How AI Is Driving a Surge in Clients for Advice Firms: The Future of AI-Enhanced Professional Services

In recent years, artificial intelligence (AI) has emerged as a pivotal force reshaping numerous sectors of the global economy. Nowhere is this transformation more evident than in the advice industry—a broad domain encompassing financial advisory services, legal consulting, tax planning, insurance brokerage, and general business consulting. As AI technologies become increasingly sophisticated and accessible, they are not only enhancing the capabilities of advisors but also fundamentally altering the way advice is delivered and consumed.

A new wave of optimism is sweeping through advice firms worldwide. According to several recent industry reports and market analyses, many firms are predicting a surge in client numbers over the next five years, driven largely by AI’s ability to democratize access to professional services and elevate service delivery to unprecedented levels. This anticipated growth comes at a time when traditional advisory models are under mounting pressure to evolve in response to shifting client expectations, regulatory changes, and competitive forces.

The drivers of this anticipated client surge are multifaceted. Advances in natural language processing, machine learning, and data analytics now enable firms to offer hyper-personalized advice at scale, improve operational efficiency, and deliver services through digital channels preferred by younger, tech-savvy clients. At the same time, the commoditization of certain advisory functions via AI-powered platforms is lowering costs and expanding market reach to previously underserved or unserved segments of the population.

Yet, the journey toward AI-powered advisory services is not without its challenges. Concerns about data privacy, algorithmic transparency, regulatory compliance, and the preservation of human judgment in complex decision-making contexts must be carefully navigated. Moreover, the integration of AI into advisory workflows requires strategic planning, significant investment in technology infrastructure, and a rethinking of talent strategies within firms.

This blog post delves deeply into the factors driving the AI-driven transformation of the advice industry and explores how firms are positioning themselves to capitalize on the resulting growth opportunities. It will examine how AI is reshaping service delivery models, identify key trends behind the projected surge in client demand, and offer strategic insights for firms seeking to navigate this new landscape. The post will also highlight potential pitfalls and best practices, providing a comprehensive roadmap for advice firms that aim to thrive in an increasingly AI-enhanced world.

As we embark on this exploration, one thing is clear: the convergence of human expertise and artificial intelligence is set to redefine the essence of professional advice. The firms that embrace this evolution thoughtfully and responsibly will be well-positioned to unlock new value for both their clients and their businesses.

The AI-Driven Shift in Service Delivery Models

The integration of artificial intelligence into the advice industry marks a profound evolution in how services are designed, delivered, and experienced. Across the financial, legal, tax, insurance, and general consulting domains, AI is not merely an efficiency tool but a catalyst enabling entirely new service delivery paradigms. This section explores the key ways in which AI is transforming the operational core of advice firms, reshaping client interactions, and redefining the value proposition of professional advice.

Revolutionizing the Advice Value Chain

AI’s impact on the advice industry begins at the foundation of the service value chain. Traditionally, advisory services have relied heavily on manual processes, bespoke client engagements, and the tacit knowledge of experienced professionals. While this model has historically delivered high-value outcomes, it is often constrained by scalability limitations, cost inefficiencies, and variable client experiences.

AI is dismantling these barriers through intelligent automation, advanced analytics, and dynamic client interaction capabilities. Several areas along the advice value chain are being fundamentally transformed:

- Client Onboarding and KYC (Know Your Customer)

The client onboarding process, which once involved extensive paperwork and prolonged identity verification procedures, is now being streamlined through AI-powered solutions. Machine learning algorithms can quickly analyze and validate client documents, detect anomalies, and ensure compliance with regulatory standards. Natural language processing (NLP) tools enable conversational interfaces that guide clients through onboarding steps seamlessly, improving user experience and accelerating time to engagement. - Automated Data Analysis and Personalized Recommendations

One of AI’s most significant contributions to the advice industry is its ability to process vast amounts of structured and unstructured data to generate actionable insights. Financial advisors, for example, can leverage AI-driven portfolio analysis tools that continuously monitor market conditions and client portfolios, delivering tailored investment recommendations in real-time. In legal consulting, AI systems analyze case law and precedent databases to support lawyers in crafting more robust legal arguments. Tax consultants utilize AI engines to identify optimization opportunities and ensure compliance with complex regulatory frameworks. - Chatbots and Virtual Assistants in Client Servicing

