AI Index Enterprise Tech Strategy Insights: Navigating the Future of Intelligent Transformation

In recent years, artificial intelligence (AI) has rapidly evolved from a specialized field of research into a cornerstone of enterprise transformation. As organizations worldwide integrate AI across operations, strategy, and innovation, the need for a structured, data-driven understanding of the AI landscape has become paramount. The AI Index, published annually by Stanford’s Human-Centered AI Institute (HAI), has emerged as a comprehensive and authoritative resource that tracks, synthesizes, and interprets global AI trends. It provides a vital framework for enterprise leaders to assess developments in AI capability, deployment, talent dynamics, investment flows, and societal impact.

The AI Index serves as a benchmark, offering measurable indicators across a range of variables such as model performance, training cost, compute intensity, research output, and ethical considerations. For chief information officers (CIOs), chief technology officers (CTOs), and other enterprise technology strategists, the AI Index is more than just a report—it is a strategic tool. It enables organizations to align their internal capabilities with the broader pace of innovation, evaluate emerging competitive threats, and identify areas where AI investment can deliver disproportionate value.

As enterprises shift from experimentation to scaled deployment of AI, the data and insights from the AI Index become increasingly relevant. Companies are under pressure to make informed decisions on AI infrastructure, talent acquisition, vendor partnerships, and governance. The AI Index provides a longitudinal perspective that cuts through the hype and helps leaders prioritize investments based on validated trends and performance benchmarks.

Moreover, the AI Index does not merely reflect the state of the field—it influences it. The widespread dissemination of its findings shapes academic focus, regulatory debate, and funding priorities. By bringing transparency to AI’s rapid development, it helps democratize access to strategic intelligence and fosters responsible innovation.

In this blog post, we will explore the AI Index through the lens of enterprise technology strategy. We will first examine what the AI Index is and why it matters to business leaders. Then, we will delve into the latest insights derived from the report, followed by a discussion on how those insights translate into actionable enterprise strategies. We will also highlight how companies can future-proof their AI investments by continuously integrating data from the AI Index into strategic planning cycles.

The AI Index — What It Is and Why It Matters

The AI Index has emerged as a pivotal tool for comprehending the multifaceted evolution of artificial intelligence. Developed and published annually by Stanford University’s Human-Centered Artificial Intelligence Institute (HAI), the AI Index offers a data-rich, empirical snapshot of the state of AI worldwide. By consolidating metrics from academic research, private sector development, policy trends, and economic impacts, the AI Index provides a comprehensive and longitudinal view of the AI ecosystem. For enterprise decision-makers, the AI Index is indispensable—not only as a benchmark of technological progress but also as a strategic guide for investments, partnerships, and innovation planning.

Origins and Evolution of the AI Index

First launched in 2017, the AI Index was created to address a significant gap in the public understanding of AI development. While technical advancements were accelerating, there was no single source that objectively measured progress across the field. Over time, the Index has expanded in scope and depth, incorporating metrics related to research publications, model benchmarking, compute costs, ethics and fairness evaluations, open-source contributions, public perceptions, and AI talent flows. It serves as a living document, updated annually to reflect the dynamic pace of innovation and disruption in AI.

From its inception, the AI Index was intended to be accessible not only to researchers and policymakers, but also to executives, journalists, educators, and technologists. Its evolution has paralleled the growing societal and economic relevance of AI, capturing trends that have direct implications for corporate strategy and national competitiveness.

Core Metrics and Dimensions

The AI Index is organized around several core dimensions that collectively map the terrain of AI progress. These include:

- Research and Development: Number of peer-reviewed papers, citations, and conference participation.

- Technical Performance: Benchmark scores for image recognition, natural language understanding, speech recognition, and reinforcement learning tasks.

- Economic Impact: Corporate investments, venture capital trends, and job market indicators related to AI roles.

- Education and Talent: Degree programs, AI coursework enrollment, and global distribution of AI talent.

- Ethics and Policy: Regulatory activity, ethical evaluations, and incidents of bias or misuse.

- Public Perception: Surveys on AI trust, acceptance, and expectations among citizens worldwide.

