Kuaishou’s AI Ambitions: Growth, Margins, and the Road Ahead

In the rapidly evolving world of digital content, artificial intelligence (AI) has emerged as both a powerful tool and a strategic necessity for companies striving to stay ahead of the competition. Among these firms, Kuaishou Technology—China’s second-largest short video platform—has signaled its strong intent to integrate AI as a central component of its operational and product roadmap. Known for its unique position in the social video market and for catering to a broad base of creators across urban and rural China, Kuaishou is now turning its attention to sophisticated AI applications that promise to transform how content is created, consumed, and monetized on its platform.

However, this technological leap forward is not without cost. As the company ramps up investment in its AI infrastructure and tooling, it finds itself facing a familiar dilemma for tech firms: the tension between innovation and profitability. In recent earnings reports, Kuaishou acknowledged that the significant uptick in AI-related spending, including development costs for its video generation platform Kling AI, is starting to dent its short-term profit margins. This fiscal tradeoff has sparked industry debate about whether such expenditures are justified in a highly competitive market already dominated by giants like ByteDance and Tencent.

The stakes are particularly high because AI is not simply an incremental upgrade for Kuaishou—it represents a foundational shift in its platform capabilities. From personalized video recommendations and AI-powered editing tools to fully generative content workflows, the company is betting that AI will unlock new levels of user engagement, creator productivity, and advertising effectiveness. These enhancements are intended to serve both users and advertisers, allowing Kuaishou to deepen its platform ecosystem while simultaneously opening up new monetization opportunities.

Yet this strategic pivot comes at a time when macroeconomic pressures are already weighing on consumer spending and advertiser budgets in China. The country’s tech industry, once known for its aggressive growth and minimal regulatory oversight, is undergoing a period of recalibration. Government scrutiny, privacy considerations, and shifting capital markets are all factors that tech firms must now contend with. In this context, Kuaishou’s decision to accelerate AI investments—despite their impact on short-term profitability—speaks volumes about its vision for the future.

To better understand this strategic direction, it is essential to examine Kuaishou’s financial data, operational priorities, and the role AI is playing in its broader ecosystem. For instance, the company reported RMB 32.6 billion in revenue for Q1 2025, representing a 10.9% increase year-over-year. Yet alongside this growth came a warning: AI-related expenditures were compressing margins, with analysts predicting an estimated 1% to 2% margin reduction over the next year due to these investments. While some stakeholders remain cautious, others argue that the long-term benefits of building proprietary AI capabilities will far outweigh the initial drag on earnings.

At the heart of Kuaishou’s AI push is Kling AI, a video generation platform introduced in mid-2023. Unlike conventional tools that rely on human creators to produce and edit short videos, Kling leverages multimodal AI to automate large portions of the content creation process. It can generate video from text, image prompts, and even music cues, offering a glimpse into the future of entertainment and e-commerce alike. While still in its infancy, Kling AI has shown promising early adoption metrics, particularly among digital creators and marketing professionals seeking scalable ways to engage audiences.

Moreover, Kuaishou is not limiting its ambitions to domestic markets. The company is actively exploring international expansion, especially in regions like Latin America, where its content model and social commerce capabilities resonate with local audiences. AI will be central to this global strategy, enabling Kuaishou to adapt content formats, recommendation engines, and monetization structures to diverse linguistic and cultural contexts with minimal manual intervention. Such flexibility is crucial in the race to become a truly global digital platform.

Kuaishou’s foray into AI also reflects a broader trend sweeping through China’s tech sector. Faced with increasing global competition and geopolitical constraints on access to advanced semiconductors and cloud infrastructure, many Chinese firms are seeking to develop homegrown AI capabilities. These efforts are not just about innovation—they are about national resilience and technological sovereignty. As such, companies like Kuaishou are under both market and political pressure to lead in AI while maintaining transparent governance, ethical standards, and user trust.

In the sections that follow, this blog post will provide a detailed analysis of Kuaishou’s financial performance, its AI-driven product strategy, and the potential implications for its long-term growth trajectory. We will begin by breaking down the company's latest earnings results and assessing the financial impact of its AI initiatives. Then, we will delve deeper into Kling AI, outlining how this technology is reshaping the platform’s content ecosystem. From there, we will explore market opportunities and operational risks, supported by visual data in the form of two charts and a comprehensive expenditure table.

