Oracle Shares Surge as AI Cloud Revenue Expectations Reshape the Competitive Landscape

Oracle Corporation, a titan in enterprise software and cloud computing, has recently captured renewed investor attention as its shares climbed on the back of robust cloud revenue expectations driven by the surging demand for artificial intelligence (AI) workloads. The company’s fiscal outlook, bolstered by strategic AI integrations across its cloud portfolio, has prompted significant market enthusiasm, leading to a notable upswing in its stock performance. This development not only reflects Oracle’s own transformation journey but also underscores the broader acceleration of AI-fueled growth across the cloud computing sector.

In its latest earnings report, Oracle delivered strong financial results that exceeded Wall Street estimates, particularly in its cloud infrastructure and software-as-a-service (SaaS) segments. Of particular interest to investors was the company’s upward revision of its cloud revenue guidance, attributing this optimistic forecast to an unprecedented wave of demand from enterprises racing to deploy AI solutions. This AI-driven demand is reshaping Oracle’s revenue mix and positioning the company as a formidable competitor in a cloud market long dominated by Amazon Web Services (AWS), Microsoft Azure, and Google Cloud.

The broader technology landscape is witnessing an inflection point where AI capabilities, particularly large language models (LLMs), generative AI applications, and advanced analytics, are driving a new era of cloud consumption. Enterprises across industries are increasingly seeking scalable, high-performance cloud platforms to support AI workloads, which require vast compute power, storage, and data orchestration capabilities. Oracle, leveraging its AI-optimized infrastructure and differentiated offerings such as Autonomous Database and industry-specific cloud solutions, is capitalizing on this trend with notable agility.

This momentum has strategic significance not just for Oracle’s business trajectory but for the competitive dynamics of the cloud market. For years, Oracle trailed its larger cloud rivals. However, its focused investments in AI infrastructure, partnerships with key players like NVIDIA and Cohere, and commitment to sovereign cloud solutions are now reshaping market perceptions. The stock market’s positive response signals growing confidence that Oracle’s AI-centric cloud strategy can drive sustained growth and market share gains in the years ahead.

Moreover, Oracle’s recent announcements come at a time when enterprises are re-evaluating their cloud partnerships with an eye toward optimizing for AI capabilities. Concerns over rising cloud costs, data sovereignty, and AI model training performance are prompting organizations to consider alternative providers. Oracle’s ability to offer competitive AI compute, coupled with its deep expertise in managing enterprise data and applications, positions it as an increasingly attractive choice.

Industry analysts have highlighted that Oracle’s AI-related cloud pipeline is robust and expanding, with significant deal wins across government, financial services, healthcare, and telecommunications sectors. These sectors, which generate substantial volumes of sensitive and mission-critical data, are seeking AI-powered insights and automation at scale—needs that align closely with Oracle’s core strengths.

The market’s reaction to Oracle’s strong AI-fueled cloud revenue expectations also reflects a broader thematic trend: the convergence of cloud computing and AI is entering a hyper-growth phase. The compute intensity of training and deploying AI models is driving cloud consumption to new heights. Providers that can deliver optimized AI infrastructure, seamless integration with data platforms, and trusted enterprise-grade capabilities are poised to benefit disproportionately. Oracle’s recent performance suggests it is becoming one of those key beneficiaries.

As we explore Oracle’s evolving strategy and market positioning in the sections that follow, several critical themes will emerge:

- Oracle’s Cloud Strategy and AI Integration Roadmap: How Oracle’s cloud business has transformed and how AI is now embedded across its offerings.

- Financial Performance and Market Expectations: A closer look at Oracle’s earnings, cloud revenue trends, and analyst outlook.

- Competitive Landscape and Differentiators: How Oracle is positioning itself in the AI-cloud race relative to AWS, Microsoft, and Google.

- Risks, Challenges, and Sustainability: The key risks and challenges Oracle faces as it seeks to sustain AI-driven cloud growth.

Through this lens, we can better understand why Oracle’s shares have climbed, why investors are optimistic about its AI-powered cloud trajectory, and what this means for the future of both Oracle and the broader cloud computing market.

In this blog, we will delve deeply into each of these dimensions, supported by relevant data, charts, and analysis, to provide a comprehensive perspective on Oracle’s strategic evolution. The story of Oracle’s AI-fueled cloud ascent is more than a short-term stock market event; it is a reflection of fundamental shifts in enterprise technology priorities and the rapidly evolving landscape of cloud and AI convergence.

Oracle’s Cloud Strategy and AI Integration Roadmap

Oracle’s evolution in the cloud computing market has been a story of strategic recalibration, technological reinvention, and deliberate investment. For much of the past decade, Oracle lagged behind the dominant hyperscalers—Amazon Web Services (AWS), Microsoft Azure, and Google Cloud—in terms of market share and innovation velocity. However, the emergence of artificial intelligence (AI) as a central driver of enterprise cloud consumption has catalyzed a profound shift in Oracle’s cloud strategy. Today, Oracle is positioning itself as a key enabler of AI-powered digital transformation, leveraging its unique strengths in data management, infrastructure optimization, and enterprise integration to carve out a differentiated space in the hypercompetitive cloud landscape.

Historical Context: From Cloud Follower to AI-Optimized Provider

Oracle’s entry into the cloud market was initially characterized by a focus on software-as-a-service (SaaS) offerings, with flagship products such as Oracle Fusion Cloud Applications Suite targeting enterprise customers across human capital management (HCM), customer relationship management (CRM), enterprise resource planning (ERP), and supply chain management (SCM). While these SaaS products gained traction, Oracle’s infrastructure-as-a-service (IaaS) offerings initially struggled to compete with the scale and maturity of AWS and Azure.

Recognizing the limitations of its first-generation cloud infrastructure, Oracle embarked on a comprehensive re-architecture initiative, culminating in the launch of Oracle Cloud Infrastructure (OCI) Gen 2. Designed to address enterprise concerns around performance, security, and predictability, OCI Gen 2 provided a modern, high-performance cloud platform optimized for demanding workloads. This architectural overhaul laid the foundation for Oracle’s current AI-centric cloud strategy.

