 1 gigawatt (GW) capacity, which would place it among the most powerful data centres in the world.

The timing of this initiative is particularly noteworthy, as global competition in AI model training, cloud computing, and digital infrastructure is intensifying. Major players across North America, Europe, and Asia are racing to build state-of-the-art data centres capable of supporting the latest advancements in generative AI, natural language processing, autonomous systems, and big data analytics. In this context, South Korea’s landmark deal is both a national statement of intent and a calculated move to secure technological sovereignty in the AI age.

South Korea has long harboured aspirations of evolving into a major global technology player. While it has achieved leadership in semiconductors, smartphones, and telecommunications—thanks to industry giants such as Samsung and SK hynix—the next frontier is AI and cloud services. The government’s Digital New Deal, launched in 2020, explicitly aims to foster a thriving AI ecosystem. The partnership with AWS provides a critical foundation for this vision, offering the compute power necessary to train large-scale AI models domestically, thereby reducing reliance on foreign data infrastructure.

Equally important is the project’s geographic dimension. Ulsan, traditionally known as a manufacturing and industrial hub, will now find itself at the forefront of South Korea’s AI revolution. By locating this hyperscale data centre outside of Seoul’s capital region, the initiative promotes a more balanced distribution of digital infrastructure and economic opportunity across the country. Ulsan’s transformation into an AI innovation hub aligns with the government’s broader efforts to decentralise the tech economy and stimulate growth in regional centres.

The ripple effects of this investment are already being felt in the financial markets. Following the announcement, shares of major AI-related firms surged. SK hynix recorded a 3% gain, Kakao saw an impressive 11% jump, and LG CNS advanced by 9%. The KOSPI index itself rose above 3,000 for the first time in months, signalling broad investor confidence in the country’s AI-driven growth trajectory. Market analysts anticipate that the data centre will attract complementary investments, foster new AI-driven business models, and enhance the competitiveness of South Korean technology firms on the global stage.

Beyond its domestic implications, the SK–AWS data centre project holds considerable geopolitical and strategic importance. As global tensions over AI leadership and data sovereignty mount, nations are increasingly seeking to host critical infrastructure within their own borders. This project will enable South Korea to safeguard sensitive data, ensure compliance with local regulations, and maintain control over key elements of its digital future. Moreover, by deepening ties with Amazon—one of the world’s most influential technology firms—South Korea strengthens its position in the global AI ecosystem and fosters greater international collaboration.