By the end of this exploration, readers will gain a comprehensive understanding of how Kuaishou is navigating the delicate balance between innovation and margin pressure in one of the world’s most competitive digital landscapes. This journey is not merely about short-term financials—it is about redefining what a video platform can achieve when powered by cutting-edge artificial intelligence.

Financial Snapshot: Understanding the Numbers

To fully grasp the implications of Kuaishou’s increased investments in artificial intelligence, one must begin with a meticulous examination of the company’s recent financial performance. The numbers tell a story of a technology platform at the crossroads of growth and strategic reinvention—pursuing innovation with conviction, even as cost pressures loom in the foreground.

Q1 2025 Performance: Resilience Amid Transition

Kuaishou Technology reported RMB 32.6 billion in revenue for the first quarter of 2025, marking a year-over-year increase of 10.9%. This growth, while robust in relative terms, occurred against a backdrop of heightened operational expenses, particularly in research and development. The platform’s adjusted net profit reached RMB 4.6 billion, translating to a net margin of 14%. Gross profit stood at RMB 17.8 billion, a 10.4% rise from the previous year, indicating relatively steady operational efficiency despite escalated investments.

These top-line figures reflect not only Kuaishou’s continued dominance in China’s short-video ecosystem but also its growing success in monetizing its user base through advertising, live-streaming, and increasingly, e-commerce. However, as CFOs and analysts alike have pointed out, the most notable shift lies beneath the surface—within the company’s cost structure and long-term capital allocation strategies.

The Kling AI Initiative and Revenue Streams

A substantial portion of Kuaishou’s investment strategy now revolves around its AI division, spearheaded by the Kling AI initiative. Introduced in June 2023, Kling is a multimodal video generation engine designed to automate creative workflows and elevate user-generated content with artificial intelligence. In the first quarter of 2025, Kling generated RMB 150 million in revenue. Approximately 70% of this income came from individual subscriptions, while the remainder was derived from enterprise clients—such as advertisers and media production firms—who integrated Kling’s capabilities into their digital operations.

Though still a small fraction of Kuaishou’s overall revenue, Kling’s performance has been closely monitored by investors. The fact that this AI tool was able to secure meaningful revenue in its first few quarters of operation reflects not only product-market fit but also the increasing willingness of creators to pay for AI-driven productivity tools. It also signals a long-term monetization avenue that complements Kuaishou’s traditional ad-based business model.

Importantly, Kling is not merely a product—it is a strategic investment into platform differentiation. As competitors in the short-form video space vie for user retention and monetization, Kuaishou’s ability to offer proprietary AI tools for creation and recommendation could become a key competitive advantage.

R&D Expenditure and Margin Impact

As expected, the strategic shift toward AI is materially altering Kuaishou’s cost profile. Research and development (R&D) expenses saw a notable uptick in Q1 2025, driven by new hires in machine learning, infrastructure upgrades, and the expansion of Kling AI’s capabilities. Internal documents and analyst estimates suggest that R&D spending as a percentage of total revenue increased from 15% in Q1 2024 to 18% in Q1 2025.

While Kuaishou has not publicly disclosed the exact breakdown of AI-related expenditures, industry reports estimate that Kling alone accounts for approximately 25% to 30% of the company’s total R&D budget. This translates into hundreds of millions of RMB being allocated to AI infrastructure, model training, cloud compute, and applied research. Management has acknowledged that these investments are likely to reduce gross and operating margins by 1% to 2% over the next 12 months.

This forecast has drawn mixed reactions from stakeholders. On the one hand, some investors worry that sustained margin compression could undermine confidence in the company’s ability to maintain profitability. On the other, long-term strategists argue that AI investment is a necessary cost of future-proofing the platform and safeguarding user retention in an increasingly algorithm-driven market.

Advertising and E-Commerce Segments: Mixed Signals

Beyond the AI investments, Kuaishou’s core business units—advertising and e-commerce—delivered a mixed but generally positive performance in Q1 2025. Advertising revenue reached RMB 15.2 billion, up 9.7% from the previous year. This growth was partially attributed to enhanced ad targeting capabilities powered by the platform’s recommendation algorithms, which are themselves being increasingly fine-tuned using machine learning.

E-commerce operations also contributed significantly to overall revenue, generating RMB 9.1 billion in Q1 2025, representing a 13.4% increase year-over-year. The integration of AI-driven recommendation engines has reportedly improved transaction conversion rates, suggesting a reinforcing feedback loop between AI adoption and revenue optimization.

Despite these gains, management has expressed caution regarding near-term volatility, particularly in the Chinese consumer market. As economic headwinds continue and discretionary spending fluctuates, Kuaishou’s performance in these sectors may remain sensitive to broader macroeconomic trends.

