AI Is Transforming Accounting by Automating Repetitive Tasks—Here’s What It Means for Your Job

For centuries, the accounting profession has served as the backbone of organizational integrity, financial accuracy, and regulatory compliance. From ledger books meticulously updated by hand to sophisticated enterprise resource planning (ERP) systems, the field has continually evolved alongside technological advancements. However, no previous innovation has promised as radical a transformation as artificial intelligence (AI). More than just a new tool, AI is poised to fundamentally reshape the function, purpose, and nature of accounting roles across industries.

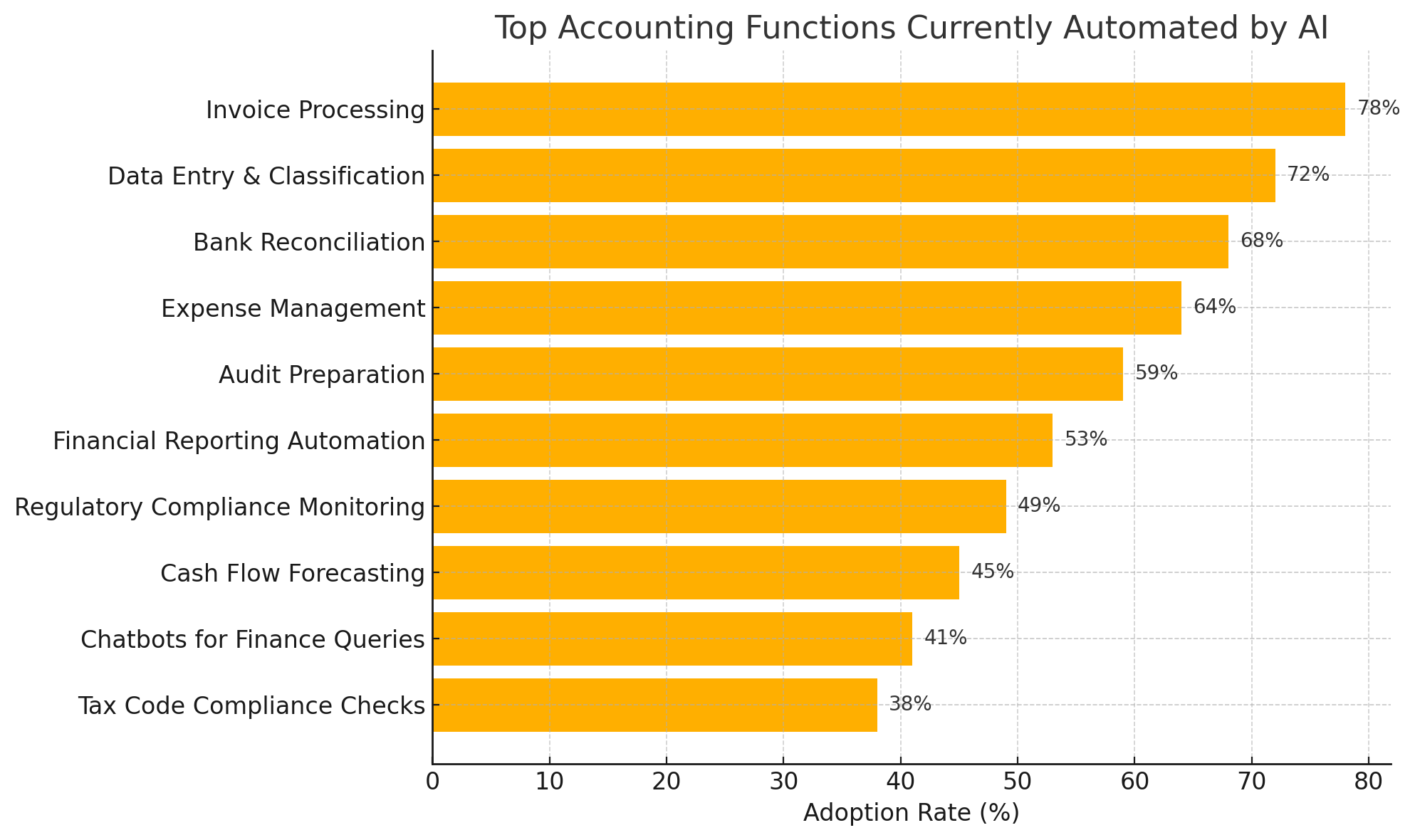

At the core of this disruption lies a paradox: AI is gaining traction in accounting precisely because it excels at the work many professionals find monotonous and repetitive—what some might label the “boring” parts of the job. These tasks, though essential, consume significant time and resources. Data entry, invoice categorization, bank reconciliation, compliance checks, and routine audit processes are integral to the accounting ecosystem, yet they require minimal strategic thinking. These are the domains where AI thrives, bringing with it unparalleled speed, accuracy, and efficiency.