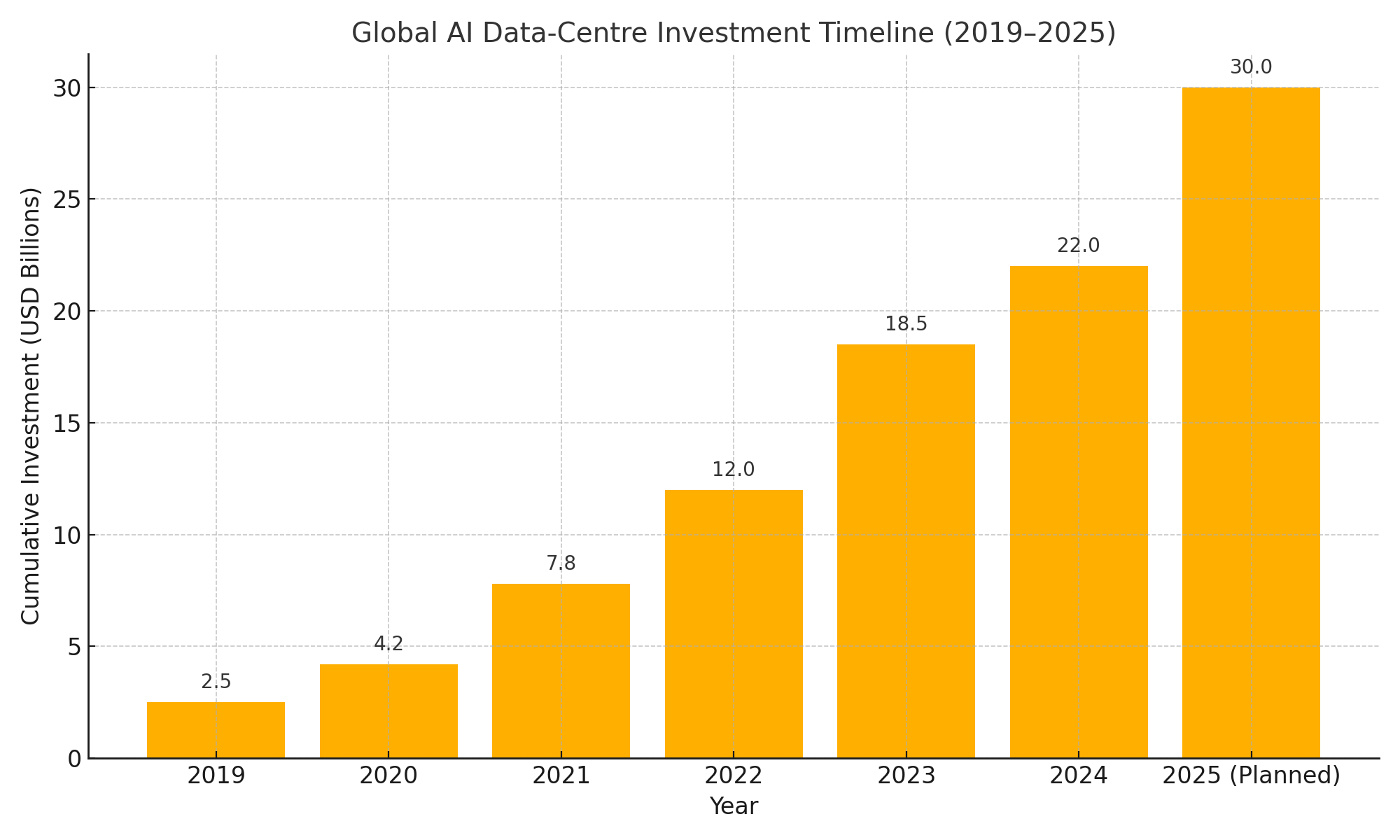

The broader landscape of AI and cloud infrastructure is marked by a surge in mega-investments. From Microsoft’s multi-billion dollar partnerships with OpenAI and Saudi Arabia to Google’s and Meta’s aggressive data-centre expansions in Europe and Southeast Asia, tech giants are pouring unprecedented resources into building the next generation of digital infrastructure. Against this backdrop, South Korea’s $5 billion initiative positions the nation as a credible contender in the AI arms race. It signals to the world that South Korea is committed to not only participating in but shaping the future of AI.

In sum, the announcement that SK and AWS will invest $5 billion in South Korea’s largest data centre is far more than a headline-grabbing deal. It reflects a strategic convergence of national ambition, corporate vision, and global market dynamics. This blog post will explore the key dimensions of this transformative project: the specifics of the partnership and construction plans, the anticipated economic and market impacts, the technological and strategic significance for South Korea’s AI ambitions, and the broader implications for the Asia-Pacific region and global cloud industry.

Deal Breakdown: Players & Plans

The landmark $5 billion data-centre initiative in South Korea represents a well-calculated partnership between some of the most influential players in the global and domestic technology sectors—Amazon Web Services (AWS), SK Group, and the South Korean government. The magnitude and structure of this deal merit detailed examination, as they reveal the underlying strategic motivations and set clear expectations for future developments. In this section, we will explore the main participants, financial commitments, project specifications, governance structures, and the broader industrial plans associated with this transformative initiative.

Key Participants: AWS, SK Group, and the South Korean Government

At the core of this investment lies a strategic alignment between AWS, the world’s largest cloud computing provider, and SK Group, South Korea’s second-largest conglomerate after Samsung. The South Korean government, through the Ministry of Science and ICT, also plays a crucial enabling role, providing the regulatory support and facilitating land-use approvals necessary for such a massive infrastructure project.

Amazon Web Services (AWS) has long been a pioneer in building hyperscale data centres across the globe. It operates some of the largest and most technologically advanced facilities in North America, Europe, and Asia. This new project marks AWS’s most significant infrastructure commitment in South Korea to date. AWS is expected to provide nearly $4 billion of the total investment. The company’s deep expertise in cloud services, AI model hosting, and hyperscale architecture will be vital to the successful deployment of the Ulsan centre.

SK Group, best known internationally for its semiconductor arm SK hynix, has been making substantial investments in AI and data-driven industries. The conglomerate is well-positioned to deliver local project management, construction expertise, and technological contributions. Furthermore, SK will provide both financial backing and business development leadership to ensure that the new data centre meets the needs of South Korea’s rapidly growing AI ecosystem.