The AI Catalyst: Driving Oracle’s Cloud Renaissance

The rapid proliferation of AI workloads—particularly those involving large language models (LLMs), generative AI applications, and advanced analytics—has introduced new requirements for cloud infrastructure. These workloads demand unparalleled compute density, low-latency networking, massive storage throughput, and seamless integration with enterprise data ecosystems. Oracle has strategically aligned its cloud offerings to meet these needs, making AI a central pillar of its growth strategy.

AI-Optimized Compute Instances

At the heart of Oracle’s AI cloud proposition is its portfolio of AI-optimized compute instances. Through deep partnerships with NVIDIA, Oracle offers access to state-of-the-art GPUs, including the NVIDIA H100 Tensor Core GPUs, which are widely regarded as the gold standard for AI training and inference. OCI’s AI infrastructure delivers superior price-performance metrics, enabling customers to run large-scale AI workloads with greater efficiency and predictability.

Oracle’s high-bandwidth, low-latency RDMA (Remote Direct Memory Access) networks further enhance the performance of distributed AI training, supporting the scale-out architectures required for modern AI models. Additionally, Oracle’s AI superclusters—pre-configured environments optimized for multi-node AI training—simplify deployment and accelerate time to value for enterprise AI initiatives.

Autonomous Database with Integrated AI

Another key differentiator in Oracle’s AI-cloud strategy is its Autonomous Database, which integrates advanced AI and machine learning capabilities directly into the database layer. Oracle’s Autonomous Database leverages AI to automate routine management tasks such as tuning, patching, backup, and scaling, thereby reducing operational overhead and improving reliability.

More importantly, it enables in-database machine learning, allowing data scientists and developers to build, train, and deploy machine learning models using data residing within the database. This architecture eliminates the need for complex data movement pipelines, reduces latency, and enhances data governance—a critical consideration for regulated industries such as financial services and healthcare.

The integration of generative AI capabilities into Autonomous Database further amplifies its value proposition. Developers can now embed conversational AI interfaces, natural language queries, and automated insights directly within enterprise applications, unlocking new opportunities for productivity and innovation.

Industry-Specific AI Cloud Solutions

Oracle has also pursued a verticalized AI cloud strategy, developing industry-specific cloud solutions that incorporate tailored AI capabilities. Examples include:

- Oracle Financial Services Analytical Applications with embedded AI for fraud detection and risk management

- Oracle Health AI Services for clinical data insights and patient outcome optimization

- Oracle Retail AI Solutions for demand forecasting, inventory optimization, and personalized customer experiences

These vertical offerings differentiate Oracle in a crowded market by addressing domain-specific challenges with pre-built AI models and workflows.

Strategic Partnerships: Building an AI Ecosystem

Oracle’s AI-cloud ambitions are further reinforced by strategic partnerships with leading AI innovators. The company’s alliance with NVIDIA extends beyond GPU supply; it encompasses joint engineering efforts to optimize AI infrastructure, co-marketing initiatives, and collaborative go-to-market strategies. Oracle is also partnering with Cohere and OpenAI to integrate cutting-edge language models into its cloud services, offering customers a choice of best-in-class AI capabilities.

Through these partnerships, Oracle is building a vibrant AI ecosystem that empowers customers to harness the full potential of generative AI and machine learning while benefiting from Oracle’s enterprise-grade cloud platform.

Major Customer Wins and AI Deployments

Oracle’s AI-optimized cloud offerings are gaining traction across a diverse range of industries. Notable examples include:

- Government Agencies: Deploying secure, sovereign AI clouds to support national data initiatives and public sector AI applications.

- Financial Institutions: Leveraging OCI’s high-performance AI infrastructure for risk modeling, algorithmic trading, and customer analytics.

- Healthcare Providers: Using Oracle Health AI Services to drive precision medicine, streamline clinical workflows, and enhance patient care.

- Telecommunications Operators: Implementing AI-driven network optimization, predictive maintenance, and customer experience enhancements.

These deployments not only contribute to Oracle’s cloud revenue growth but also validate its strategic focus on delivering AI-powered solutions that address real-world enterprise needs.

Roadmap: The Future of Oracle’s AI Cloud Strategy

Looking ahead, Oracle’s AI-cloud roadmap is centered on three strategic priorities:

- Scaling AI Infrastructure: Oracle plans to continue expanding its global network of AI data centers, adding capacity to support growing demand for AI training and inference workloads.

- Deepening Industry Focus: The company will further enhance its portfolio of industry-specific AI cloud solutions, leveraging its deep domain expertise and customer relationships.

- Advancing AI Integration: Oracle is committed to embedding generative AI capabilities across its entire cloud suite, enabling more intelligent, adaptive, and autonomous enterprise applications.

In parallel, Oracle is exploring innovations in custom silicon, sovereign AI cloud regions, and hybrid cloud architectures to address emerging customer requirements and regulatory considerations.

Conclusion

Oracle’s cloud strategy has undergone a remarkable transformation, propelled by the strategic integration of AI across its infrastructure, platform, and application layers. By aligning its offerings with the needs of modern AI workloads and fostering a robust ecosystem of partnerships and industry solutions, Oracle is redefining its role in the cloud market.

As demand for AI-driven cloud services continues to accelerate, Oracle’s differentiated capabilities position it to capture a growing share of this expanding market. The company’s ability to deliver performance, security, and enterprise-grade functionality at scale will be key to sustaining its momentum and driving long-term growth.

Financial Performance and Market Expectations

Oracle’s recent financial performance has served as a powerful testament to the success of its evolving cloud strategy, particularly its pivot toward AI-driven offerings. The company’s latest earnings results exceeded market expectations and demonstrated significant progress in cloud revenue growth—a segment increasingly buoyed by demand for artificial intelligence (AI) infrastructure and services. This performance has reshaped both investor sentiment and analyst forecasts, positioning Oracle as a compelling player in the next phase of enterprise cloud expansion.