The proliferation of intelligent automation tools and machine learning models has enabled businesses to offload these routine functions to AI-powered systems. In doing so, they have not only streamlined operations but also redefined the roles of human accountants. Freed from repetitive grunt work, accountants are now being repositioned as strategic analysts, data interpreters, and business advisors—responsible not just for compiling numbers but for deriving insights and guiding organizational decisions.

This transformation is no longer theoretical. According to a growing body of industry surveys and reports, accounting departments across enterprises—from small businesses to multinational corporations—are rapidly adopting AI technologies. Invoices are now read and processed by optical character recognition (OCR) systems; anomaly detection algorithms flag suspicious transactions in real-time; and intelligent bots reconcile accounts with precision that far exceeds human capacity. These capabilities are not replacing accountants outright, but they are changing what it means to be one.

Yet, the rise of AI in accounting also brings complex questions and potential risks. How should organizations manage the ethical implications of delegating financial oversight to machines? Will AI disproportionately eliminate entry-level jobs, thereby creating a skills gap in the profession? And what safeguards are needed to ensure transparency and trust in AI-driven decision-making? These questions warrant serious attention from policymakers, professional bodies, and business leaders alike.

At the same time, the opportunities are substantial. AI enables firms to move beyond operational efficiency and embrace predictive analytics, real-time forecasting, and dynamic scenario planning. As the function evolves from “bean counting” to strategic forecasting, the future accountant must blend financial knowledge with technological fluency, critical thinking, and advisory expertise.

This blog post explores how AI is transforming accounting from a routine, rules-driven discipline into a dynamic, insight-oriented profession. In the sections that follow, we will delve into the core capabilities of AI in accounting, the shift in professional roles, real-world use cases, associated risks, and the long-term implications of this ongoing transformation. Through charts, tables, and case studies, we will paint a comprehensive picture of a future where human accountants and AI systems collaborate rather than compete.

In short, AI is not erasing the accounting profession—it is redefining it. By automating the “boring” but essential aspects of the job, AI is making space for accountants to focus on what truly adds value: strategic thinking, human judgment, and meaningful business impact.

The Automation Surge – What AI Can Do in Accounting Today

The convergence of artificial intelligence (AI) with accounting practices has ushered in a new era of efficiency, speed, and accuracy. No longer confined to theoretical discussions, AI-powered solutions are now embedded within accounting software, finance platforms, and enterprise resource planning (ERP) systems. This surge in automation is not limited to large corporations; small- and medium-sized enterprises (SMEs) are equally embracing the transformative power of AI. As a result, the profession is undergoing a seismic shift, with machine learning models, intelligent bots, and cognitive tools taking over core accounting functions that were once painstakingly manual.

At the heart of this transition lies the unique capability of AI to mimic human cognitive functions—particularly in processing vast volumes of structured and unstructured data. In the context of accounting, this means AI systems can now read, extract, classify, reconcile, and analyze financial data with increasing precision and contextual understanding. These capabilities are not only enhancing productivity but also redefining what it means to deliver accounting services.

Intelligent Data Entry and Processing

One of the most significant ways AI is transforming accounting is by automating the ingestion and categorization of financial data. Through optical character recognition (OCR) and natural language processing (NLP), AI can scan invoices, receipts, and purchase orders—converting scanned or photographed documents into structured, usable data. AI algorithms are then trained to classify each entry into the appropriate accounting categories, such as expenses, assets, liabilities, and revenue streams. This level of automation eliminates the need for manual data entry, which has long been regarded as one of the most tedious and error-prone aspects of accounting work.

For instance, AI-powered platforms like Rossum, Vic.ai, and DocuWare allow companies to process thousands of invoices in real time, flag inconsistencies, and ensure compliance with internal accounting standards. The result is a dramatic reduction in labor hours, faster processing cycles, and increased data reliability—especially during month-end and year-end close.

Reconciliation and Error Detection

Bank and account reconciliation is another area where AI tools are delivering remarkable results. By continuously comparing internal records with bank statements and transaction logs, AI systems can identify discrepancies, duplicates, or missing entries with unmatched speed. Advanced machine learning models can even learn an organization’s transaction patterns and develop predictive capabilities to anticipate anomalies or recurring reconciliation issues.

Unlike traditional reconciliation software that relies on rigid rule-based systems, AI models are adaptive. They can handle exceptions, learn from historical corrections, and improve over time. This not only enhances the accuracy of reconciliation processes but also empowers finance teams to shift their focus from rectifying errors to analyzing trends and improving controls.