AI-driven chatbots and virtual assistants are revolutionizing client servicing by providing instant responses to routine queries and facilitating 24/7 engagement. These tools not only enhance client satisfaction but also free up human advisors to focus on higher-value advisory tasks. The use of conversational AI is expanding rapidly across advice firms, with capabilities evolving beyond scripted responses to more sophisticated, context-aware interactions. - Workflow Optimization and Advisor Productivity Tools

Internally, AI is driving substantial gains in advisor productivity and operational efficiency. Intelligent document management systems automate document classification and retrieval, while AI-driven scheduling tools optimize client meeting calendars. Predictive analytics help firms anticipate client needs and proactively suggest engagement opportunities, fostering deeper and more personalized client relationships.

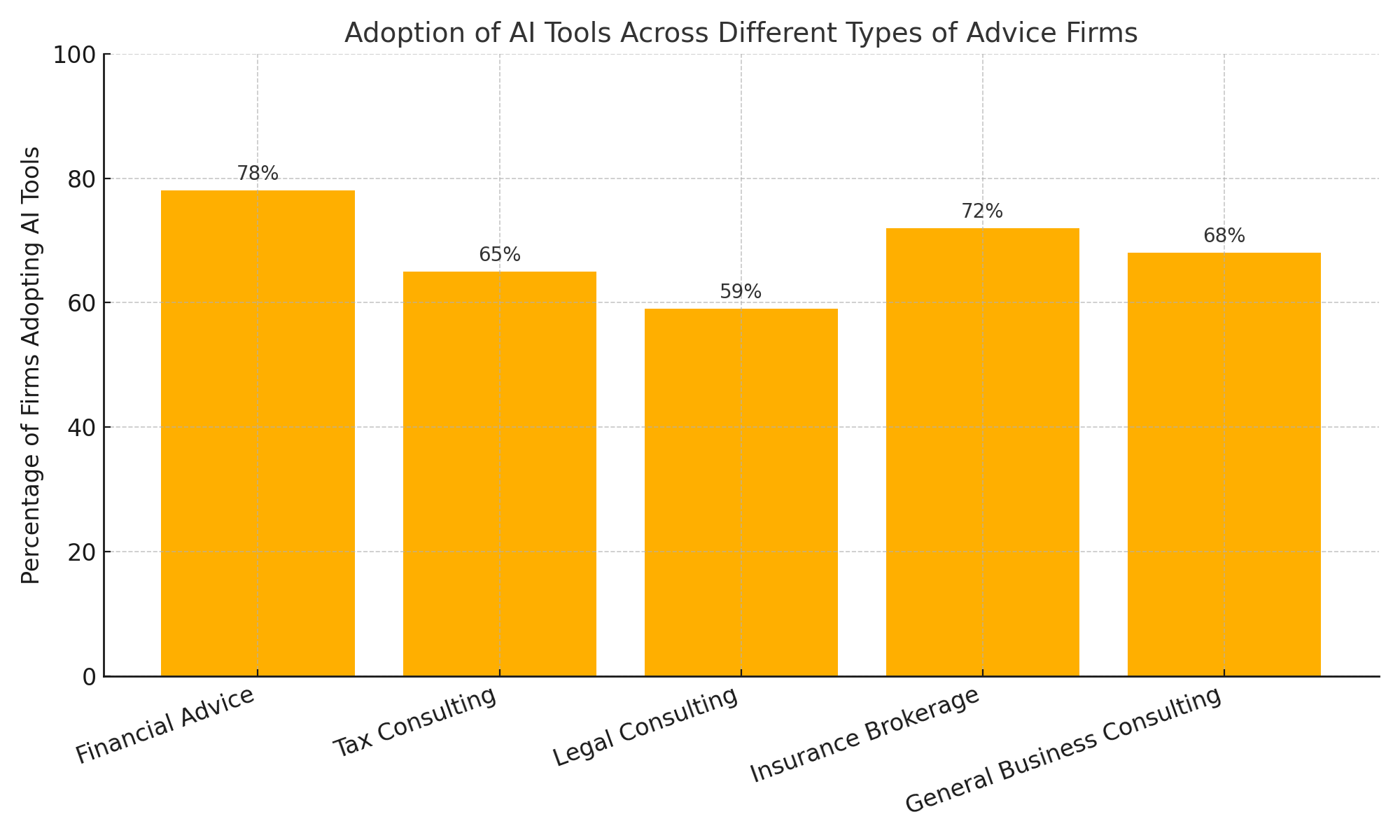

The breadth and pace of AI adoption vary across different segments of the advice industry. The following chart illustrates the current levels of AI tool adoption across key types of advice firms, highlighting where AI integration is most advanced and where opportunities for further transformation remain.

Real-World Deployments and Case Examples

Several pioneering advice firms have already begun to harness the transformative potential of AI. In the financial advisory space, firms like Vanguard and Charles Schwab have integrated AI into their robo-advisory platforms, offering personalized investment management at scale. Legal tech firms such as Luminance and ROSS Intelligence employ AI to support document review and legal research, enhancing the capabilities of legal practitioners. Major tax advisory firms, including Deloitte and PwC, leverage AI to deliver real-time tax insights and compliance solutions to corporate clients.

These early adopters demonstrate that AI is not a distant future aspiration but a present-day differentiator. Firms that strategically integrate AI into their service models are gaining competitive advantages in cost efficiency, service quality, and client satisfaction.

Navigating Implementation Challenges

Despite its promise, AI integration in the advice industry is not without its complexities. Trust remains a critical concern—both clients and regulators demand transparency in AI-driven decision-making processes. Firms must ensure that AI recommendations are explainable and aligned with ethical standards. Data privacy and cybersecurity also pose significant challenges, given the sensitive nature of client information handled by advice firms.

Moreover, achieving seamless AI integration requires thoughtful change management. Firms must invest in upskilling their workforce, adapting organizational culture, and fostering a collaborative environment where human expertise and AI capabilities complement each other.