In this section, we will examine the key elements of Oracle’s financial performance, the impact of AI-fueled demand on its revenue trajectory, and how this has influenced market expectations and stock valuation. We will also consider the broader economic trends that are shaping Oracle’s outlook in the AI era.

Latest Earnings Breakdown: A Strong Showing Across Cloud Segments

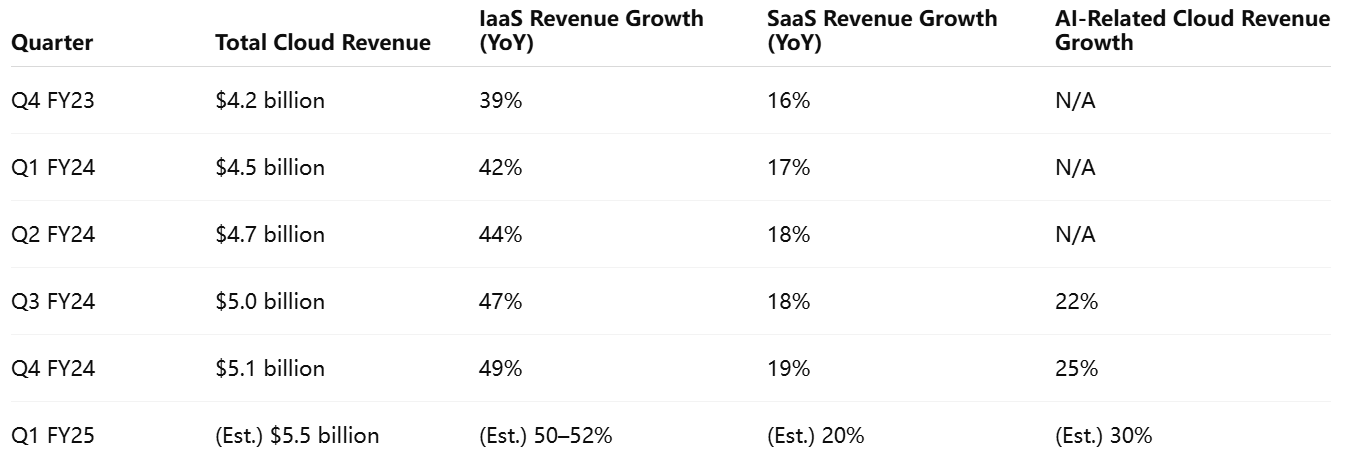

Oracle’s most recent quarterly earnings report revealed a pronounced acceleration in cloud-related revenues. Total quarterly revenue reached $14.3 billion, representing a year-over-year (YoY) increase of 7%. More importantly, cloud-related revenues—which include both infrastructure-as-a-service (IaaS) and software-as-a-service (SaaS)—surged by 20% YoY to reach $5.1 billion.

Cloud Infrastructure Growth

Oracle Cloud Infrastructure (OCI), the centerpiece of Oracle’s AI-optimized cloud offerings, reported IaaS revenue growth of 49% YoY, a figure that outpaced growth rates reported by several competitors. This growth is being driven by strong demand for Oracle’s AI superclusters, high-performance GPU instances, and AI-integrated database services.

Enterprise customers increasingly see OCI as an attractive platform for training large language models, deploying inference services, and integrating AI into critical business workflows. The performance, scalability, and cost advantages of OCI are contributing to both customer retention and new customer acquisition.

SaaS Momentum

Oracle’s SaaS portfolio also demonstrated robust performance, with Fusion Cloud ERP revenue up 16% YoY and NetSuite Cloud ERP revenue increasing 19% YoY. While not all SaaS revenue is directly attributable to AI demand, Oracle’s integration of generative AI and advanced machine learning into these applications has enhanced their value proposition, driving higher customer engagement and license expansion.

AI-Fueled Revenue Contributions

Oracle management has explicitly linked its improved revenue guidance to AI-related demand. In the latest earnings call, CEO Safra Catz noted that AI-related cloud deals now represent a significant and rapidly growing portion of Oracle’s cloud pipeline. The company disclosed that its backlog of AI-related contracts has grown substantially, with many deals involving multi-year commitments and large-scale GPU capacity reservations.

This dynamic is reshaping Oracle’s revenue mix, with AI-driven workloads now constituting one of the fastest-growing categories within its cloud business.

Forward Guidance and Market Optimism

Oracle’s upbeat forward guidance has further fueled market optimism. The company projected that total cloud revenue will grow at an annual rate of 30–35% over the next 12 months, with AI-related workloads serving as a primary driver of this growth.

Management emphasized that demand for AI compute continues to outstrip supply, leading Oracle to aggressively expand its AI data center capacity. This expansion is expected to sustain elevated cloud revenue growth well into fiscal year 2026.

Market Response

The market has responded enthusiastically to Oracle’s improved outlook. Following the earnings release and revised guidance, Oracle’s share price surged by nearly 12%, reaching an all-time high. The rally reflects growing investor confidence that Oracle is positioned to capture a meaningful share of the AI-driven cloud opportunity.

Several prominent analysts upgraded their ratings on Oracle stock, citing the company’s differentiated AI capabilities and accelerating cloud revenue growth. Consensus price targets were revised upward, with many analysts now viewing Oracle as one of the most attractive growth stories in the enterprise cloud space.

Comparative Valuation

Oracle’s valuation multiple has also expanded in response to its AI-driven growth narrative. Historically trading at a discount to peers such as Microsoft and Amazon, Oracle is now commanding a premium relative to its historical averages. Its price-to-earnings (P/E) ratio has moved into the high 20s, reflecting the market’s expectations for sustained double-digit cloud growth.