Audit and Compliance Automation

Audit preparation is a traditionally resource-intensive process, often involving extensive document retrieval, sampling, and cross-referencing. AI streamlines this by automatically extracting and organizing audit trails from transactional databases, ensuring that every record is tagged, time-stamped, and linked to its source. AI-driven platforms can also perform real-time compliance checks, monitoring transactions against internal policies and external regulations.

In the realm of regulatory compliance, AI has proven particularly beneficial in detecting fraud, ensuring adherence to tax codes, and verifying financial disclosures. For example, AI tools are now capable of scanning all transactions within an organization’s ledger and cross-referencing them with up-to-date tax rules, flagging those that deviate from legal parameters. This proactive compliance approach is vastly more efficient and reliable than traditional post-hoc audits.

Forecasting and Predictive Analytics

Beyond routine tasks, AI is increasingly being deployed for forward-looking functions such as cash flow forecasting, budgeting, and scenario planning. Machine learning algorithms can process historical financial data and external economic indicators to generate highly accurate forecasts. These tools enable finance departments to model “what-if” scenarios, assess financial risk, and guide strategic planning with data-backed projections.

AI-based predictive analytics are particularly valuable during periods of economic uncertainty. By identifying patterns across multiple variables, AI can uncover emerging risks and opportunities far earlier than human analysts, allowing companies to respond with agility.

Chatbots and Virtual Assistants

Another emerging application of AI in accounting is the deployment of virtual assistants and chatbots. Integrated into accounting platforms, these conversational agents can handle common queries, assist with data retrieval, and even guide users through complex workflows such as preparing tax filings or generating financial reports. While these tools may appear rudimentary, they significantly reduce the cognitive load on accounting teams by handling repetitive informational tasks.

For example, a chatbot integrated into a payroll system can instantly answer questions related to pay periods, deductions, or leave balances—reducing the volume of HR and finance support tickets. Similarly, virtual assistants can help junior accountants locate and interpret relevant accounting standards or templates, accelerating learning and productivity.

Robotic Process Automation (RPA)

AI is often complemented by Robotic Process Automation (RPA)—a technology that mimics the actions of human users within digital systems. In accounting, RPA bots are frequently used to execute rule-based processes such as compiling reports, transferring data between systems, or sending notifications. When combined with AI, RPA becomes significantly more powerful, as the bots can now make decisions based on context, not just pre-defined rules.

For example, an RPA bot augmented with AI might not only extract data from invoices but also determine the appropriate cost center, validate supplier information, and initiate a payment approval workflow—without any human intervention. This seamless orchestration of tasks drastically reduces processing times while minimizing the likelihood of human error.

Transformational Impact on Efficiency and Accuracy

The value proposition of AI in accounting is not limited to cost-cutting or headcount reduction. More fundamentally, AI enhances accuracy, accelerates processing, and enables accountants to focus on higher-value tasks. Organizations leveraging AI report faster financial closes, improved audit readiness, and higher compliance scores. Moreover, the automation of mundane tasks contributes significantly to employee satisfaction, as finance professionals are increasingly able to engage in strategic analysis and creative problem-solving.

This automation surge is not without its challenges, including data privacy concerns, model explainability, and integration complexities. However, as AI technologies mature and become more accessible, the momentum toward widespread adoption is expected to accelerate.

Redefining Roles – Accountants as Strategic Advisors

As AI technologies rapidly transform the accounting landscape by taking over repetitive and rules-based functions, the traditional role of the accountant is undergoing a fundamental evolution. What was once a profession focused heavily on data input, reconciliations, and compliance reporting is now pivoting toward higher-value tasks centered on strategic decision-making, forecasting, and advisory services. Rather than displacing accountants, AI is redefining the profession, freeing human capital from low-impact tasks and enabling a shift toward roles that require analytical judgment, business acumen, and cross-functional collaboration.

This transformation is not merely aspirational—it is already manifesting across industries. Organizations that have embraced AI in their finance departments report a significant change in how accounting professionals allocate their time and effort. Freed from routine work, accountants are now being called upon to serve as interpreters of data, communicators of financial narratives, and architects of forward-looking strategies.

From Transaction Processing to Strategic Analysis

In the traditional accounting model, a significant portion of time was devoted to processing transactions, performing reconciliations, and preparing reports for compliance and audit purposes. These activities, while critical, are inherently retrospective. They focus on documenting what has already occurred, offering little time or capacity for proactive analysis.

AI has upended this structure. By automating transaction classification, ledger updates, and compliance checks, intelligent systems allow accountants to shift their attention from “what happened” to “why it happened” and “what should happen next.” This reorientation enables professionals to derive insights from financial patterns, analyze operational inefficiencies, and model strategic scenarios for the future. As a result, accountants are increasingly involved in cross-departmental discussions, contributing to pricing strategies, capital allocation, risk management, and resource optimization.