The Path Forward

As AI continues to mature, its role in reshaping service delivery models within the advice industry will only expand. The transition from traditional, manually intensive models to AI-enhanced, client-centric approaches is well underway. Firms that embrace this evolution proactively—while maintaining a steadfast commitment to trust, transparency, and human judgment—will be poised to lead in a dynamic and increasingly competitive marketplace.

Projected Surge in Client Demand: Key Trends and Drivers

As artificial intelligence becomes an integral part of advice delivery, industry leaders are forecasting a notable surge in client demand. This growth is not confined to any one segment of the advice industry but is expected across financial, legal, tax, insurance, and general consulting services. The convergence of enhanced service accessibility, cost efficiencies, evolving client expectations, and new market opportunities is fueling this expansion. This section examines the core trends and drivers behind the projected growth, supported by both industry forecasts and practical market dynamics.

Democratization of Professional Advice

One of the most transformative effects of AI is the democratization of access to professional advice. Historically, personalized advice has been a premium service—costly, time-intensive, and typically reserved for affluent individuals or large organizations. AI fundamentally alters this equation by automating routine tasks, reducing operational costs, and enabling scalable service delivery.

For instance, AI-powered robo-advisors can now offer investment recommendations to retail investors at a fraction of the traditional cost. Legal advice platforms powered by AI chatbots can assist small businesses and individuals with basic legal queries without the need for expensive retainers. Similarly, AI-driven tax tools make sophisticated tax planning accessible to freelancers and gig workers, a demographic previously underserved by traditional firms.

This democratization is driving a significant expansion of the addressable market for advice firms. By lowering barriers to entry, AI allows firms to attract a broader and more diverse client base, contributing to the anticipated surge in demand.

Enhanced Client Experience

In today’s digital-first world, clients expect seamless, personalized, and responsive interactions. AI enables advice firms to meet—and exceed—these expectations. Advanced analytics and machine learning algorithms analyze client data to deliver hyper-personalized recommendations. Natural language processing facilitates real-time, conversational interfaces that make client interactions more engaging and intuitive.