By structuring its findings across these dimensions, the AI Index delivers a nuanced and granular understanding of AI’s global trajectory. Enterprise leaders can use these insights to better grasp where innovation is accelerating, where risk is materializing, and where opportunities are emerging.

Strategic Relevance for the Enterprise

In an enterprise context, the AI Index functions as both a mirror and a compass. It reflects where the broader AI field currently stands and indicates where it is heading. For CIOs and CTOs, it offers evidence-based input into strategic decisions regarding R&D investments, infrastructure provisioning, and capability development.

One of the most salient areas for enterprises is the model performance vs. compute trade-off. The AI Index documents how performance gains increasingly require disproportionate increases in compute resources and energy consumption. This has direct implications for procurement strategy, sustainability initiatives, and vendor negotiation. Companies must balance the desire for cutting-edge AI functionality with the realities of operational cost and environmental responsibility.

Additionally, the Index’s talent tracking enables firms to calibrate their workforce strategy. By analyzing global trends in AI job postings, salary benchmarks, and academic output, companies can assess where to locate AI hubs, how to attract top-tier talent, and when to reskill existing staff. This intelligence is particularly critical in a labor market where AI expertise remains in high demand and short supply.

Democratizing Insight and Fostering Alignment

Another reason the AI Index is of great significance to enterprises is its role in democratizing insight. By publishing publicly accessible data and visualizations, it reduces the asymmetry of information that can otherwise favor a handful of leading technology firms. It allows companies outside the traditional AI elite to align themselves with state-of-the-art developments and identify partners whose capabilities match their strategic priorities.

Moreover, the AI Index promotes cross-sectoral alignment. Enterprises can align their AI strategies with policy trends, ethical standards, and societal expectations. This is especially pertinent in industries like finance, healthcare, and energy, where the regulatory landscape is evolving in parallel with AI capabilities.

Leveraging the AI Index for Competitive Advantage

Organizations that embed the AI Index into their strategic planning process are better positioned to anticipate disruption and adapt proactively. Rather than relying solely on anecdotal evidence or vendor-driven marketing, they gain access to a macro-level view of innovation trajectories. This enables the formulation of long-term roadmaps that are grounded in empirical trends.

For instance, a multinational logistics firm may use the Index to evaluate the maturity of natural language processing (NLP) tools for global customer service automation. A pharmaceutical company might track reinforcement learning benchmarks as part of its drug discovery AI strategy. A financial institution could benchmark its AI governance policies against emerging norms identified in the Index.

In each case, the AI Index transforms abstract data into actionable intelligence. It empowers enterprises not only to adopt AI but to do so in a manner that is efficient, responsible, and aligned with long-term goals.