The Emergence of the "Augmented Accountant"

The rise of AI has given birth to a new archetype in the profession: the "augmented accountant." This individual leverages AI tools not as a replacement, but as a collaborator—enhancing their ability to work faster, smarter, and with greater precision. These professionals are expected to interpret algorithmic outputs, challenge assumptions, and ensure that the insights generated by machines align with organizational goals and ethical standards.

Importantly, the augmented accountant must possess a dual competency. On one side lies deep financial knowledge, including GAAP/IFRS standards, tax regulations, and auditing frameworks. On the other side are technology-oriented skills, including data literacy, familiarity with analytics platforms, and a working knowledge of how AI models function and fail. This hybrid profile is rapidly becoming the gold standard in hiring for modern accounting teams.

Upskilling and Reskilling the Workforce

The evolving role of the accountant has prompted a reassessment of the skills needed for success in a digitally transformed workplace. Traditional training focused heavily on ledger mechanics, debits and credits, and regulatory frameworks. While these remain foundational, today’s accounting professionals must also develop proficiencies in data analytics, AI tool usage, and financial storytelling.

In response, many organizations and professional bodies are investing heavily in upskilling and reskilling initiatives. Certification programs like those offered by the Association of International Certified Professional Accountants (AICPA), Chartered Institute of Management Accountants (CIMA), and Certified Management Accountants (CMA) have introduced AI and analytics modules into their curricula. Workshops, webinars, and micro-credentials on RPA, machine learning, and business intelligence tools such as Power BI and Tableau are also being widely adopted.

Moreover, firms are fostering internal learning ecosystems to support continuous professional development. These include peer-to-peer learning communities, sandbox environments for experimenting with AI tools, and mentorship programs to help junior accountants adapt to their expanding roles. By equipping professionals with both financial and digital fluency, firms ensure they remain competitive in a rapidly changing market.

| Function | Traditional Accountant Role | AI-Augmented Accountant Role |

|---|---|---|

| Data Entry | Manual input of invoices, receipts, and transactions | Oversees automated data extraction and validation |

| Reconciliation | Periodic review and matching of bank and ledger entries | Supervises continuous, real-time reconciliation |

| Compliance | Reviews policies and manually checks for violations | Monitors automated alerts for compliance issues |

| Audit Preparation | Gathers documents and prepares audit trails manually | Uses AI to pre-organize and tag relevant audit data |

| Reporting | Creates monthly/quarterly reports with spreadsheets | Uses dynamic dashboards and auto-generated insights |

| Forecasting | Relies on static models and historical averages | Collaborates with AI to generate predictive forecasts |

| Advisory | Provides insight based on historical data | Uses real-time data and scenarios to drive strategy |

| Collaboration | Works within the finance silo | Partners with cross-functional teams (Ops, Sales, IT) |

| Skillset | Accounting standards, Excel proficiency | Financial acumen + data literacy + AI comprehension |

| Value Contribution | Accuracy, compliance, and audit readiness | Strategic insight, business enablement, real-time input |

Redefining Performance Metrics and KPIs

As the scope of the accounting role expands, so too must the metrics used to evaluate performance. Traditional KPIs such as accuracy rate, days to close, or audit pass rate remain relevant, but are no longer sufficient on their own. AI handles many of these metrics autonomously and with high precision. Therefore, organizations are increasingly evaluating accountants on their ability to generate insights, collaborate effectively, and contribute to decision-making processes.

New performance indicators include:

- Time-to-insight: How quickly an accountant can translate raw data into strategic input

- Forecast accuracy: The precision of forward-looking models generated with AI support

- Stakeholder satisfaction: Feedback from internal clients regarding financial clarity and usability of reports

- Innovation score: Participation in process improvement and digital transformation initiatives

This evolution in performance expectations further reinforces the need for a strategic mindset and continuous learning orientation among today’s accounting professionals.

Fostering Human Judgment in an AI Ecosystem

While AI is remarkably effective in pattern recognition, anomaly detection, and process automation, it lacks human judgment, ethical reasoning, and contextual understanding. In complex scenarios—such as evaluating the implications of a regulatory change, navigating a financial crisis, or advising on a merger—human insight remains irreplaceable.

Accountants must therefore act as mediators between machine outputs and business realities. This involves questioning AI-generated recommendations, identifying false positives or interpretive gaps, and applying domain expertise to fine-tune conclusions. In many ways, the future of accounting depends not on humans outperforming machines, but on mastering the art of critical oversight in an increasingly automated landscape.