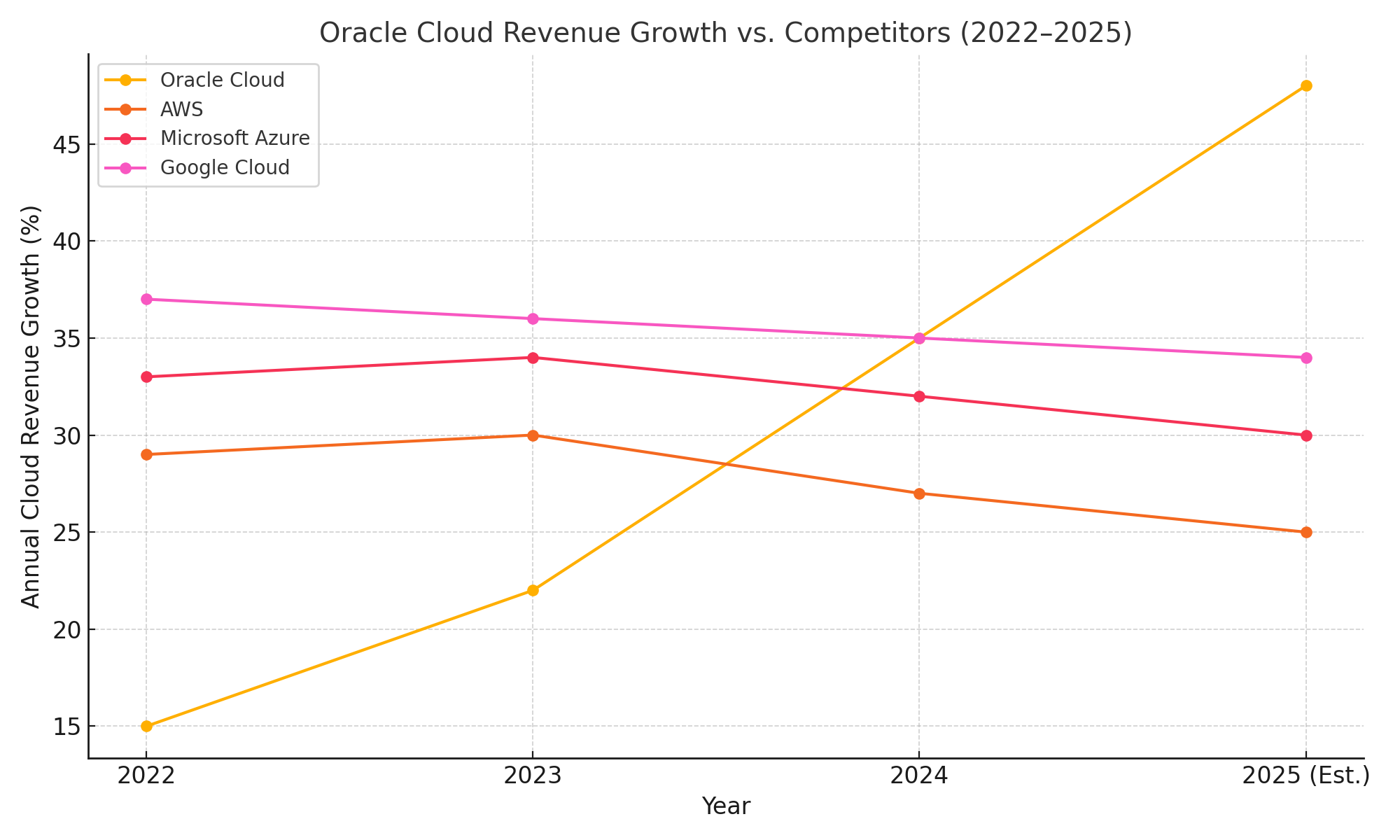

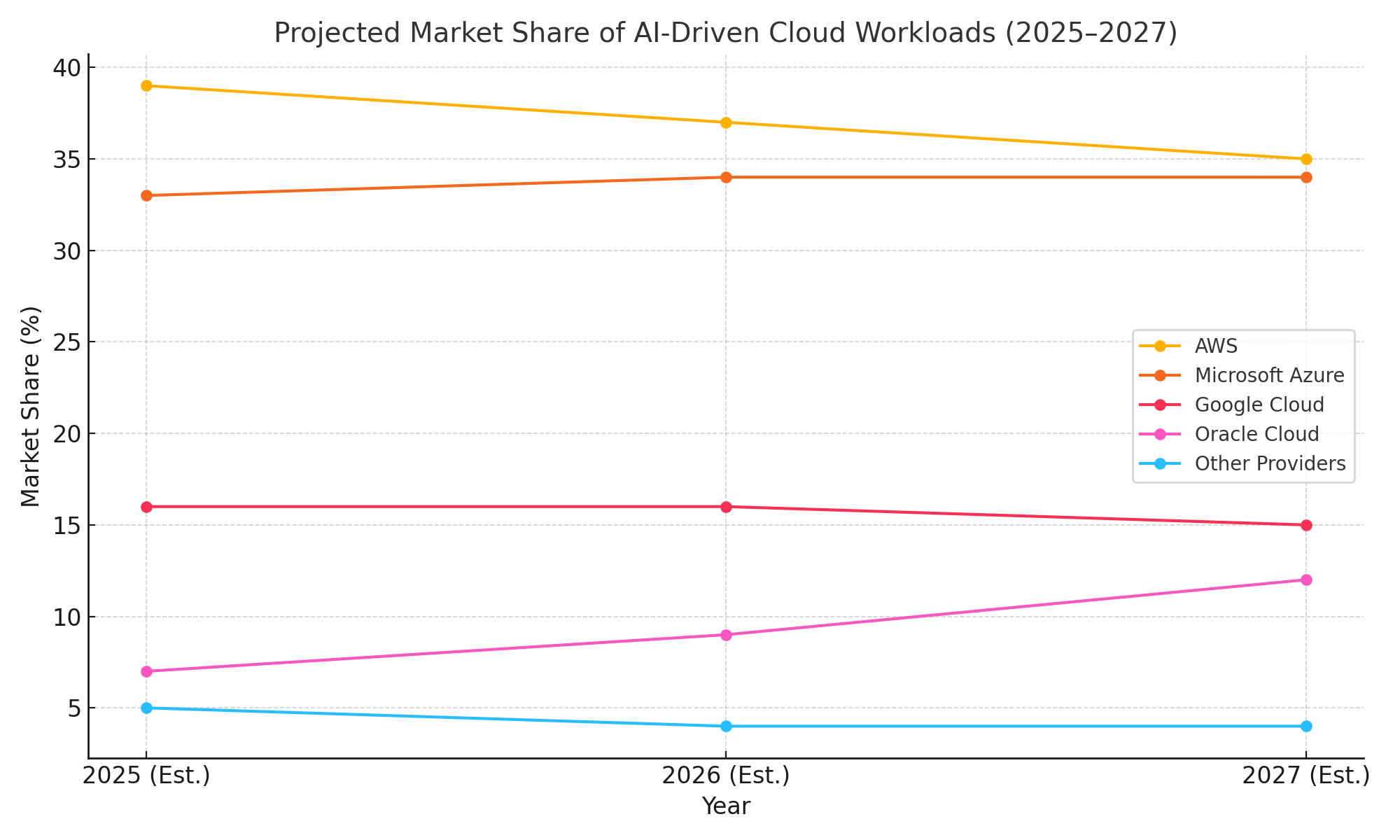

Notably, Oracle’s IaaS growth rate now rivals—and in some cases exceeds—that of Amazon Web Services (AWS) and Microsoft Azure. While Oracle’s overall cloud market share remains smaller, its ability to achieve superior growth rates in AI workloads suggests that it is competing effectively in the fastest-growing segment of the market.

Key Factors Influencing Market Optimism

Several factors are underpinning market optimism regarding Oracle’s AI-driven cloud trajectory:

Secured AI Cloud Deals

Oracle has secured major AI cloud contracts with a range of enterprise customers and AI-native companies. Multi-year deals with commitments for large-scale GPU capacity have created a visible and durable revenue stream that supports forward growth projections.

These deals not only enhance Oracle’s revenue visibility but also validate its technological capabilities and competitiveness in the AI cloud market.

Enterprise AI Adoption Trends

Broader trends in enterprise AI adoption are driving incremental demand for cloud services. As organizations accelerate their AI initiatives, they require scalable, secure, and high-performance cloud platforms. Oracle’s positioning—combining AI-optimized infrastructure with integrated data and application services—aligns well with these evolving customer needs.

Cost and Performance Differentiation

Oracle’s AI cloud offerings deliver compelling value in terms of both performance and cost. The combination of high-bandwidth networking, state-of-the-art GPUs, and autonomous database capabilities allows customers to achieve superior outcomes with greater efficiency. This differentiation is contributing to customer wins and higher wallet share among existing clients.

Analyst Perspectives and Stock Valuation

Sell-side analysts are increasingly bullish on Oracle’s cloud trajectory. In recent research notes:

- Goldman Sachs upgraded Oracle to a "Buy," citing the company’s ability to monetize AI-driven cloud demand more effectively than previously expected.

- Barclays highlighted Oracle’s superior price-performance in AI compute as a key competitive advantage.

- Morgan Stanley raised its price target, noting that Oracle’s IaaS growth rate is now approaching parity with leading hyperscalers.

Investor sentiment mirrors these assessments. Institutional investors have increased their exposure to Oracle, viewing it as a beneficiary of the AI investment wave that is reshaping the technology landscape.

Conclusion

Oracle’s financial performance over the past several quarters underscores the transformative impact of AI on its cloud business. With accelerating IaaS and SaaS revenue growth, a robust pipeline of AI-related cloud deals, and an expanding AI infrastructure footprint, Oracle is redefining its role in the cloud market.