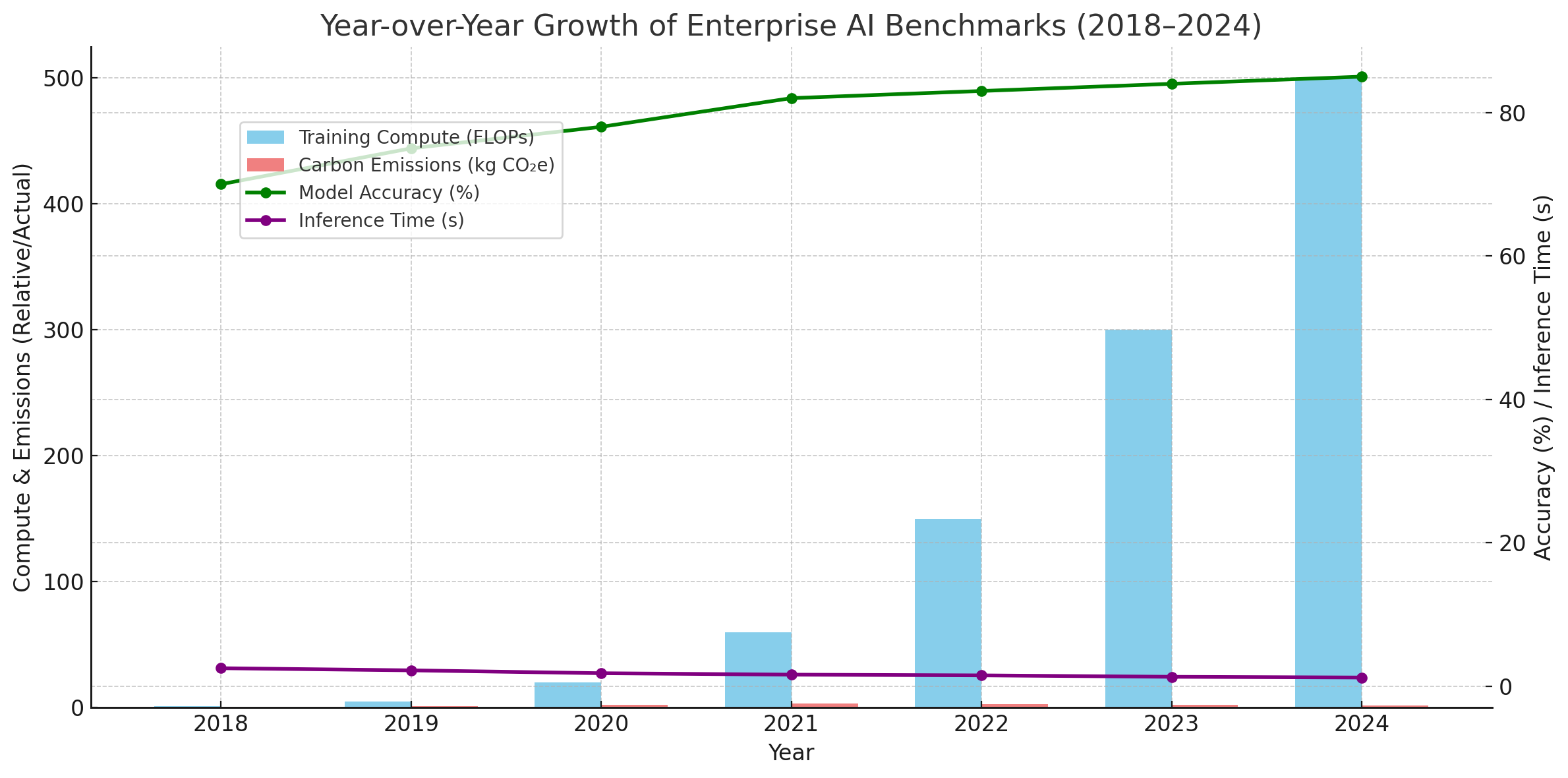

This bar and line combination chart visualizes the year-over-year progression of key enterprise-relevant AI benchmarks tracked in the AI Index between 2018 and 2024. It highlights four core indicators:

- Training Compute Requirements (FLOPs)

- Inference Time (Seconds per Query)

- Model Accuracy on Industry Standard Tasks (e.g., SQuAD, ImageNet)

- Carbon Emissions per Model (kg CO₂e)

This chart underscores the performance-resource trade-offs enterprises must navigate, reinforcing the strategic value of balancing innovation with sustainability and cost-efficiency.

Strategic Enterprise Insights from the Latest AI Index

The most recent edition of the AI Index delivers a comprehensive array of findings that hold significant strategic implications for enterprise technology planning and decision-making. In an era where artificial intelligence is becoming integral to organizational competitiveness, the insights distilled from this annual report offer a vital knowledge advantage. From shifting patterns in AI model capabilities to changes in talent mobility and investment flows, the AI Index provides an empirical foundation upon which enterprise leaders can build resilient, future-ready strategies.

This section unpacks key strategic insights from the latest AI Index, drawing attention to the indicators most relevant to enterprise transformation.

The Performance-Compute Trade-off Is Intensifying

One of the most pronounced trends documented in the AI Index is the growing divergence between AI performance improvements and the compute resources required to achieve them. Over the past year, large language models (LLMs), diffusion models, and vision transformers have demonstrated incremental gains in accuracy and generalization. However, these gains are increasingly coming at the cost of exponentially higher training compute and energy expenditure.