The Cultural Shift Toward Value Creation

The transformation of the accountant into a strategic advisor also marks a broader cultural shift in how finance departments operate. No longer viewed solely as cost centers or compliance enforcers, modern accounting teams are becoming value creators—leveraging AI not just to cut costs but to uncover revenue opportunities, optimize operations, and elevate the overall competitiveness of the organization.

This cultural shift must be reinforced from the top down. Leadership buy-in, investment in enabling technologies, and the redefinition of organizational priorities are critical to unlocking the full potential of the AI-augmented accountant. When supported properly, finance professionals can play a central role in shaping the strategic trajectory of their organizations.

Use Cases – AI in Action

Theoretical discussions about the benefits of AI in accounting are increasingly being validated by real-world applications. Across industries and business sizes, companies are harnessing AI technologies to transform financial operations, drive accuracy, and generate strategic insights. From invoice automation to real-time compliance monitoring, AI is not only streamlining workflows but also delivering measurable business value. This section highlights key use cases and practical implementations of AI in accounting, demonstrating how enterprises are leveraging intelligent automation to improve efficiency, reduce risk, and enhance decision-making.

Enterprise-Level Transformation: Automating Audit Preparation

One of the most significant beneficiaries of AI in accounting has been the auditing process, particularly for large corporations dealing with vast volumes of data. A notable example is a global manufacturing conglomerate that implemented AI-driven audit preparation tools within its internal finance function.

Before AI adoption, the audit process was cumbersome and manually intensive. Teams spent weeks gathering supporting documents, cross-referencing ledgers, and compiling audit trails. With the deployment of AI, the system now continuously captures and organizes relevant financial transactions throughout the fiscal year. Each entry is tagged with contextual metadata—such as source system, transaction type, and approval status—making it instantly retrievable by auditors.

The result has been a drastic reduction in audit preparation time, from an average of 3 weeks to just 5 days. In addition, error rates in documentation retrieval have fallen by over 80%, and compliance audit scores have improved across the board. More importantly, finance personnel can now focus their efforts on interpreting findings rather than simply preparing for audits.

Streamlining Payroll and Tax Filing for SMEs

AI is not confined to the upper echelons of the corporate world; it is equally impactful for small and medium-sized enterprises (SMEs). Consider the case of a mid-sized logistics company operating in multiple states across the U.S. The firm struggled with managing complex payroll requirements, including varying state taxes, benefit deductions, and compliance deadlines.

By integrating an AI-enabled payroll and tax filing system, the company transformed its human resource and finance operations. The AI engine automatically categorized employees by tax jurisdiction, calculated withholdings, and submitted filings on time. It also monitored changes in local regulations and updated calculations accordingly—without human intervention.

Within a few months of deployment, the company reported a 90% reduction in payroll errors, faster payroll cycles, and significant time savings. Employees gained access to AI-powered chatbots that answered tax-related questions in real time, further reducing HR workload and improving satisfaction. For SMEs with limited accounting staff, such AI systems offer scale and compliance support that would otherwise be prohibitively expensive.

Industry-Specific Applications: Real Estate and E-Commerce

AI's flexibility allows it to be adapted to the nuances of different industries, leading to targeted innovations in accounting practices.

In the real estate sector, property management firms have begun leveraging AI to automate rent roll reconciliation, lease abstraction, and capital expenditure forecasting. For example, one commercial property manager deployed an NLP-based AI engine that reads leases, extracts financial terms, and maps them to accounting systems. This eliminated the need for paralegal review, reduced turnaround time for new leases, and improved accuracy in income projections.

In the e-commerce domain, businesses face the challenge of managing thousands of transactions across multiple platforms and payment gateways. AI-powered reconciliation engines now allow these firms to ingest transaction data from Shopify, Stripe, PayPal, and bank feeds in real-time. One online retailer reported that after implementing AI-based tools, they reconciled over 30,000 transactions per month with 99.5% accuracy, compared to 85% accuracy when performed manually. This not only improved financial integrity but also provided near-instant visibility into sales performance and cash flow.

AI in Expense Management and Budget Optimization

Expense management is another area where AI delivers immediate impact. By combining machine learning and pattern recognition, AI tools can scan submitted expenses, identify anomalies, and ensure policy compliance without human review. In one case, a large consulting firm used an AI platform to audit travel and entertainment (T&E) expenses. The system flagged duplicate receipts, out-of-policy spend, and questionable vendor entries. Over a single fiscal year, this process prevented more than $600,000 in fraudulent or non-compliant claims.