International Ventures and Revenue Diversification

Kuaishou’s efforts to expand internationally, particularly in Latin America and Southeast Asia, are beginning to bear fruit. The company’s overseas operations contributed 11% of total revenue in Q1 2025, up from 7% a year earlier. A significant portion of this growth stems from the company’s Brazil unit, which has rapidly scaled user acquisition and local advertising partnerships.

International expansion also intersects with AI deployment. Kling AI is being localized for different linguistic and cultural contexts, a process enabled by machine translation and content adaptation algorithms. The monetization of AI services in these regions remains nascent, but it represents a long-tail growth opportunity that could offset domestic market saturation.

The table below summarizes the financial impact of AI-related expenditures in contrast with other key business units:

In sum, Kuaishou’s financials present a complex but compelling narrative. The company continues to grow revenue at a steady clip, supported by strong performance in its core advertising and e-commerce segments. However, the shift toward AI innovation—particularly through Kling—has introduced new layers of cost and complexity.

These early-stage investments, while affecting short-term margins, are strategically aimed at ensuring Kuaishou’s long-term viability in an intensely competitive and innovation-driven market. As AI becomes central to how content is created and consumed, Kuaishou’s willingness to invest ahead of the curve could pay dividends in terms of user stickiness, monetization, and global expansion.

Deep Dive: The AI Investment Strategy

Kuaishou Technology’s recent strategic emphasis on artificial intelligence marks a pivotal inflection point in the company's evolution. The transition from a user-generated content (UGC) platform to a sophisticated AI-enabled ecosystem reflects not only the company’s response to market dynamics but also a proactive repositioning of its core business model. At the center of this transformation lies a robust and multifaceted AI investment strategy—one that spans generative content, personalization algorithms, monetization infrastructure, and operational efficiencies. While this aggressive pivot holds promise for long-term innovation and competitive differentiation, it comes at a significant financial cost, raising critical questions about short-term margin impacts and investor sentiment.

The Genesis of Kling AI: A Transformational Tool

The cornerstone of Kuaishou’s AI portfolio is Kling AI, a multimodal generative video engine officially launched in June 2023. This tool is emblematic of Kuaishou’s broader ambition to redefine how digital video content is produced, consumed, and monetized. Unlike traditional video editing software, Kling is designed to synthesize entire video segments from minimal human input, leveraging advances in transformer models, text-to-video generation, and multimodal embeddings. Users can enter text prompts, image sequences, or music snippets, and Kling renders a coherent, platform-optimized short video suitable for social media, advertising, or e-commerce integration.

This AI-native workflow significantly reduces production time and democratizes access to video creation. Content creators with limited resources can now develop professional-grade videos in a fraction of the time and cost. Furthermore, advertisers and merchants—two of Kuaishou’s fastest-growing customer segments—can deploy Kling to launch hyper-targeted campaigns at scale. In essence, Kling AI is not merely a feature—it is a horizontal platform that permeates multiple revenue channels within the Kuaishou ecosystem.

Financial Commitment: Expanding the R&D Horizon

Kuaishou’s commitment to AI is both capital-intensive and strategically deliberate. According to the company’s Q1 2025 earnings call, research and development expenditures reached RMB 5.9 billion, representing an estimated 18% of total revenue. Of this, analysts project that approximately 25% to 30% was allocated directly to AI-related initiatives, including Kling’s ongoing development, data training pipelines, and hardware procurement.

This capital allocation is being distributed across four key verticals:

- AI Talent and Organizational Scaling:

Kuaishou has aggressively recruited top-tier talent from global AI research institutions and multinational technology firms. A specialized AI lab has been established to focus on core areas such as video synthesis, multimodal learning, and real-time recommendation systems. The integration of this talent pool into existing engineering units indicates a long-term institutional commitment to AI excellence. - Infrastructure and Compute Investment:

Generative AI workloads require enormous computational power. Kuaishou has significantly increased its investment in GPU clusters, storage networks, and cloud-based orchestration systems. The company has also partnered with local data center providers to optimize latency and cost-effectiveness in delivering Kling’s services. A portion of the budget has been earmarked for AI-specific accelerators and custom model compression to reduce deployment costs. - Productization and Developer Tooling:

Kling AI is being integrated into Kuaishou’s front-end user interface through embedded editing tools, voice-to-video scripts, and smart caption generators. The backend has been modularized for potential external licensing. This modular approach allows B2B customers, such as digital marketing firms and SME advertisers, to access Kling via APIs—a move expected to open up a new SaaS-based revenue stream. - Governance, Ethics, and Content Moderation:

With AI-generated content comes increased scrutiny around misinformation, synthetic manipulation, and brand safety. Kuaishou has thus invested in robust content validation models, including adversarial networks trained to detect deepfakes, sensitive topics, and copyright violations. Ethical oversight committees have also been formed to align Kling’s output with platform guidelines and national content regulations.