For enterprise technology strategists, this trend necessitates a fundamental reassessment of deployment feasibility and infrastructure planning. While leading-edge models may deliver superior results, their hardware requirements and associated costs may render them impractical for enterprise-scale applications—especially in edge computing or resource-constrained environments. Enterprises must increasingly weigh the trade-offs between deploying state-of-the-art models versus leveraging smaller, fine-tuned models optimized for specific tasks.

Additionally, sustainability concerns are coming to the fore. As the carbon footprint of model training becomes more widely scrutinized, organizations are under pressure to select models and training paradigms that align with ESG (Environmental, Social, and Governance) objectives. The AI Index’s carbon accounting data is now an essential input into corporate sustainability reports and procurement criteria.

Talent Dynamics Are Redefining the Global AI Workforce

The Index highlights continued volatility in the global distribution of AI talent. While the United States remains the dominant hub for top-tier AI research and employment, other regions—notably China, the European Union, and India—are gaining ground through aggressive policy support, academic expansion, and public-private partnerships.

Enterprise strategists must interpret these dynamics in two distinct contexts: talent acquisition and capability localization. With AI talent in high demand and short supply, companies that proactively map labor market trends are better positioned to recruit, retain, and upskill their workforce. The AI Index provides granular data on AI job postings, salary benchmarks, and migration flows, enabling firms to target high-potential regions and universities.

Notably, the 2024 Index shows a marked increase in AI job growth in mid-tier cities with strong technical universities—such as Austin, Bangalore, and Tel Aviv. This dispersion of talent creates new opportunities for enterprises to establish AI centers of excellence outside traditional hubs like Silicon Valley or London, thereby reducing operating costs while maintaining access to skilled labor.

Furthermore, the Index reveals a sharp uptick in cross-disciplinary AI education programs that combine technical training with domain expertise (e.g., AI in law, healthcare, or logistics). Enterprises should view these programs as pipelines for future-ready hires capable of integrating AI capabilities into vertical-specific workflows.

Investment Patterns Signal a Shift Toward Domain-Specific AI

The AI Index also tracks the flow of capital into AI-related ventures, offering insight into how the innovation landscape is evolving. In 2023, global investment in AI startups reached an estimated $95 billion, with over 60% of that funding directed toward domain-specific applications such as AI for drug discovery, legal research automation, supply chain optimization, and financial modeling.

This trend suggests that the era of general-purpose AI models dominating venture capital interest is giving way to specialized solutions that promise rapid integration and measurable ROI in defined contexts. For enterprise strategists, this shift reinforces the importance of identifying and partnering with AI startups that have deep domain knowledge and tailored offerings.

Moreover, the Index notes that corporate R&D spending on AI continues to grow, particularly among Fortune 500 firms. However, this growth is being channeled into strategic areas such as model distillation, responsible AI frameworks, and toolchains that facilitate deployment and compliance. This internal reallocation of resources suggests that enterprises are maturing in their AI adoption, moving beyond experimentation toward full-stack operationalization.

Case Studies in Strategic AI Index Utilization

To illustrate the practical relevance of the AI Index in enterprise strategy, the report features multiple case studies of organizations that have successfully leveraged its insights.

One such example is a global insurance firm that used AI Index data to benchmark its use of NLP models for claims processing. By comparing its internal performance metrics against open-source model benchmarks reported in the Index, the firm identified underutilized capabilities and recalibrated its vendor selection strategy. The result was a 30% reduction in processing time and improved customer satisfaction.

Another example involves a European pharmaceutical company that employed talent distribution data from the Index to select a location for its new AI R&D lab. By identifying cities with a high concentration of AI graduates and low competition from tech giants, the company reduced talent acquisition costs while accelerating time-to-market for AI-driven drug discovery pipelines.

Such case studies reinforce the Index’s utility not merely as an academic or policy document, but as a tactical asset for operational decision-making.