Market expectations have adjusted accordingly, with analysts and investors increasingly optimistic about Oracle’s ability to sustain elevated growth rates. The company’s improved valuation reflects this optimism, positioning Oracle as one of the most compelling cloud growth stories of 2025.

The Competitive Landscape and Oracle’s AI Cloud Differentiators

As artificial intelligence (AI) transforms the cloud computing landscape, competition among the major cloud providers has entered a new phase of intensity. The race to deliver AI-optimized infrastructure, robust model training environments, and integrated AI services is now a defining feature of the cloud market. Within this context, Oracle’s emergence as a credible and differentiated player is reshaping industry dynamics and challenging long-held assumptions about cloud leadership.

In this section, we will examine the evolving competitive landscape, analyze how Oracle positions itself against rivals such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, and explore the unique differentiators that are enabling Oracle to capture an outsized share of AI-driven cloud demand.

The Shifting Dynamics of Cloud Competition

For much of the past decade, AWS, Azure, and Google Cloud dominated the cloud infrastructure market, benefiting from early-mover advantages, massive scale, and rich service portfolios. Oracle, in contrast, was a relative latecomer, initially struggling to gain traction with its first-generation cloud offerings.

The rapid proliferation of AI workloads, however, has disrupted this equilibrium. AI applications—particularly large language models (LLMs), generative AI services, and advanced analytics—require infrastructure that is fundamentally different from traditional cloud computing environments. Key requirements include:

- High-density GPU clusters with fast interconnects

- Low-latency, high-bandwidth networking

- Massive data throughput for model training

- Integrated data management and AI model orchestration

- Support for sovereign cloud regions and regulatory compliance

Meeting these requirements at scale requires significant architectural innovation, something Oracle has embraced with its next-generation Oracle Cloud Infrastructure (OCI) and targeted AI partnerships.

Oracle’s Strategic Positioning in the AI-Cloud Race

Oracle’s strategic positioning is based on several core pillars that differentiate it from the competition:

Performance and Cost Advantages in AI Workloads

OCI has been architected to deliver industry-leading performance for AI workloads. Its AI superclusters leverage NVIDIA H100 Tensor Core GPUs, high-speed RDMA networking, and optimized storage architectures to enable ultra-fast training and inference.