Moreover, AI supports continuous service delivery. Clients can access advice and information 24/7 through AI-driven platforms, eliminating traditional time constraints and improving satisfaction. This enhanced experience is particularly appealing to younger demographics, such as Millennials and Gen Z, who prioritize digital convenience and personalization.

The net effect is twofold: existing clients are more likely to deepen their engagement with firms, and potential clients who value digital experiences are increasingly attracted to AI-enabled advisory services.

Cost Reduction and Market Expansion

AI-driven efficiencies translate directly into cost savings for advice firms. By automating routine tasks—such as data collection, document analysis, compliance checks, and reporting—AI reduces the time and labor required to serve each client. These cost savings enable firms to offer more competitive pricing, making their services accessible to market segments previously excluded by cost barriers.

Furthermore, the ability to serve clients at scale without a proportional increase in human resources allows firms to expand their client base rapidly. Small and medium-sized enterprises (SMEs), startups, and individuals with moderate budgets are increasingly turning to AI-enhanced advice services, driving market growth across all segments.

Shifts in Client Demographics and Preferences

Demographic shifts are also contributing to the projected demand surge. Digital-native generations are becoming the primary consumers of advice services. These clients are comfortable interacting with AI-driven platforms and value the speed, convenience, and personalization they offer.

Additionally, the rise of new business models—such as the gig economy and decentralized finance (DeFi)—is creating demand for novel forms of advice. Freelancers require flexible financial planning; crypto investors seek guidance on navigating volatile markets; and remote-first businesses need dynamic tax and legal support. AI-enabled advice firms are uniquely positioned to address these emerging needs, further expanding their client base.

Insights from Industry Reports

Recent industry surveys underscore these trends. According to a report by Accenture, 75% of advice firms expect AI to drive significant client growth over the next three years. A PwC study found that 68% of firms anticipate that AI will enable them to serve entirely new client segments. Meanwhile, Deloitte projects that AI-powered advisory services will account for over 40% of the industry’s revenue growth between 2025 and 2030.