The involvement of the South Korean government elevates this initiative from a purely commercial project to a nationally significant infrastructure undertaking. The Ministry of Science and ICT, alongside other agencies, will facilitate the regulatory framework, energy access, and talent pipeline necessary to support the hyperscale facility. President Yoon Suk-yeol’s administration views this as a core component of its Digital New Deal 2.0 strategy.

Financial Commitments and Resource Allocation

The combined investment will total $5 billion, with AWS contributing approximately $4 billion and SK Group funding the remainder. The funds will be used to cover multiple phases of construction, procurement of cutting-edge equipment, staffing, and long-term operational costs.

It is worth noting that this investment also includes significant renewable energy commitments, as AWS and SK have pledged to ensure that the centre operates on a sustainable energy model. This is in alignment with both companies’ global environmental, social, and governance (ESG) goals and with South Korea’s own national green energy policies.

Additionally, tax incentives and government subsidies are expected to be structured into the project, although precise details have not been disclosed publicly. These incentives will help offset initial capital expenditure and accelerate the development timeline.

Project Specifications and Timelines

The hyperscale data centre will be constructed in Ulsan, a city historically associated with heavy industry but now being repositioned as a future tech and innovation hub. The selection of Ulsan, rather than the more saturated Seoul-Incheon corridor, reflects a deliberate strategy to promote balanced regional development.

Groundbreaking is scheduled to take place in September 2025, with the first major construction phase targeting a 100-megawatt (MW) operational capacity by 2029. To contextualize, a 100 MW facility is sufficient to host thousands of advanced GPU clusters—capable of training large-scale AI models in a fraction of the time possible today.

The long-term roadmap envisions scaling the facility to 1 gigawatt (GW) of capacity, making it one of the largest AI-focused data centres in Asia. Achieving this level of scale will place South Korea in a highly competitive position relative to Japan, Singapore, and Australia in the Asia-Pacific cloud ecosystem.

The design will incorporate modular architecture, allowing for phased expansion as demand for compute capacity accelerates. This will also enable the rapid adoption of next-generation hardware such as NVIDIA’s upcoming AI accelerators and new optical interconnect technologies.

Governance and Strategic Oversight

The partnership will operate under a joint governance framework, with a steering committee comprising representatives from AWS, SK Group, and relevant government bodies. Chey Tae-won, chairman of SK Group, has personally signaled his commitment to ensuring the project’s alignment with the national AI strategy.

President Yoon’s administration has also created an inter-agency AI Infrastructure Task Force to oversee regulatory harmonization, grid integration, and cybersecurity standards for the centre. This high-level political involvement underscores the project’s strategic significance.

In addition, academic and research partnerships will be encouraged as part of the project’s mission to cultivate South Korea’s AI talent pool. Leading universities and public R&D institutes will be provided access to the centre’s computing resources, fostering innovation and collaboration.

Industrial Ecosystem and Complementary Investments

The project is expected to act as a catalyst for secondary investments across South Korea’s AI and tech sectors. Already, several domestic companies have signalled interest in co-locating facilities and services near Ulsan to take advantage of proximity to the data centre.

Kakao, Naver, LG CNS, and several semiconductor startups are among those that have expressed preliminary interest in future collaborations. The facility’s availability will also provide SMEs and AI startups with access to previously unattainable levels of compute power, democratizing innovation across the ecosystem.

Furthermore, energy and utilities providers in Ulsan are preparing to upgrade grid capacity and renewable supply chains to support the data centre’s substantial power requirements. This will create synergies with South Korea’s broader green energy transition.

The SK–AWS partnership represents an unprecedented commitment to advancing South Korea’s AI infrastructure. By pooling world-class cloud expertise with domestic industrial strengths, this initiative is poised to deliver a transformative data-centre project that can reshape the nation’s AI landscape for decades to come. The collaboration’s detailed financial planning, phased implementation, and governance structure reflect a maturity that bodes well for its success.

As the first construction milestones approach in 2025, global industry watchers will closely monitor the Ulsan project’s progress—not just for what it represents within South Korea, but for its wider impact on the global AI and cloud computing race.

Economic & Market Impacts

The SK–AWS $5 billion data-centre project in Ulsan is not merely an exercise in infrastructure development—it represents a critical lever for economic transformation at multiple levels. From immediate stock market reactions to long-term industrial and regional impacts, this initiative is poised to reshape South Korea’s digital economy, labour market, and investment environment. In this section, we examine the various dimensions of these economic and market effects.