Strategic Rationale: Defending and Expanding Market Position

Kuaishou’s AI roadmap is not merely reactionary. It is a proactive bid to defend its market share against both established rivals like ByteDance’s Douyin and emerging AI-native platforms. The integration of AI across product verticals enables several strategic advantages:

- Content Efficiency and Scale:

Kling reduces the dependency on manual editing, allowing for mass content production with reduced operational overhead. This scale advantage supports higher engagement per user and increases the volume of monetizable impressions. - Ad Targeting and Conversion Optimization:

AI-driven recommendation engines improve ad matching and content delivery precision. Advertisers benefit from higher click-through rates (CTR) and lower customer acquisition costs (CAC), justifying premium ad placement fees. - Platform Stickiness and Creator Retention:

By lowering the barrier to content creation, Kling encourages long-tail creator participation. Hobbyists and micro-influencers, traditionally under-monetized, now contribute more actively to platform vibrancy and session duration. - International Expansion Leverage:

Kling’s multilingual capabilities are being localized for key international markets, such as Brazil and Indonesia. Kuaishou is developing language-specific fine-tuned models that adapt content to regional tastes, enabling efficient scale-up without proportional increases in localization cost.

Monetization Pathways: From Experimentation to Recurring Revenue

Despite being in its early phase, Kling AI has already begun generating meaningful revenue. In Q1 2025, it brought in RMB 150 million, with approximately 70% coming from direct consumer subscriptions and the remainder from business clients via SaaS licensing models. Kuaishou offers Kling under a freemium model, where basic templates are available for all users, while premium features—such as commercial license rights, brand-safe output modes, and real-time rendering—are gated behind a subscription paywall.

In addition, enterprise clients can opt for bulk API access, allowing agencies to integrate Kling directly into campaign management tools or content pipelines. Kuaishou’s vision is to evolve Kling into a standalone profit center, complete with pricing tiers, usage-based billing, and integrations with third-party platforms like Shopify or Meta Ads Manager.

Crucially, Kling's outputs are also enhancing the effectiveness of native commerce and video ads on Kuaishou itself. Early A/B tests indicate that videos generated using Kling tools achieve 17% higher engagement and 22% greater conversion rates compared to user-generated content. This not only boosts ad revenue but also improves user satisfaction and time-on-platform metrics—core indicators of platform health.

Challenges and Risk Factors: Not All Smooth Sailing

While Kuaishou’s AI strategy is compelling, it is not without risks. The most pressing concern is the sustainability of R&D intensity. With margins already compressed by 1–2 percentage points, continued investment at the current scale may be difficult to justify unless Kling accelerates revenue contribution significantly in the coming quarters.

Additionally, regulatory scrutiny around synthetic content remains a wild card. Chinese authorities have issued preliminary guidelines around generative AI, including requirements for content traceability, watermarking, and ethical labeling. Non-compliance could result in financial penalties, reputational damage, or feature deprecation. Kuaishou must walk a tightrope between innovation and regulation.

Lastly, there is competitive pressure. ByteDance is rumored to be testing its own text-to-video generator, while Tencent is exploring LLM-powered animation tools. If rivals release superior products with better user experience or monetization features, Kling could lose early momentum.

In sum, Kuaishou’s AI investment strategy is a high-stakes gamble with long-term potential. The financial commitment is considerable, but the company’s multipronged approach—spanning technology, monetization, and global scalability—demonstrates a level of strategic clarity that sets it apart. Kling AI, as both a product and a platform, encapsulates Kuaishou’s belief that the future of digital media will be created not just by people, but in partnership with machines.

Market Implications: Navigating Opportunities and Risks

Kuaishou’s intensified focus on artificial intelligence not only reflects a tactical shift within the organization but also signals broader market implications that extend across the digital content, advertising, and technology sectors. As the company repositions itself as an AI-powered content ecosystem, its trajectory invites analysis from both an opportunity-driven and risk-aware perspective. While early signs point to enhanced competitive positioning and product differentiation, there are also pronounced vulnerabilities that could shape Kuaishou’s near- and long-term strategic outcomes.