Benchmark tests published by both Oracle and third-party analysts show that OCI delivers superior price-performance for many AI scenarios compared to AWS EC2 P4d instances and Microsoft Azure NDv5 instances. Customers can achieve faster model convergence and lower total cost of ownership, particularly for large-scale LLM training.

These advantages are not theoretical—enterprise customers and AI-native companies have validated them through large-scale deployments, contributing to Oracle’s surging IaaS growth.

Sovereign AI Cloud Regions

Data sovereignty and regulatory compliance are critical considerations for organizations deploying AI applications, particularly in sectors such as government, healthcare, and financial services. Oracle has responded by offering sovereign AI cloud regions—isolated cloud environments designed to meet strict data residency, privacy, and compliance requirements.

Unlike many competitors, Oracle offers customers the flexibility to run AI workloads in sovereign regions without compromising on performance or functionality. This capability is a key differentiator that has helped Oracle win major public sector and highly regulated industry contracts.

Enterprise Data and Application Integration

Oracle’s deep expertise in enterprise data management remains a powerful competitive advantage. Its Autonomous Database, Oracle Data Lakehouse, and data integration services are tightly integrated with OCI’s AI infrastructure, enabling seamless data ingestion, transformation, and model training.

For enterprises seeking to leverage their existing data assets in AI initiatives, Oracle offers a uniquely integrated stack that reduces complexity and accelerates time to value. This is particularly appealing for organizations with large Oracle database footprints or those running mission-critical enterprise applications.

Custom Silicon and AI Compute Innovations

Oracle is also exploring innovations in custom silicon to further optimize AI performance. The company has partnered with NVIDIA to develop specialized AI supercomputing architectures and is investing in next-generation data center designs to support increasingly demanding AI workloads.

While AWS has its Inferentia and Trainium chips, and Google offers Tensor Processing Units (TPUs), Oracle’s collaborative approach with NVIDIA allows it to rapidly adopt and deploy the latest GPU innovations without the constraints of proprietary silicon development cycles.

Flexible AI Model Ecosystem

Oracle’s AI cloud strategy embraces an open ecosystem approach, allowing customers to deploy a wide range of AI models and frameworks. Through partnerships with Cohere and OpenAI, Oracle offers pre-integrated access to state-of-the-art language models while also supporting open-source models such as Meta’s LLaMA and Mistral AI’s offerings.

This flexibility contrasts with more vertically integrated approaches taken by some competitors and gives customers greater choice in selecting the optimal models for their use cases.

Strategic Partnerships and Ecosystem Play

Oracle’s partnerships with key AI innovators further enhance its competitiveness:

- Oracle-NVIDIA Alliance: Joint engineering to optimize AI infrastructure, co-marketing of AI superclusters, and deep integration of NVIDIA AI Enterprise software stack.

- Partnership with Cohere: Integration of Cohere’s enterprise-grade language models into OCI and Oracle SaaS applications.

- Collaboration with OpenAI: Enabling customers to access OpenAI models within Oracle Cloud, providing additional flexibility and choice.

These partnerships position Oracle as a trusted platform for both enterprise AI adoption and AI-native innovation.

Enterprise Customer Case Studies

Oracle’s competitive strengths are reflected in a growing roster of enterprise customer wins:

- Government Sector: Several national governments are deploying Oracle’s sovereign AI cloud regions to support public sector AI initiatives with strict data residency requirements.

- Financial Services: Global banks are using OCI’s AI infrastructure for fraud detection, risk modeling, and personalized customer experiences.

- Healthcare: Leading healthcare providers are leveraging Oracle Health AI Services for precision medicine, clinical decision support, and operational optimization.

- Telecommunications: Telecom operators are running AI-driven network optimization and predictive maintenance workloads on OCI.

These customer successes demonstrate Oracle’s ability to address the most demanding AI use cases across multiple verticals.

Conclusion

The AI-driven cloud market is ushering in a new era of competition, one that rewards architectural innovation, performance leadership, and enterprise-grade capabilities. Oracle’s deliberate investments in AI-optimized infrastructure, data integration, sovereign cloud regions, and ecosystem partnerships have positioned it to compete effectively—and win—against the largest players in the market.

As AI workloads continue to drive cloud consumption, Oracle’s differentiated value proposition is resonating with a growing segment of enterprise customers. The company’s ability to deliver superior price-performance, regulatory compliance, and integrated data-AI solutions gives it a strategic edge that is reflected in its accelerating cloud growth.

Risks, Challenges, and Sustainability of AI-Fueled Cloud Growth

While Oracle’s recent success in AI-driven cloud services has reshaped its market positioning and elevated its financial outlook, sustaining this momentum presents a complex array of risks and challenges. As AI adoption accelerates globally, cloud providers face intensifying competition, mounting operational pressures, evolving regulatory landscapes, and shifting customer expectations. For Oracle, maintaining its trajectory in this dynamic environment will require continued strategic focus, disciplined execution, and proactive risk management.

In this section, we explore the key risks and challenges confronting Oracle’s AI-fueled cloud growth and assess the sustainability of this expansion in the medium to long term.

Supply Chain Constraints and AI Infrastructure Scaling

One of the most immediate risks to Oracle’s AI cloud growth is the availability of the specialized hardware required to support AI workloads—namely, high-performance GPUs and advanced networking components. The global supply of NVIDIA H100 Tensor Core GPUs, currently the gold standard for AI training, remains constrained due to surging demand from cloud providers, AI startups, and large enterprises.

Oracle, like its competitors, is engaged in an ongoing effort to secure sufficient GPU capacity to meet its growing pipeline of AI-related cloud deals. CEO Safra Catz has publicly acknowledged that demand continues to outstrip supply, a dynamic that could limit the pace of revenue growth if not carefully managed.

Furthermore, scaling AI infrastructure at a global level involves significant operational complexity. Building, provisioning, and maintaining AI superclusters requires expertise in data center design, thermal management, power optimization, and high-speed networking—all areas where even the most capable cloud providers face ongoing challenges.