Immediate Financial Market Reaction

The public announcement of this data-centre investment produced an almost instantaneous response in South Korea’s capital markets. Major AI-related and cloud-aligned equities surged in value, reflecting both institutional investor optimism and wider public confidence in the country’s digital future.

Shares of SK hynix, one of the world’s leading suppliers of DRAM and NAND flash memory essential for AI data centres, climbed 3% in the days following the news. Kakao, a diversified tech company with strong interests in AI-powered services and cloud-based platforms, experienced an even more pronounced rally—gaining 11%. Similarly, LG CNS, which provides IT services and cloud integration solutions, advanced by 9%.

The bullish sentiment was not limited to individual stocks. The KOSPI Index, South Korea’s benchmark equity index, rose above 3,000 points for the first time in months—a clear signal that investors perceived this infrastructure move as a major positive for the nation’s medium- and long-term economic trajectory.

Many market analysts have interpreted these gains as more than just a transient “news pop.” Rather, they are viewed as a vote of confidence in South Korea’s potential to emerge as a key regional hub for AI and cloud computing—thus opening up new revenue streams for both established conglomerates and emerging tech firms.

| Company | Stock Price (Before) | Stock Price (After) | % Change |

|---|---|---|---|

| SK hynix | 123,000 KRW | 126,690 KRW | +3% |

| Kakao | 56,000 KRW | 62,160 KRW | +11% |

| LG CNS | 34,500 KRW | 37,605 KRW | +9% |

| KOSPI Index | 2,940 | 3,010 | +2.38% |

Boost to Regional Economies

The selection of Ulsan as the site for this massive investment carries important implications for regional economic development. Traditionally an industrial powerhouse known for shipbuilding and automotive manufacturing, Ulsan has struggled in recent years with an overreliance on legacy sectors.

This data-centre project provides Ulsan with an opportunity to diversify its economy and become a magnet for high-tech investment. The city is expected to benefit from:

- Job creation: both during construction and operational phases, with thousands of skilled and semi-skilled positions being generated.

- Higher tax revenues: new business activity and increased property values will contribute to local government coffers.

- Ancillary business growth: demand for services such as IT support, maintenance, hospitality, and professional consulting is expected to rise substantially.

Moreover, spillover effects are likely to ripple across surrounding regions in Gyeongsang Province, encouraging complementary investments in fibre-optic networking, renewable energy generation, and digital services.

Industrial Ecosystem Expansion

South Korea’s ambition to become a leading global AI hub depends on cultivating a thriving industrial ecosystem. The SK–AWS project addresses this imperative in multiple ways.

First, the sheer scale of the hyperscale facility will dramatically expand available compute capacity within the country. This will enable AI startups, academic researchers, and even SMEs to access cutting-edge infrastructure without needing to rely on foreign providers.

Second, the project is expected to stimulate growth across related sectors, particularly:

- Semiconductors: demand for high-performance chips—such as HBM (High Bandwidth Memory) and AI-optimized GPUs—will rise in tandem with data-centre deployment.

- Telecommunications: South Korea’s telcos will need to upgrade backbone networks to support vast increases in data flow to and from the centre.

- Cloud software and platform services: a new generation of AI-driven platforms and Software-as-a-Service (SaaS) products will emerge to capitalize on the compute resources.

Already, leading firms such as Kakao, Naver, and LG CNS are exploring partnerships and service offerings that can leverage the new data-centre’s infrastructure.

Attracting Foreign and Domestic Investment

The high-profile nature of this project also sends an important signal to international investors and partners: South Korea is open for business in the AI and cloud computing sectors.

Institutional investors—including sovereign wealth funds and large pension funds—are likely to view this as a green light to increase allocations toward Korean tech equities. Additionally, the presence of AWS as a global player may encourage other multinational tech firms to either co-invest or initiate related infrastructure projects in the region.

Domestically, many Korean conglomerates (chaebol) are expected to expand their own AI investment portfolios in response. This competitive dynamic could generate a virtuous cycle of innovation, with increased venture capital flows and higher startup formation rates.