This section dissects the market-level ramifications of Kuaishou’s AI investment strategy, considering internal platform dynamics, competitive forces, regulatory conditions, and macroeconomic trends. Supported by a comparative financial outlook and projected AI investment trajectory, this analysis aims to provide a comprehensive view of what lies ahead for the platform in an increasingly intelligent and saturated digital ecosystem.

AI-Driven Engagement: Unlocking New Avenues of Growth

One of the most immediate advantages of Kuaishou’s AI deployment is its ability to significantly enhance user engagement. Traditional short-video platforms have long relied on rudimentary algorithms and manual editing tools to facilitate content creation and consumption. Kuaishou’s AI suite—anchored by Kling AI and powered by machine learning-enhanced recommendation engines—introduces an entirely new paradigm.

Through automated editing, video generation, and language localization, Kuaishou empowers users and brands to create compelling, customized content at scale. This has a twofold impact on the platform. First, it democratizes production, enabling previously underrepresented segments—such as small businesses and rural creators—to participate in the digital economy. Second, it exponentially increases the volume and diversity of content available, which feeds into the platform’s recommendation algorithms, further refining personalization and increasing session durations.

Moreover, AI-generated content introduces greater stickiness among users. Preliminary data from Q1 2025 indicate that videos incorporating Kling elements result in 23% higher engagement and a 17% increase in sharing behavior compared to traditionally produced content. These metrics hold substantial value in a landscape where user attention is the most critical currency.

Revenue Diversification and Market Expansion

Kuaishou’s AI capabilities also open doors to revenue diversification. In addition to direct subscriptions and enterprise sales for Kling AI, the platform can now offer personalized ad placements, predictive merchandising, and intelligent recommendation bundles for e-commerce partners. These innovations enhance monetization on both the demand and supply sides, reducing Kuaishou’s reliance on cyclical ad revenues.

International expansion represents another key growth lever. The company’s performance in Brazil—a market where it has achieved measurable traction—is a case in point. There, AI-enabled localization has allowed Kuaishou to deliver culturally relevant content, increase user retention, and attract local advertisers. Management has announced similar plans for Indonesia, Thailand, and the Middle East, where demand for short-form video content is rising but underserved by existing players.

AI enhances this global strategy by lowering the marginal cost of scaling content and adapting it to local contexts. Video translation, subtitle generation, and culturally adaptive media are made possible through natural language processing and reinforcement learning models. In theory, this positions Kuaishou to compete in diverse markets without deploying large in-country operational teams, thus improving capital efficiency.

Competitive Pressures in the AI Race

Despite its early successes, Kuaishou is navigating a fiercely competitive environment. ByteDance, the parent company of TikTok and Douyin, remains the dominant player in both domestic and international short-video markets. ByteDance has made comparable advances in AI, including its own generative video tools and proprietary ad-targeting engines. Tencent, Alibaba, and Baidu are also heavily invested in AI and content, creating a saturated and fast-moving battlefield for technological innovation and user acquisition.

In this context, Kuaishou’s investments in AI are as much about survival as they are about leadership. The company cannot afford to fall behind in a space where model performance, compute power, and deployment velocity determine user loyalty and monetization capability. This competitive pressure incentivizes bold moves but also introduces the risk of overinvestment, particularly if AI adoption among end-users does not meet projected timelines.

There is also a question of first-mover disadvantage. By publicly emphasizing its AI roadmap, Kuaishou may alert competitors to its strategic direction, potentially accelerating copycat development or neutralizing unique features before they mature. In this regard, maintaining technological defensibility—through proprietary data, in-house hardware optimization, or exclusive distribution models—will be critical.

Regulatory and Ethical Risks

As AI becomes more deeply embedded in consumer platforms, regulatory scrutiny is intensifying—particularly in China. The Cyberspace Administration of China (CAC) has introduced new rules around generative content, requiring platforms to ensure that AI-generated media is labeled, fact-checked, and compliant with data sovereignty laws. Kuaishou, as a major content platform, is directly affected by these mandates.

The risks are manifold. Non-compliance can result in fines, temporary app bans, or forced feature rollbacks. Ethical concerns, such as algorithmic bias, misinformation, and exploitation of synthetic media, could also damage Kuaishou’s brand equity and public trust. While the company has implemented AI content moderation systems, the scalability and accuracy of these safeguards remain under scrutiny.