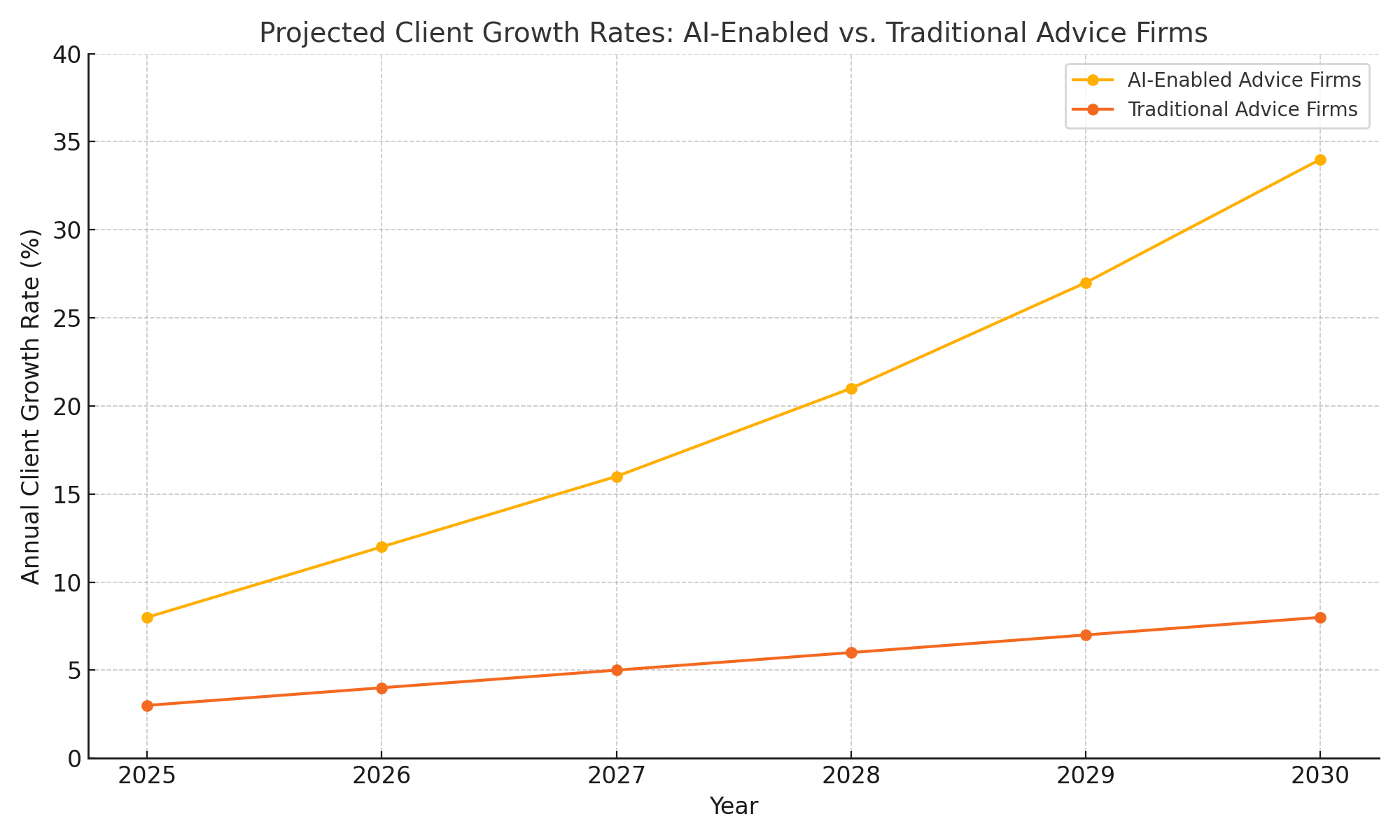

The chart below visualizes the projected client growth rates for AI-enabled advice firms compared to their traditional counterparts:

Geographic Trends

Geographically, the surge in client demand is expected to be most pronounced in markets with high digital adoption rates and supportive regulatory environments. North America and Western Europe currently lead in AI adoption within the advice industry. However, significant growth is also anticipated in Asia-Pacific markets, where rising middle-class populations and rapid digital transformation are driving demand for affordable, technology-driven advisory services.

The convergence of democratized access, enhanced client experience, cost efficiencies, shifting demographics, and emerging market opportunities is driving a projected surge in client demand for AI-enabled advice services. Firms that can strategically leverage AI to align with these trends will be well-positioned to capture this growing market and secure a competitive advantage in an increasingly dynamic landscape.

Strategic Considerations for Advice Firms Embracing AI

The rapid integration of artificial intelligence into the advice industry presents both unprecedented opportunities and complex challenges. To navigate this evolving landscape successfully, advice firms must adopt a comprehensive and forward-looking strategy that aligns technology with business objectives, regulatory requirements, and ethical imperatives. This section explores the critical strategic considerations that firms should address as they embrace AI-driven transformation.

Rethinking Business Models

AI is reshaping the economic fundamentals of advisory services. Firms must revisit their business models to harness the full potential of AI while preserving their core value proposition.

- Fee Structures and Service Tiers

AI enables firms to offer tiered service models that cater to a broader spectrum of clients. For example, firms can introduce low-cost, AI-driven basic services alongside premium, hybrid offerings that combine human expertise with AI-enhanced insights. This approach allows firms to tap into underserved market segments without cannibalizing higher-margin offerings. - Hybrid Advice Models

The future of advisory services lies in hybrid models where AI augments human expertise rather than replaces it. Advisors equipped with AI tools can deliver more informed, personalized, and efficient services. By positioning AI as a trusted co-pilot rather than a substitute, firms can enhance client trust and engagement. - New Revenue Streams

AI opens opportunities for new revenue streams, such as subscription-based services, AI-powered knowledge platforms, and data-driven insights products. Exploring these avenues can diversify income sources and enhance business resilience.

Technology Stack and Investment Priorities

A robust technology foundation is critical for successful AI integration. Firms must strategically invest in building an AI-ready infrastructure.