Furthermore, AI’s analytical capabilities are being used to optimize budgets. A consumer goods manufacturer implemented an AI tool to analyze procurement data and detect supplier pricing trends. The platform not only helped negotiate better vendor contracts but also predicted budget overruns months in advance. This allowed the finance team to adjust their spending strategies proactively, improving budget adherence by 15%.

Enhancing Financial Forecasting Accuracy

In an increasingly volatile economic environment, accurate forecasting is vital. AI-based forecasting models are being deployed to support rolling forecasts, dynamic scenario modeling, and real-time revenue projections. For instance, a multinational tech firm replaced its static Excel-based forecasting system with an AI-powered predictive analytics platform.

This system processed historical financial data, market trends, and external macroeconomic indicators to generate forecasts. It also enabled finance teams to run “what-if” scenarios in minutes—modeling the impact of pricing changes, supply chain disruptions, or geopolitical shifts. After implementation, the accuracy of revenue forecasts improved from 70% to over 90%, and the time required to generate forecasts dropped by 60%.

Moreover, the AI system highlighted leading indicators—such as customer churn rates or supplier delays—that were previously overlooked. This gave leadership teams critical foresight to mitigate risks and capitalize on emerging opportunities.

Ethical and Operational Considerations

While these use cases underscore AI’s transformative potential, they also bring operational and ethical responsibilities. For instance, AI models must be audited for bias, transparency, and auditability. Finance teams must validate that decision-making processes—such as fraud detection or credit assessment—are not only statistically sound but also ethically defensible.

In a real-world example, a financial services firm discovered that its AI model for expense approvals had disproportionately rejected claims from a specific region due to historical bias in training data. Upon auditing the model, the firm revised the algorithm and implemented regular bias-checking protocols. This highlights the importance of human oversight and ethical governance in AI deployment.

Additionally, businesses must invest in proper data infrastructure, ensure cybersecurity measures, and provide training to end-users. The success of AI in accounting is not simply a function of technical capability, but also of cultural readiness and organizational alignment.

The aforementioned use cases illustrate that AI is not a futuristic abstraction but a present-day force reshaping financial operations. By enabling faster, smarter, and more accurate decision-making, AI is delivering tangible value across diverse industries and accounting functions. These examples offer a blueprint for other organizations contemplating the shift toward intelligent automation.

Challenges, Risks and Human Impact

While the integration of artificial intelligence into accounting has undoubtedly yielded transformative benefits—ranging from automation of repetitive tasks to real-time financial insights—it is not without its challenges. As with any systemic shift, the rise of AI in accounting introduces complex trade-offs that demand careful consideration by stakeholders, including corporate leaders, policymakers, regulators, and professionals within the field. These concerns span operational risks, ethical questions, and human workforce implications. To harness AI's full potential responsibly, it is essential to address these emerging issues with foresight, structure, and accountability.

Concerns About Job Displacement

The most frequently voiced concern about AI in accounting is the threat of job displacement. As AI automates tasks such as data entry, invoice processing, reconciliation, and compliance reporting, roles traditionally performed by entry-level accountants may diminish or evolve significantly. This creates anxiety among both current professionals and aspiring accountants regarding the long-term viability of their careers.

While it is true that automation will likely reduce demand for some low-skill tasks, it does not equate to mass unemployment. Instead, job roles are undergoing transformation. Routine functions are giving way to higher-order responsibilities involving analysis, judgment, and decision-making. However, the transition may be uneven. Entry-level roles have historically served as the foundation for training and advancement. Without those stepping stones, the profession risks losing its talent pipeline.

To address this, organizations must not only reskill existing staff but also redesign job structures to ensure junior employees gain exposure to strategic tasks early in their careers. Professional bodies and educational institutions must also reframe curricula to emphasize technological proficiency and critical thinking over manual processing.

Over-Reliance and Black-Box Decision-Making

A growing operational risk in AI-driven accounting environments is the over-reliance on algorithmic decision-making. AI models, particularly those driven by machine learning, operate in what is often referred to as a “black box”—where the logic behind decisions is not easily understood by humans. This opacity becomes problematic in audit scenarios, legal compliance, and executive decision-making, where traceability and justification are critical.

For example, if an AI model flags a transaction as potentially fraudulent, auditors and regulators must understand how that determination was made. If the model cannot provide a rationale in human-interpretable terms, the organization may be exposed to scrutiny and legal risk. Transparency, explainability, and auditability are therefore essential requirements for AI adoption in accounting.

To mitigate this risk, companies should adopt “glass-box” models—systems that provide visibility into decision logic. Additionally, human oversight mechanisms must be institutionalized to ensure that AI outputs are reviewed, interpreted, and, when necessary, challenged before final action is taken.