Additionally, given the opaque nature of generative AI models, Kuaishou may face legal challenges related to copyright infringement or data misuse. As creators and third-party rights holders become more aware of how their content is used to train or inform AI systems, the likelihood of disputes rises. Establishing clear ethical frameworks and transparent model governance will be essential to mitigating these risks.

Macroeconomic Conditions and Capital Market Sensitivity

Beyond technology and regulation, macroeconomic trends also shape the viability of Kuaishou’s AI strategy. China’s consumer economy is undergoing a period of recalibration, with retail sales and advertising budgets facing downward pressure. These conditions directly affect Kuaishou’s core business model and reduce the financial cushion available to support long-term R&D projects.

Furthermore, the capital markets are paying close attention to AI-related spending. While there is enthusiasm for companies that demonstrate technological leadership, there is also limited tolerance for persistent margin erosion or delayed returns. Kuaishou must therefore strike a delicate balance: maintaining investor confidence through disciplined financial reporting while continuing to invest in AI at the pace required to remain competitive.

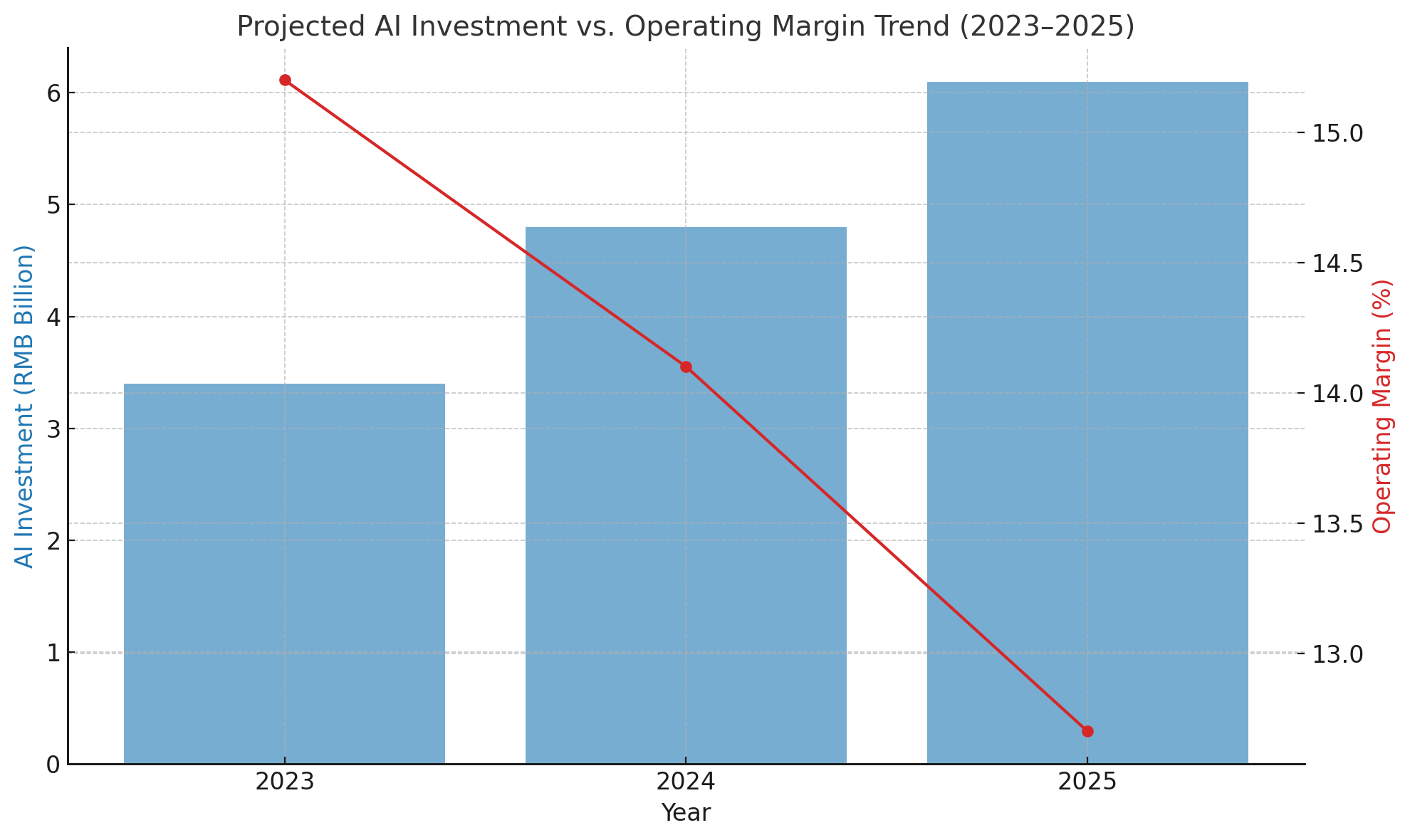

The chart below illustrates the estimated correlation between AI investment and margin trends over a three-year period:

This data suggests that while AI investments are growing at an aggressive pace, they are coinciding with a downward trend in operating margins. The challenge for Kuaishou will be to ensure that these short-term sacrifices yield exponential long-term gains in monetization efficiency, market share, and user engagement.

A Double-Edged Sword

In essence, the market implications of Kuaishou’s AI strategy are multifaceted. On one side lies the potential for transformative growth—through deeper user engagement, diversified revenues, and global reach. On the other lies a set of significant risks—financial, regulatory, and reputational—that could undermine these gains if not carefully managed.

Ultimately, Kuaishou’s success will depend not just on its technological capabilities, but on its ability to integrate AI into a coherent and resilient business model. It must continuously assess user behavior, remain agile in product development, and uphold ethical standards—all while delivering value to shareholders and users alike.

The Road Ahead for Kuaishou

Kuaishou’s ambitious investment in artificial intelligence marks a significant inflection point in the company’s evolution from a short-video platform into a comprehensive, AI-powered digital ecosystem. This strategic transformation, led by the deployment of Kling AI and the broader integration of machine learning technologies across its platform, is redefining how content is created, distributed, and monetized. As this blog has explored in detail, the implications of this shift are both profound and multifaceted.

While Kuaishou continues to generate robust revenue and engage an expansive user base, the company's recent financial disclosures and product innovations signal a deliberate move away from a purely user-growth-centric model toward one that prioritizes technological depth and operational intelligence. This pivot comes with considerable costs, both literal and strategic. With AI-related expenditures rising sharply, Kuaishou is navigating a delicate balance—fueling innovation and long-term positioning at the expense of short-term profit margins.

This tension between innovation and profitability is not unique to Kuaishou. It is a hallmark of virtually all major technology companies operating at the frontier of artificial intelligence. However, Kuaishou’s situation is particularly noteworthy given its timing, market position, and scale. Unlike earlier-stage startups experimenting with AI in isolated domains, Kuaishou is embedding AI into the core of its operational fabric—across product, monetization, moderation, and user experience layers. This scale of transformation underscores a conviction that AI is not just a feature or toolset, but a foundational capability that will define platform competitiveness over the coming decade.

From a strategic standpoint, Kuaishou’s investment in Kling AI illustrates a pragmatic attempt to democratize content production. By reducing barriers to high-quality video creation, the platform empowers a more diverse range of users—especially small creators, rural entrepreneurs, and niche influencers. This broadening of the creator base increases platform vibrancy, encourages deeper engagement, and enhances monetization potential. Moreover, by embedding Kling as both a front-end creation tool and a back-end operational engine, Kuaishou gains significant control over quality, efficiency, and data feedback loops, all of which are essential to AI optimization.

Simultaneously, Kuaishou’s AI initiatives carry profound implications for international growth. The platform’s expansion into Latin America and Southeast Asia is gaining traction, and AI-enabled localization is enabling faster, more cost-effective penetration into diverse linguistic and cultural markets. Kling’s potential to adapt content formats, translate content in real-time, and generate culturally resonant media offers a scalable path toward global user acquisition and brand differentiation. These capabilities also reduce dependency on large regional teams, thus improving cost structures and operational agility.

Yet, as has been clearly demonstrated throughout this analysis, the opportunities presented by AI are counterbalanced by a complex array of risks. Financially, Kuaishou’s AI spending has resulted in margin compression, with projections indicating further downward pressure as capital intensity increases. Operationally, the company must ensure that its AI infrastructure scales reliably and ethically. Technical debt, data management challenges, and compute resource constraints are all barriers that can stifle performance if not addressed proactively.

Equally important are the regulatory and ethical challenges that accompany AI deployment at scale. With Chinese authorities imposing stricter content guidelines and algorithmic transparency mandates, Kuaishou must navigate an evolving compliance landscape that could restrict certain applications of generative AI. Globally, the rise of legal disputes around model training, data privacy, and intellectual property underscores the importance of building transparent, accountable AI systems. Kuaishou’s long-term viability will, in part, hinge on its ability to balance rapid innovation with principled governance.