Oracle is investing aggressively to expand its AI data center footprint, but continued success will depend on its ability to manage these supply chain and operational risks effectively. Any prolonged disruptions in GPU supply or data center capacity could impact its ability to deliver on committed AI cloud contracts.

Margin Pressures from AI Workloads

AI workloads are among the most compute-intensive and resource-hungry applications running in the cloud. Training large language models, for example, can consume thousands of GPU hours and require massive data throughput. Even inference workloads, particularly those supporting real-time generative AI applications, impose significant demands on cloud infrastructure.

These characteristics can create margin pressures for cloud providers. While AI services command premium pricing, the capital and operational costs associated with delivering them are also substantial. Profitability depends on achieving high utilization rates, optimizing hardware efficiency, and managing the balance between reserved capacity and on-demand elasticity.

For Oracle, sustaining healthy margins in its AI cloud business will require continued innovation in infrastructure efficiency, pricing models, and workload orchestration. As competition intensifies and pricing pressure mounts, maintaining this balance will become increasingly challenging.

Regulatory and Geopolitical Risks

The rapid adoption of AI is prompting heightened scrutiny from regulators around the world. Issues such as data privacy, model transparency, algorithmic bias, and the environmental impact of AI are rising to the forefront of public policy debates. Governments are exploring new regulatory frameworks that could impose additional compliance requirements on cloud providers delivering AI services.

Oracle’s focus on sovereign AI cloud regions positions it well to address some of these concerns, particularly around data residency and privacy. However, the regulatory landscape is evolving rapidly and inconsistently across jurisdictions. Staying ahead of these changes and ensuring full compliance will require ongoing investment in legal, compliance, and engineering resources.

Geopolitical risks also loom large. Tensions between the United States and China, as well as broader trade disputes, could disrupt global supply chains for critical AI hardware or limit Oracle’s ability to serve certain markets. Additionally, restrictions on the export of advanced semiconductors and AI technologies could affect Oracle’s partnerships and technology sourcing strategies.

Managing these geopolitical and regulatory risks will be essential to ensuring the long-term sustainability of Oracle’s AI cloud growth.

Competitive Pricing and Market Saturation

The AI cloud market is entering a phase of hyper-competition. All major cloud providers—AWS, Microsoft Azure, Google Cloud, and Oracle—are racing to capture market share in AI infrastructure and services. This competition is driving rapid innovation but also intensifying pricing pressure.

Hyperscalers with larger balance sheets and greater economies of scale may engage in aggressive pricing strategies to defend or expand their market positions. Oracle must balance the need to remain competitive on price with the imperative to maintain profitability.

Additionally, as AI cloud adoption becomes more widespread, the market could approach saturation in certain segments. Enterprises may increasingly seek to optimize and consolidate their AI spending, favoring multi-cloud strategies or negotiating more favorable terms. Oracle will need to differentiate its offerings and demonstrate clear value to sustain customer loyalty in this evolving landscape.

Customer Retention and Long-Term Value Realization

Securing large AI cloud deals is an important driver of Oracle’s current growth, but long-term sustainability depends on ensuring that these deals translate into enduring customer relationships and value realization.

AI projects are inherently complex and often involve a significant learning curve. Ensuring that customers achieve their desired outcomes—whether in terms of model performance, operational efficiency, or business impact—requires more than just infrastructure. It demands robust support, best practices guidance, and ongoing partnership.

Oracle’s ability to deliver a superior customer experience and foster deep, trusted relationships will be critical to maximizing customer lifetime value and mitigating churn risk. This is particularly important as the AI cloud market matures and customers become more discerning in their provider choices.

Environmental Sustainability

The environmental impact of large-scale AI workloads is an emerging concern for cloud providers and their customers alike. Training massive AI models consumes substantial amounts of electricity and generates significant carbon emissions, prompting scrutiny from environmental advocates and regulators.

Oracle has made public commitments to achieving sustainability goals in its data center operations, including increased use of renewable energy and improvements in energy efficiency. However, the AI boom introduces new sustainability challenges that will require continued innovation and transparency.

Demonstrating leadership in sustainable AI infrastructure could become a competitive differentiator for Oracle, but it will also necessitate ongoing investment and operational focus.

Oracle’s Mitigation Strategies

To address these risks and challenges, Oracle is pursuing several key mitigation strategies:

- Diversified Supply Chain: Expanding partnerships with hardware vendors and investing in long-term supply agreements to secure critical AI infrastructure components.

- Infrastructure Innovation: Continuing to optimize OCI’s architecture for energy efficiency, performance, and scalability to maintain competitive cost structures.

- Sovereign Cloud Leadership: Deepening its sovereign AI cloud capabilities to address evolving regulatory requirements and customer concerns.

- Strategic Partnerships: Strengthening alliances with NVIDIA, Cohere, and OpenAI to deliver differentiated AI offerings and ecosystem value.

- Customer Success Focus: Investing in customer success programs, professional services, and ecosystem enablement to drive adoption and value realization.

- Sustainability Initiatives: Advancing sustainability goals through renewable energy adoption, carbon reduction initiatives, and transparent reporting.

Conclusion

Oracle’s AI-fueled cloud growth represents one of the most compelling technology stories of the current market cycle. The company’s ability to align its infrastructure, partnerships, and enterprise expertise with the needs of AI workloads has propelled it into the upper echelon of cloud providers.

However, sustaining this momentum will not be without challenges. Supply chain constraints, margin pressures, regulatory uncertainty, competitive dynamics, and sustainability considerations all pose meaningful risks to Oracle’s growth trajectory.

By proactively addressing these risks and executing with discipline, Oracle has the opportunity to solidify its position as a trusted leader in AI-powered cloud services. Its success in navigating this complex landscape will ultimately determine whether its recent gains translate into durable, long-term market leadership.

Oracle’s New Chapter in AI-First Cloud Growth

Oracle’s recent surge in market confidence, underpinned by strong AI-fueled cloud revenue expectations, signals a pivotal new chapter in the company’s ongoing transformation. Once perceived as a laggard in the cloud infrastructure race, Oracle has strategically repositioned itself as an agile and innovative player, well-suited to address the unique demands of AI workloads across the enterprise landscape.