Labour Market and Talent Development

The data-centre initiative will also have a marked impact on the South Korean labour market. Demand for:

- AI engineers and data scientists

- Cloud architects and systems administrators

- Cybersecurity specialists

- Renewable energy technologists

… is set to increase significantly over the next 3–5 years. This will, in turn, spur universities and vocational institutions to revise curricula and expand AI- and cloud-focused programmes.

SK Group and AWS have already hinted that they will partner with academic institutions to ensure that the pipeline of skilled graduates meets future demand.

The economic and market impacts of the SK–AWS data-centre project extend well beyond the immediate stock market gains. By stimulating regional development, accelerating the evolution of South Korea’s AI industrial ecosystem, attracting new investment, and enhancing the labour market, this initiative represents a multi-dimensional boost to the nation’s digital economy.

As construction progresses, further waves of positive market sentiment and economic ripple effects are likely to materialize—especially as the facility approaches its first operational milestones. For policymakers, business leaders, and investors alike, the project offers both tangible and symbolic confirmation that South Korea is rapidly ascending the global AI infrastructure ladder.

Why This Centre Matters for AI & Cloud Infrastructure

Beyond its scale and monetary value, the SK–AWS hyperscale data-centre project holds profound significance for South Korea’s future role in the global AI and cloud computing ecosystem. In an era where data-centre capacity equates to national economic competitiveness and digital sovereignty, this initiative addresses critical gaps and propels the country into a new technological era.

In this section, we examine why this data centre matters strategically: its technical significance, its implications for global cloud competition, the benefits it brings to South Korea’s AI ecosystem, and how it positions the nation in the fast-evolving digital landscape.

Hyperscale Capacity as a Strategic Asset

At full buildout, the Ulsan data centre is projected to reach 1 gigawatt (GW) in capacity, placing it firmly in the hyperscale category. This level of capacity is not merely a numerical milestone; it represents a foundational enabler for next-generation AI systems.

AI development today requires immense compute power. The training of large language models (LLMs) and multimodal AI systems—such as OpenAI’s GPT-5 series, Google DeepMind’s Gemini family, and Anthropic’s Claude models—demands tens of thousands of GPU clusters operating in parallel. Without domestic hyperscale infrastructure, South Korean companies and researchers have had to rely on overseas compute resources, often at considerable cost and with concerns over latency, data privacy, and export restrictions.

By hosting such compute power within its own borders, South Korea will achieve critical digital autonomy:

- Latency will be dramatically reduced, improving responsiveness for AI-powered services in sectors such as healthcare, automotive, robotics, and smart cities.

- Data sovereignty will be strengthened, with sensitive data processed and stored in-country in compliance with Korean privacy laws.

- Innovation cycles will accelerate, as AI researchers and startups gain affordable access to infrastructure that was previously out of reach.

In effect, the data centre becomes a national strategic asset, as essential to the digital economy as ports, airports, and power grids have been to industrial economies.

Reinforcing AWS’s Asia-Pacific Footprint

This investment also reflects broader shifts in global cloud competition. While AWS has long been the dominant cloud provider globally, Microsoft Azure, Google Cloud, Tencent Cloud, and Alibaba Cloud have been investing aggressively across Asia-Pacific.

By constructing this flagship facility in South Korea, AWS strengthens its regional positioning:

- It provides a competitive edge over rivals in terms of capacity, latency, and tailored services for Korean enterprises.

- It aligns AWS more closely with Korean corporate partners such as SK Group, Samsung, and LG.

- It creates opportunities to serve regional markets beyond Korea, including Japan, Southeast Asia, and potentially India, through interconnectivity and peering agreements.

For AWS, this project thus represents both a defensive move—retaining leadership in the face of rising competition—and an offensive move—expanding its service portfolio with AI-optimized infrastructure.

Accelerating the Domestic AI Ecosystem

For South Korea’s own AI ecosystem, the significance of this data centre cannot be overstated.

Over the past five years, Korean AI development has made impressive strides. However, the lack of domestic hyperscale compute infrastructure has been a bottleneck for further progress:

- AI startups have faced prohibitive cloud costs when accessing overseas compute.

- University researchers have encountered limitations in the size of models they can train.

- Korean LLMs and generative AI projects have lagged behind their US and Chinese counterparts.

The SK–AWS data centre will transform this landscape:

- Startups and SMEs will gain access to affordable, scalable AI compute through AWS’s cloud offerings.

- Academic consortia can partner with SK and AWS to train state-of-the-art models on Korean language and datasets.