Data Privacy and Security Risks

AI’s efficacy is heavily dependent on access to high-quality, comprehensive datasets. In accounting, this includes sensitive financial information, payroll records, customer details, and regulatory documentation. The centralization and processing of such data by AI systems create potential vulnerabilities around data privacy, cyber threats, and regulatory non-compliance.

High-profile data breaches in recent years have demonstrated the severe consequences of poor data governance. In the context of AI, the threat surface expands—particularly when third-party AI vendors are involved or when data is processed via cloud-based platforms.

To address these risks, organizations must implement robust cybersecurity frameworks, ensure compliance with regulations such as the General Data Protection Regulation (GDPR) and Sarbanes-Oxley (SOX), and establish clear data governance policies. Encryption, role-based access controls, regular security audits, and incident response protocols should be standard practice in any AI-integrated accounting infrastructure.

Ethical and Bias Considerations

Ethical concerns related to AI in accounting often arise from the data that feeds the system. Machine learning models learn patterns from historical data, and if those data sets contain embedded biases—such as preferential treatment of certain vendors, inconsistent policy enforcement, or regional disparities—AI may replicate and amplify those biases.

For instance, an AI model trained to automate expense approvals may begin to disproportionately reject claims from certain departments or geographic regions due to historical anomalies in the dataset. Such unintended discrimination can have serious implications, including reputational damage and legal liability.

Moreover, ethical dilemmas emerge when AI is used to make borderline decisions—for example, determining creditworthiness, risk profiling, or fraud suspicion. Without human input, these decisions can become impersonal and potentially unjust.

To mitigate ethical risks, organizations should implement fairness checks, conduct bias audits, and involve cross-disciplinary teams—including ethicists, data scientists, and financial experts—in the AI design and deployment process. Transparency with users—whether employees, auditors, or customers—regarding how AI is used and what data it relies on is also essential for building trust.

Organizational Resistance and Change Management

Despite the potential advantages, not all accounting departments embrace AI with enthusiasm. Change management remains a significant barrier to successful adoption. Resistance may stem from fear of obsolescence, lack of familiarity with AI tools, or organizational inertia rooted in long-established processes.

Senior professionals may be hesitant to trust AI outputs, while junior staff may be uncertain about how automation will affect their future roles. In such environments, even the most advanced AI systems can be underutilized or improperly implemented.

To overcome resistance, leadership must champion a culture of innovation and continuous learning. Successful change management includes:

- Communicating the strategic value of AI clearly and frequently

- Offering hands-on training and support

- Highlighting early wins and showcasing measurable benefits

- Providing clear pathways for career advancement in an AI-enabled context

Change should be positioned not as a threat but as an opportunity—an evolution of roles rather than an elimination.

Regulatory and Legal Uncertainty

The regulatory landscape surrounding AI in accounting is still evolving. Unlike traditional financial systems governed by clear standards (e.g., IFRS, GAAP), AI models are relatively unregulated. This introduces uncertainty, particularly in jurisdictions where regulators are beginning to scrutinize algorithmic decision-making.

Questions that remain unresolved include:

- Should AI-generated financial decisions be subject to audit standards?

- Who is liable when an AI system makes a financial error?

- What disclosures are required about AI use in financial reporting?

Regulators are increasingly exploring frameworks to address these questions, but in the interim, companies must operate in a gray zone. The prudent path forward involves proactive self-regulation—adopting internal controls, transparency protocols, and documentation standards that preempt regulatory scrutiny.

In conclusion, the integration of AI in accounting brings not only opportunities but also a host of new responsibilities. Addressing these challenges proactively will ensure that the profession evolves in a way that is inclusive, ethical, and future-ready.

Toward an AI-Augmented Accounting Profession

As artificial intelligence continues to evolve, its integration into the accounting profession will intensify, bringing new possibilities and fresh challenges. While early applications have focused primarily on automating repetitive tasks, the next decade will likely see AI systems becoming more sophisticated, proactive, and deeply embedded in every facet of financial operations. For accountants, this transition will represent not merely an incremental change, but a paradigm shift in how value is created, measured, and delivered.

From Automation to Augmentation

The first wave of AI adoption in accounting has largely centered on task automation—replacing manual processes with intelligent systems. Moving forward, the emphasis will shift toward augmentation, wherein AI serves as a partner that enhances human capability rather than substituting it outright. In this augmented model, AI systems will:

- Continuously monitor financial ecosystems for risks and opportunities.

- Generate predictive insights that inform executive decisions in real time.

- Automate routine components of complex workflows while leaving final judgments to humans.

For example, instead of simply reconciling transactions, AI-powered platforms will evaluate the strategic implications of variances, recommend corrective actions, and model the long-term impacts of those actions. Accountants will increasingly spend their time validating these insights and integrating them into business strategies.