- Core Capabilities

Key components of an effective AI stack include advanced data management systems, machine learning platforms, natural language processing engines, and secure cloud infrastructure. Firms should prioritize technologies that enable seamless integration with existing systems and support scalable service delivery. - Vendor Partnerships

Collaborating with AI vendors, fintech, legaltech, and regtech partners can accelerate AI adoption and innovation. Strategic partnerships allow firms to leverage cutting-edge capabilities without the need for extensive in-house development. - Continuous Innovation

The AI landscape is evolving rapidly. Firms must foster a culture of continuous innovation, encouraging experimentation with emerging technologies such as generative AI, explainable AI, and AI-driven client engagement tools.

Talent and Organizational Transformation

The successful adoption of AI requires a parallel transformation of organizational capabilities and culture.

- Upskilling and Reskilling

Advisors and staff must be equipped with new skills to effectively leverage AI tools. Training programs should focus on data literacy, AI ethics, and human-AI collaboration competencies. - Evolving Roles

AI will redefine traditional roles within advice firms. Advisors will transition from information providers to strategic consultants, focusing on complex, high-value client interactions that require human judgment and empathy. - Change Management

Managing organizational change is crucial to overcoming resistance and fostering AI adoption. Transparent communication, leadership commitment, and inclusive change processes can help build trust and alignment across the organization.

Regulatory and Ethical Considerations

As AI becomes integral to advisory services, firms must navigate a complex web of regulatory and ethical considerations.

- Compliance and Transparency

Regulators are increasingly scrutinizing the use of AI in client-facing roles. Firms must ensure that AI-driven recommendations are transparent, explainable, and compliant with applicable laws and standards. - Data Privacy and Security

Given the sensitive nature of client data, robust data privacy and cybersecurity measures are non-negotiable. Firms must implement advanced encryption, access controls, and monitoring to safeguard client information. - Ethical AI Deployment

Ethical considerations must guide AI deployment. Firms should establish governance frameworks to ensure that AI systems operate fairly, avoid bias, and respect client autonomy. Ethical guidelines should be embedded into AI development, testing, and deployment processes.

Risk Management and Mitigation Strategies

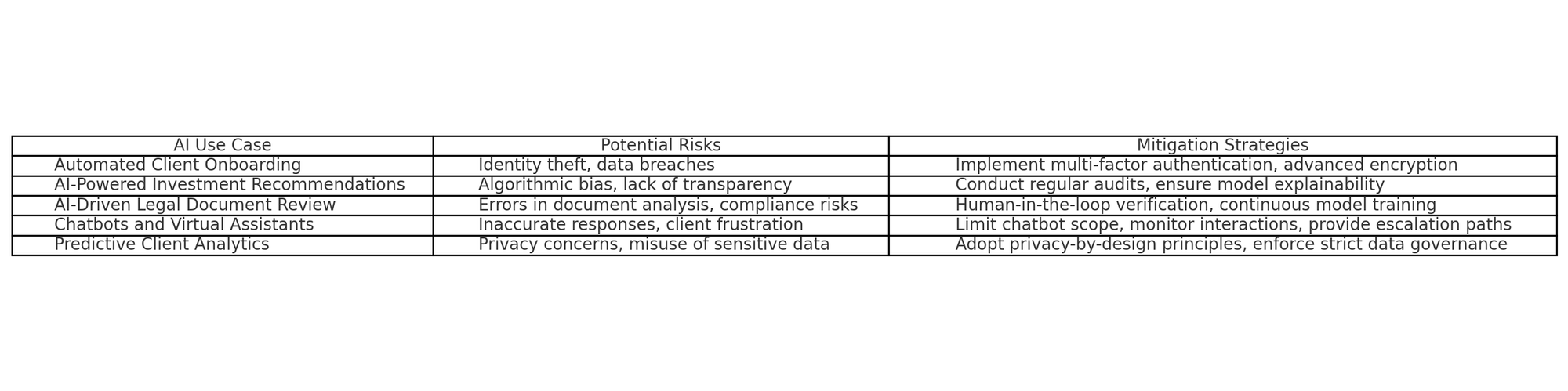

Integrating AI into advisory services introduces new risks that must be proactively managed. The table below summarizes key AI use cases, associated risks, and recommended mitigation strategies:

Embracing AI offers advice firms a pathway to enhanced client value, operational excellence, and sustained competitive advantage. However, this journey demands more than technology adoption; it requires a strategic, holistic approach that balances innovation with trust, transparency, and human-centric values. Firms that thoughtfully navigate these strategic considerations will be best positioned to lead the next era of AI-enhanced professional advice.