- Large Korean tech firms (such as Naver and Kakao) can scale their AI services and deploy them with reduced latency to local users.

Moreover, the facility is expected to incorporate AI accelerators optimized for specific tasks—ranging from natural language understanding to computer vision and recommendation systems. This will unlock new use cases in industries such as fintech, biotech, entertainment, and manufacturing.

Enabling AI-Driven Public Services

An often-overlooked dimension is the potential for this centre to enable AI-powered public services. The South Korean government has ambitious plans to digitize public administration, healthcare, education, and transportation.

With hyperscale AI compute available domestically:

- Public sector AI deployments—such as intelligent traffic systems or AI-driven healthcare diagnostics—can operate with real-time responsiveness.

- Citizen data can remain within national jurisdiction, addressing privacy and ethical concerns.

- Inter-agency AI collaboration will be simplified, fostering a more integrated approach to e-government.

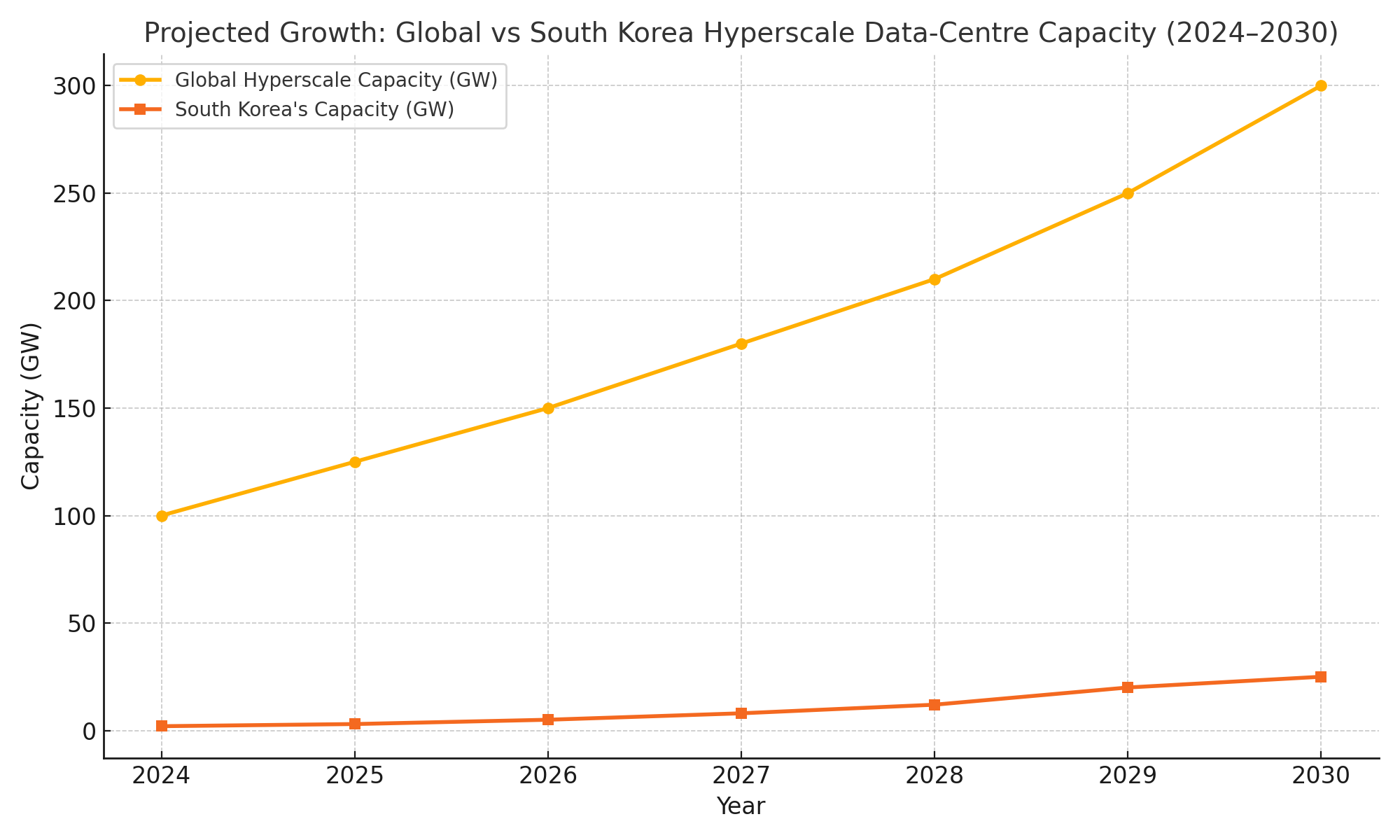

This chart will illustrate how South Korea’s share of global hyperscale data-centre capacity is projected to rise once the SK–AWS facility reaches 1 GW. In 2024, Korea’s share of Asia-Pacific hyperscale capacity is modest, dwarfed by Japan, Singapore, and Australia. By 2030, with this facility online, Korea is projected to close the gap, positioning itself as a top-tier regional AI hub.

Such capacity growth is not merely about prestige. It translates directly into economic multipliers—attracting foreign direct investment (FDI), anchoring AI supply chains, and enabling Korea’s technology exports to scale.

Positioning Korea in the Global AI Race

As of 2025, the AI “arms race” is in full swing globally. Nations such as the US, China, and the UAE are investing tens of billions into AI and cloud infrastructure, viewing them as determinants of future economic leadership.

With the SK–AWS data centre:

- South Korea signals its intent to compete in this race on equal terms.

- It gains leverage in regional alliances—including in Quad, Indo-Pacific Economic Framework, and other multilateral partnerships.

- It positions itself as a potential neutral AI development hub—trusted by both Western and Asian partners.

In an era where compute power equates to geopolitical influence, South Korea’s enhanced digital infrastructure will become a strategic asset for national resilience and international cooperation.

The SK–AWS hyperscale data centre matters because it bridges South Korea’s current digital infrastructure gap. It empowers Korean companies to innovate faster, enables public services to become smarter, and elevates Korea’s standing in the global AI and cloud landscape.

While the road to full 1-GW capacity will take years to complete, the strategic impact of this investment is already evident. For Korea’s AI ecosystem, policymakers, and global tech partners, this project represents a decisive leap forward into the next era of digital transformation.