As this blog has explored, the convergence of cloud computing and artificial intelligence is fundamentally reshaping the competitive dynamics of the technology industry. AI is no longer an isolated capability or specialized niche; it is becoming a core driver of enterprise IT strategies and cloud consumption patterns. Organizations across sectors are racing to integrate AI into their operations, applications, and customer experiences—a trend that is fueling unprecedented demand for high-performance cloud infrastructure and services.

Oracle’s deliberate focus on building an AI-optimized cloud platform, expanding its global AI data center footprint, forging key partnerships with industry leaders such as NVIDIA and Cohere, and delivering differentiated enterprise solutions has enabled it to capture a meaningful share of this burgeoning market. The company’s ability to align its core strengths—enterprise data management, security, compliance, and industry expertise—with the requirements of AI-driven digital transformation has resonated strongly with customers.

A Compelling Growth Trajectory

Oracle’s latest financial results, characterized by accelerating IaaS and SaaS revenue growth, robust AI-related deal momentum, and upwardly revised forward guidance, reflect the tangible impact of its AI-cloud strategy. The market’s positive response, as evidenced by the surge in Oracle’s share price and the shift in analyst sentiment, further validates the company’s trajectory.

While Oracle’s overall cloud market share still trails that of AWS, Microsoft Azure, and Google Cloud, its ability to achieve superior growth rates in AI workloads demonstrates its competitiveness in the most dynamic segment of the market. Moreover, Oracle’s targeted approach—focusing on high-value enterprise use cases, regulated industries, and sovereign cloud capabilities—differentiates it from competitors pursuing a more generalized cloud strategy.

Broader Market Implications

Oracle’s ascent in the AI cloud market also has broader implications for the technology industry:

The Democratization of Cloud Leadership

The rise of AI workloads has leveled the playing field for cloud providers. Technical differentiation in AI infrastructure, data integration, and regulatory compliance now matters more than raw scale alone. Oracle’s success illustrates that with the right strategy and execution, even late entrants can challenge established leaders and capture meaningful market share.

The Rise of Sovereign AI Clouds

As governments and enterprises grapple with data sovereignty, privacy, and compliance concerns, sovereign AI cloud regions are becoming a critical differentiator. Oracle’s leadership in this area positions it to benefit from growing demand for trusted, jurisdiction-specific AI cloud solutions—a trend likely to accelerate in the years ahead.

The Fusion of Data and AI

Oracle’s integrated approach to data and AI underscores a key industry trend: the fusion of data management, analytics, and machine learning is becoming a strategic imperative for enterprises. Cloud platforms that can seamlessly integrate data and AI capabilities are poised to capture greater wallet share and drive deeper customer engagement.

The Sustainability Imperative

As the environmental impact of AI workloads comes under increasing scrutiny, cloud providers will face growing pressure to deliver sustainable AI infrastructure. Oracle’s commitments to renewable energy adoption and carbon reduction position it to lead in this emerging area of differentiation.

Sustaining Momentum: The Road Ahead

While Oracle’s progress has been impressive, sustaining its AI-fueled cloud growth will require continued focus and investment. The company must navigate several key imperatives:

- Scaling AI Infrastructure: Expanding GPU capacity and data center capabilities to meet surging demand while managing supply chain risks.

- Optimizing Margins: Enhancing operational efficiency and pricing models to sustain profitability in the face of competitive pressures.

- Driving Innovation: Advancing AI infrastructure, data services, and developer tools to maintain a technological edge.

- Deepening Customer Engagement: Investing in customer success, ecosystem partnerships, and industry solutions to drive long-term value.

- Leading in Sustainability: Continuing to innovate in sustainable AI infrastructure and transparent environmental reporting.

Oracle’s ability to execute on these priorities will determine whether its recent gains translate into durable market leadership.

Final Reflections

The story of Oracle’s AI-fueled cloud ascent is not merely a narrative of financial outperformance or stock market gains. It is a reflection of deeper shifts in enterprise technology priorities and industry dynamics. AI is becoming the defining workload of the cloud era, and cloud providers that can deliver optimized, trusted, and integrated AI platforms will shape the future of enterprise IT.

Oracle’s transformation offers important lessons for the broader technology ecosystem:

- Strategic Focus Matters: By aligning its cloud strategy with the most compelling growth vector in the market—AI—Oracle has reignited its growth trajectory and enhanced its market relevance.

- Differentiation is Key: Oracle’s focus on sovereign cloud capabilities, data integration, and industry-specific solutions has enabled it to compete effectively despite entering the cloud race later than its rivals.

- Partnerships Drive Innovation: Strategic alliances with NVIDIA, Cohere, and OpenAI have amplified Oracle’s ability to deliver differentiated AI capabilities and ecosystem value.

- Execution Drives Credibility: Oracle’s disciplined execution, as evidenced by its accelerating cloud growth and improving financial metrics, has earned the trust of customers, partners, and investors alike.

As the AI-cloud market continues to evolve, Oracle’s next chapter will be defined by its ability to scale its infrastructure, deepen its customer relationships, and lead in innovation and sustainability. The company’s strong foundation and strategic clarity position it well to navigate this dynamic landscape and capture the opportunities of the AI era.

For enterprises, technology leaders, and investors, Oracle’s journey serves as both a case study in strategic reinvention and a bellwether for the broader evolution of cloud computing. The age of AI-first cloud growth has arrived—and Oracle is determined to be at the forefront.

References

- https://www.oracle.com/cloud

- https://www.oracle.com/news

- https://www.nvidia.com/en-us/about-nvidia/press-room

- https://www.microsoft.com/en-us/azure

- https://aws.amazon.com

- https://cloud.google.com

- https://www.cohere.com

- https://openai.com/blog

- https://www.idc.com

- https://www.gartner.com/en/insights/cloud-computing