There is also the question of market timing. While Kling AI and other initiatives are gaining traction, mass adoption of AI-generated content and subscription-based creator tools is still in its early stages. User behavior, especially in mobile-first entertainment markets, can be slow to adapt to new technologies unless accompanied by significant incentives or perceived value-add. Kuaishou must therefore invest not only in technology, but in user education, interface simplification, and ecosystem building to ensure its AI offerings reach critical mass.

In light of these dynamics, the road ahead for Kuaishou is best described as a strategic high-wire act. The company must sustain growth, defend market share, and expand globally—all while managing costs and responding to a volatile regulatory and economic environment. AI offers the tools to accomplish these objectives, but its implementation must be both sophisticated and adaptive.

To that end, several strategic imperatives emerge for Kuaishou’s next phase:

- Operational Discipline: Kuaishou must continue to refine its AI R&D allocation, prioritizing initiatives that deliver measurable ROI while keeping long-term innovation pathways open. Striking a balance between experimentation and execution will be critical to maintaining investor confidence.

- AI Ecosystem Integration: Beyond Kling AI, the company should work to embed AI more deeply into every facet of its user experience—recommendations, e-commerce, advertising, and live streaming. Creating a seamless AI-enhanced journey for both creators and viewers will be key to differentiation.

- Globalization Through Localization: Kuaishou’s international success will depend on its ability to use AI for nuanced content localization and cultural adaptation. The expansion strategy must be data-driven, responsive to regional dynamics, and supported by localized AI infrastructures.

- Ethics and Trust: As AI-generated media proliferates, transparency and ethical alignment will become non-negotiable. Kuaishou should take a leadership role in establishing standards for labeling synthetic content, managing data provenance, and ensuring fairness in algorithmic decision-making.

- Strategic Partnerships: Finally, collaboration with cloud providers, AI research institutions, and even regulatory bodies will help Kuaishou access critical infrastructure, validate best practices, and accelerate innovation. Building a networked innovation model will reduce isolation risks and improve time-to-market.

In conclusion, Kuaishou’s AI transformation is a bold bet on the future of media, commerce, and technology. It demonstrates a deep understanding of platform economics and a willingness to evolve in order to meet the demands of a dynamic digital landscape. While the immediate impact on margins has prompted skepticism in some quarters, the longer-term benefits of AI—ranging from productivity and personalization to monetization and market expansion—are difficult to overstate.

Kuaishou is not simply responding to trends; it is attempting to shape them. By placing artificial intelligence at the core of its strategy, it is laying the groundwork for a new kind of digital platform—one that is intelligent, adaptive, creator-first, and globally scalable. The journey will be complex, and the risks are real. But if executed with precision, foresight, and ethical clarity, this could be the blueprint for the next generation of content platforms in China and beyond.

As the dust settles on Kuaishou’s latest earnings cycle and the next phase of AI integration unfolds, one thing remains clear: the future of digital platforms will be built not just on content, but on code—intelligent, generative, and transformative code. Kuaishou, for now, is leading that charge.

References

- Kuaishou Technology – Investor Relations

https://ir.kuaishou.com - KrASIA – Kuaishou turns a corner in Q1 as AI push begins to pay off

https://kr-asia.com/kuaishou-turns-a-corner-in-q1-as-ai-push-begins-to-pay-off - TechCrunch – Kuaishou’s AI ambitions expand with Kling video generator

https://techcrunch.com/kuaishou-ai-video-generator-kling - South China Morning Post – Kuaishou launches AI video creation tool

https://scmp.com/tech/china-tech/article/kuai-ai-video-creation - Pandaily – Kuaishou Deploys Kling to Enter Generative AI Space

https://pandaily.com/kuaishou-deploys-kling-ai-generator - Caixin Global – Kuaishou to invest heavily in AI to boost monetization

https://www.caixinglobal.com/kuaishou-ai-investment-strategy - Nikkei Asia – Kuaishou’s global expansion and tech investments

https://asia.nikkei.com/Business/Technology/Kuaishou-expansion-ai - Sina Finance – Kuaishou Financial Report Commentary

https://finance.sina.com.cn/kuaishou-financial-review - Aibase – Kling AI and Kuaishou’s multimodal strategy

https://www.aibase.com/news/18432 - Rest of World – AI’s role in shaping content creation in Asia

https://restofworld.org/2023/china-kuaishou-ai-content-platforms