Broader Implications & Future Outlook

The SK–AWS hyperscale data-centre project represents far more than a major infrastructure investment. It reflects a deliberate pivot in South Korea’s national strategy—toward securing digital leadership, driving AI innovation, and positioning the country as a regional and global hub for cloud computing. As this project unfolds, the implications for geopolitical alignment, sustainability, technology partnerships, and industrial competitiveness will ripple across sectors. This section explores the broader significance of the initiative and provides an outlook on the pathways ahead.

Geopolitical Dynamics and Digital Sovereignty

At a time of intensifying competition over AI leadership and cloud infrastructure, data-centre capacity is increasingly viewed as a form of geopolitical capital. Nations that control significant domestic AI compute resources are better positioned to shape international standards, safeguard their data, and support national innovation ecosystems.

For South Korea, the Ulsan project marks a decisive move toward enhanced digital sovereignty:

- In-country hosting of AI infrastructure reduces dependence on foreign data flows and mitigates risks associated with geopolitical tensions.

- Compliance with Korean privacy and security regulations becomes more straightforward when data remains within national borders.

- Alignment with allied technology standards (notably those of the US and Quad nations) helps South Korea avoid entanglement in divergent regulatory regimes.

At the same time, the project deepens strategic ties between South Korea and the United States. AWS, as a major US technology actor, becomes more embedded in Korea’s digital landscape—while SK Group gains greater leverage in global cloud partnerships. This partnership may influence how Korea navigates its AI diplomacy within the Indo-Pacific region and beyond.

Catalyzing Follow-On Expansion and Partnerships

While the initial $5 billion investment will build out a 100 MW facility by 2029—with scaling toward 1 GW—the project is expected to serve as a magnet for follow-on investments:

- Foreign direct investment (FDI) from global AI startups and scaleups is likely to increase as South Korea markets itself as an AI-friendly jurisdiction.

- Domestic conglomerates (Samsung, LG, Hyundai) may accelerate their own AI infrastructure buildouts to complement the SK–AWS facility.

- New technology partnerships could emerge with Japanese, European, and North American firms seeking access to hyperscale compute within South Korea.

Such clustering effects can transform Ulsan into a regional digital hub—not unlike how Dublin, Frankfurt, and Singapore have become AI cloud magnets for their respective markets.

Sustainability and Energy Considerations

One of the critical challenges for any hyperscale data-centre project lies in balancing energy consumption with sustainability objectives.