The Rise of AI Co-Pilots and Autonomous Finance Systems

Emerging trends indicate that AI co-pilots—virtual assistants capable of interpreting queries and producing actionable outputs—will become mainstream within the next several years. These systems will be embedded directly into enterprise accounting platforms, allowing professionals to ask natural language questions such as:

- “What is our forecasted cash flow for the next two quarters?”

- “Which expense categories are exceeding budget by more than 10%?”

- “What are the compliance risks associated with this transaction?”

AI co-pilots will deliver instant responses backed by data analysis, dynamic visualizations, and scenario modeling. In parallel, fully autonomous finance systems will handle certain back-office processes end to end—such as purchase-to-pay and order-to-cash workflows—requiring minimal human intervention.

While these developments will dramatically improve efficiency, they will also necessitate robust governance frameworks to manage accountability, transparency, and ethical considerations.

Evolving Skillsets and Professional Development

In an AI-augmented future, accountants will require a diverse skillset blending financial expertise, technological fluency, and soft skills. Core competencies will include:

- Data literacy: Understanding how data is structured, analyzed, and visualized.

- AI literacy: Grasping the principles behind machine learning models and knowing how to interpret their outputs.

- Critical thinking: Evaluating AI recommendations in the context of business strategy and regulatory frameworks.

- Communication: Translating complex financial insights into actionable guidance for non-financial stakeholders.

- Ethical judgment: Ensuring that automation aligns with organizational values and legal obligations.

Professional certification bodies and educational institutions are already adapting to this reality by integrating AI-related modules, data analytics courses, and practical training in emerging technologies. Lifelong learning will no longer be optional but an essential element of career sustainability.

Regulatory Standardization and Accountability

Another defining feature of the future landscape will be the maturation of regulatory standards governing AI in accounting. Governments and oversight bodies are actively considering frameworks to address:

- Disclosure requirements for AI-assisted financial statements.

- Accountability for errors or bias introduced by AI systems.

- Minimum standards for transparency and explainability.

These developments will introduce clarity while also raising the bar for compliance. Organizations that proactively adopt best practices in AI governance will be well-positioned to navigate this evolving regulatory environment.

Cultural Transformation and Organizational Mindset

Perhaps the most challenging aspect of the coming decade will be fostering a cultural shift that fully embraces AI’s role in accounting. While technology adoption is a critical step, the mindset with which it is approached will ultimately determine its success.

Forward-looking organizations will recognize that AI is not simply a tool for cost reduction but a catalyst for redefining how finance contributes to business value. They will cultivate cultures where continuous improvement, experimentation, and collaboration between humans and machines are the norm.

Such environments will attract top talent, foster innovation, and build resilience in an increasingly complex economic landscape.

Final Reflections

The future of accounting in an AI-driven world will be characterized by unprecedented opportunities to elevate the profession. Repetitive tasks will recede into the background, while strategic thinking, ethical stewardship, and creative problem-solving take center stage. AI will not replace accountants but will empower them to do more impactful work than ever before.

However, success in this new era will require intentional action—investing in technology, developing talent, reimagining processes, and embracing a culture of adaptability. The organizations and professionals who navigate this transformation with clarity and purpose will be the ones to define the next chapter of accounting.

References

- PwC – The impact of AI on accounting and auditing

https://www.pwc.com/gx/en/services/audit-assurance/assets/impact-of-ai-on-accounting.pdf - Deloitte – AI in the Finance Function

https://www2.deloitte.com/insights/us/en/focus/cognitive-technologies/artificial-intelligence-finance.html - McKinsey – The future of work in financial services

https://www.mckinsey.com/industries/financial-services/our-insights/the-future-of-work-in-financial-services - ACCA – Machine learning in accounting and finance

https://www.accaglobal.com/gb/en/professional-insights/technology/machine-learning.html - AICPA – Automation and the accounting profession

https://www.aicpa-cima.com/news/accounting-automation-impact - IFAC – Accountants and AI: Navigating a changing landscape

https://www.ifac.org/knowledge-gateway/preparing-future-ready-professionals/discussion/accountants-and-ai - Gartner – Future of finance: AI and automation

https://www.gartner.com/en/articles/the-future-of-finance-ai-automation-and-analytics - IBM – Accounting use cases for AI and automation

https://www.ibm.com/blogs/watson/ai-use-cases-in-accounting/ - KPMG – Reinventing finance with intelligent automation

https://home.kpmg/xx/en/home/insights/2020/03/reinventing-finance-intelligent-automation.html - Oracle – How AI is shaping the future of finance

https://blogs.oracle.com/erp/post/how-ai-is-shaping-the-future-of-finance