The Future of Advice in an AI-Enhanced World

The integration of artificial intelligence into the advice industry is not a fleeting trend, but a structural shift that is redefining how professional services are conceived, delivered, and experienced. The insights explored throughout this blog underscore a clear trajectory: AI is fundamentally transforming the value chain of advisory services, fueling unprecedented growth in client demand and reshaping competitive dynamics.

Summary of Key Insights

The journey of AI in the advice industry is driven by several powerful forces. First, the ability of AI to democratize access to professional advice is expanding the market, making high-quality services available to a broader demographic. Second, AI’s capacity to enhance client experience through personalization, convenience, and responsiveness is fostering deeper and more sustained client engagement. Third, AI-driven operational efficiencies are enabling firms to scale services cost-effectively, further amplifying their reach.

The projected surge in client demand reflects these dynamics in action. As Chart 2 illustrated, AI-enabled advice firms are expected to outpace their traditional counterparts significantly in client growth over the next five years. This trend is reinforced by shifts in client demographics, the emergence of new advice needs driven by the digital economy, and increasing comfort with AI-driven interactions among younger generations.

At the same time, advice firms must navigate a complex array of strategic considerations to succeed in this evolving landscape. Business model innovation, technology investment, talent transformation, and rigorous adherence to regulatory and ethical standards are all critical components of an effective AI strategy. The table presented in Section IV highlights the importance of proactive risk management to ensure that AI deployments enhance trust and safeguard client interests.

The Vision for the Next 3-5 Years

Looking ahead, the advice industry will likely be characterized by hybrid models that seamlessly blend human expertise with AI capabilities. Clients will expect—and receive—advice that is not only deeply personalized but also instantly accessible and continuously updated. Firms that embrace AI thoughtfully will be able to serve new market segments, innovate in service offerings, and build stronger, more enduring client relationships.

The role of the human advisor will evolve, focusing on areas where empathy, judgment, and complex problem-solving are paramount. Meanwhile, AI will handle data-driven tasks, routine interactions, and predictive analytics. This symbiosis will enhance the overall value proposition of advisory services.

Technologically, the next wave of AI innovation—including explainable AI, generative AI, and more advanced natural language interfaces—will further elevate service quality and client experience. Firms that foster a culture of continuous learning and innovation will be best positioned to leverage these advancements.

Implications for Clients

For clients, the future holds great promise. They can look forward to more affordable, personalized, and proactive advice services. AI will empower clients with greater visibility into their financial, legal, and risk landscapes, enabling smarter decision-making. However, clients must also remain vigilant about data privacy and the ethical use of AI in services they consume.

Final Recommendations for Firms

To capitalize on the opportunities presented by AI, advice firms should:

- Develop a clear AI strategy aligned with business goals and client needs.

- Invest in robust, secure, and scalable AI infrastructure.

- Foster a culture of innovation and continuous learning.

- Ensure transparency, fairness, and ethical integrity in AI deployments.

- Engage proactively with regulators and industry bodies to shape responsible AI practices.

In conclusion, the convergence of human expertise and artificial intelligence is ushering in a new era for the advice industry. Firms that embrace this transformation with vision, responsibility, and agility will not only thrive but also elevate the standards of professional advice for generations to come.

References

- https://www.accenture.com/us-en/insights/artificial-intelligence/ai-reinventing-financial-services

- https://www.pwc.com/gx/en/industries/financial-services/ai-in-financial-services.html

- https://www2.deloitte.com/global/en/pages/financial-services/articles/ai-in-the-future-of-financial-services.html

- https://www.ey.com/en_gl/ai/ai-in-wealth-and-asset-management

- https://www.luminance.com/insights

- https://rossintelligence.com/blog

- https://www.charlesschwab.com/intelligent-portfolios

- https://www.vanguard.com/advisors/solutions/digital-advice

- https://www.ibm.com/industries/financial-services/ai

- https://hbr.org/2022/ai-in-consulting-industry-opportunities-and-risks