AWS and SK Group have publicly committed to integrating renewable energy solutions and achieving high energy efficiency for the Ulsan facility. This aligns with:

- South Korea’s Net Zero 2050 goals.

- AWS’s Climate Pledge to operate all infrastructure with 100% renewable energy by 2025.

- SK’s corporate ESG mandates.

However, delivering on these goals will not be simple. The data centre, at full 1 GW capacity, will require a substantial portion of Ulsan’s energy grid. To mitigate this:

- New renewable energy generation (offshore wind, solar) will need to be brought online.

- Grid upgrades will be required to handle the load while maintaining stability.

- Advanced cooling and energy management systems will need to be implemented to reduce per-MW power consumption.

If executed successfully, the project could serve as a benchmark for sustainable AI infrastructure in the Asia-Pacific region—demonstrating that hyperscale facilities can be aligned with climate commitments.

Risks and Execution Challenges

No project of this scale is without risks. Key challenges to monitor include:

- Supply chain volatility: global shortages of GPUs, networking hardware, or construction materials could delay timelines.

- Regulatory shifts: evolving Korean or international rules on AI ethics, data localization, or energy use may introduce new compliance burdens.

- Cost inflation: rising costs for energy, labour, or key components could impact project economics.

- Geopolitical tensions: further deterioration in US–China relations could affect supply chains for semiconductors and AI hardware.

Both SK Group and AWS have robust project governance mechanisms in place to manage such risks, but ongoing vigilance will be required.

Implications for Korea’s AI Talent Ecosystem

The successful operation of a hyperscale AI data centre will drive demand for highly skilled talent in:

- AI engineering and data science.

- Cloud architecture and systems administration.

- Cybersecurity.

- Advanced semiconductor design and manufacturing.

- Sustainable energy management.

This will, in turn, influence Korea’s education and workforce development policies:

- Universities may expand AI-focused degree programmes.

- Vocational training initiatives will grow to fill technician and support roles.

- International talent recruitment may be accelerated to meet specialist needs.

In the long run, Korea could emerge as a regional talent hub for AI and cloud infrastructure, enhancing its competitiveness in the global digital economy.

Shaping the Next Phase of South Korea’s Digital Strategy

The SK–AWS partnership also feeds directly into South Korea’s Digital New Deal 2.0 strategy and broader economic vision.

As the Ulsan data centre scales:

- AI-driven industries—healthcare, robotics, fintech, smart mobility—will gain a new foundation for innovation.

- Public sector services will be empowered by domestic AI capabilities.

- Export opportunities for Korean AI platforms and services will expand, especially into Southeast Asia.

Moreover, the project serves as a model for public–private partnerships (PPPs) in high-tech infrastructure. Its success may encourage similar collaborations in quantum computing, semiconductor R&D, or advanced networking (6G).

Conclusion

The SK–AWS hyperscale data-centre project represents a turning point in South Korea’s digital evolution. It is not merely a facility—it is an enabler of future economic growth, geopolitical positioning, sustainability leadership, and AI ecosystem development.

As global demand for AI compute accelerates, nations that invest boldly in infrastructure will define the next chapter of technological innovation. With this landmark project, South Korea signals that it intends to be among that vanguard.

The coming years will reveal just how transformative this initiative can be. For now, it stands as a powerful example of what is possible when visionary national strategy aligns with global corporate expertise.

References

- https://www.reuters.com/technology/sk-amazon-aws-invest-5-billion-south-korea-data-centre

- https://www.bloomberg.com/news/articles/amazon-sk-to-build-largest-ai-data-center-in-south-korea

- https://www.ft.com/content/technology-sk-aws-south-korea-data-centre

- https://www.wsj.com/articles/amazon-expands-ai-infrastructure-in-asia-with-south-korea-deal

- https://asia.nikkei.com/Business/Technology/Amazon-and-SK-announce-5-billion-data-hub-in-South-Korea

- https://www.koreatimes.co.kr/www/tech/2025/06/133_XXXXXX.html

- https://www.koreaherald.com/view.php?ud=XXXXXX

- https://aws.amazon.com/blogs/publicsector/aws-invests-in-korea-s-biggest-ai-data-center

- https://www.businesskorea.co.kr/news/articleView.html?idxno=XXXXXX

- https://www.cnbc.com/2025/06/amazon-sk-to-invest-5b-in-korea-ai-data-centre-project.html