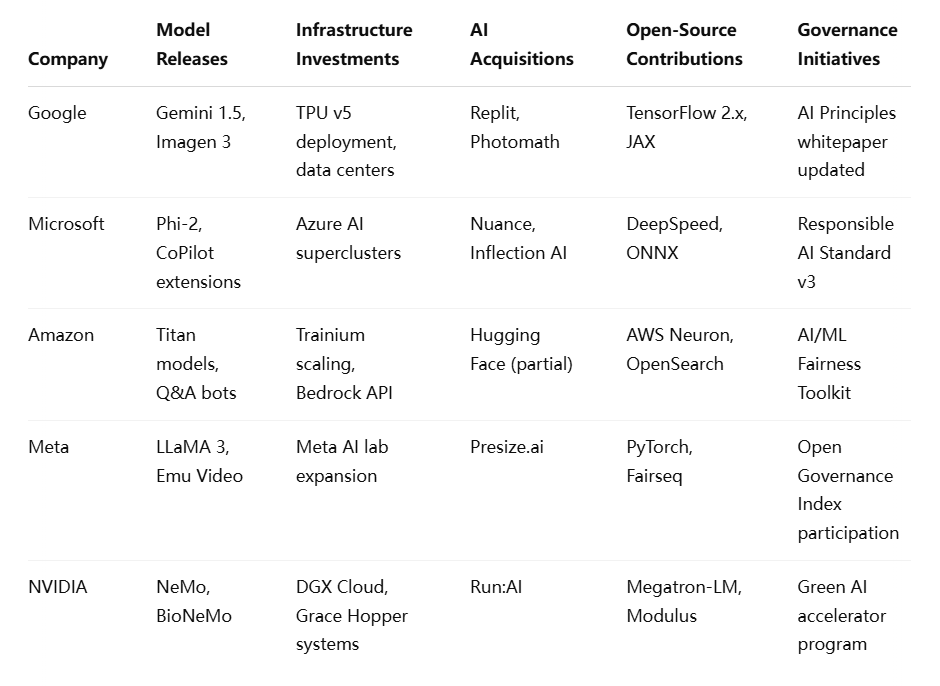

Benchmarking Against Industry Leaders

In a rapidly evolving landscape, competitive benchmarking is crucial. The AI Index provides detailed information on the AI activities of leading technology firms, enabling enterprises to assess how their strategies align or diverge from those of market leaders.

The table below summarizes recent strategic moves by five major technology companies—Google, Microsoft, Amazon, Meta, and NVIDIA—based on data aggregated from the AI Index.

This comparative analysis demonstrates the diverse approaches enterprises are taking in their AI strategies—from vertically integrated model stacks and proprietary hardware to ethical frameworks and open-source leadership. Enterprises studying these patterns can identify white space opportunities, anticipate market moves, and adapt accordingly.

In sum, the AI Index serves as a robust strategic asset, offering insights that span technical feasibility, organizational capability, and competitive positioning. By integrating its findings into executive decision-making, enterprises can build AI strategies that are not only informed but also differentiated and future-proof.

Enterprise Tech Strategy Implications

The insights presented in the AI Index are not merely informative—they are transformative. For enterprise leaders, the Index provides the critical data points necessary to recalibrate technology strategies in the face of accelerating change. As AI capabilities evolve rapidly and adoption deepens across industries, enterprises must reshape their strategic frameworks to address emerging opportunities and challenges. In this section, we explore how findings from the AI Index are driving key shifts in enterprise tech strategy across four core areas: infrastructure investment, vendor selection, ethical governance, and resource allocation.

Infrastructure Investment Realignment

Perhaps the most immediate implication of the AI Index is the need to reconfigure enterprise IT infrastructure to meet the demands of modern AI workloads. As the Index demonstrates, state-of-the-art models require exponential growth in compute, memory, and bandwidth. Enterprises are consequently reassessing their data center strategies, exploring hybrid cloud solutions, and investing in specialized hardware accelerators such as GPUs, TPUs, and FPGAs.

The move toward heterogeneous computing environments is being further accelerated by trends in model complexity and training volume. According to the AI Index, the average parameter count of enterprise-scale models has increased fivefold since 2020, while training durations have grown proportionally. To manage these requirements, enterprises are adopting cloud-native architectures with modular AI infrastructure, such as Kubernetes-integrated ML pipelines and AI-optimized storage solutions.

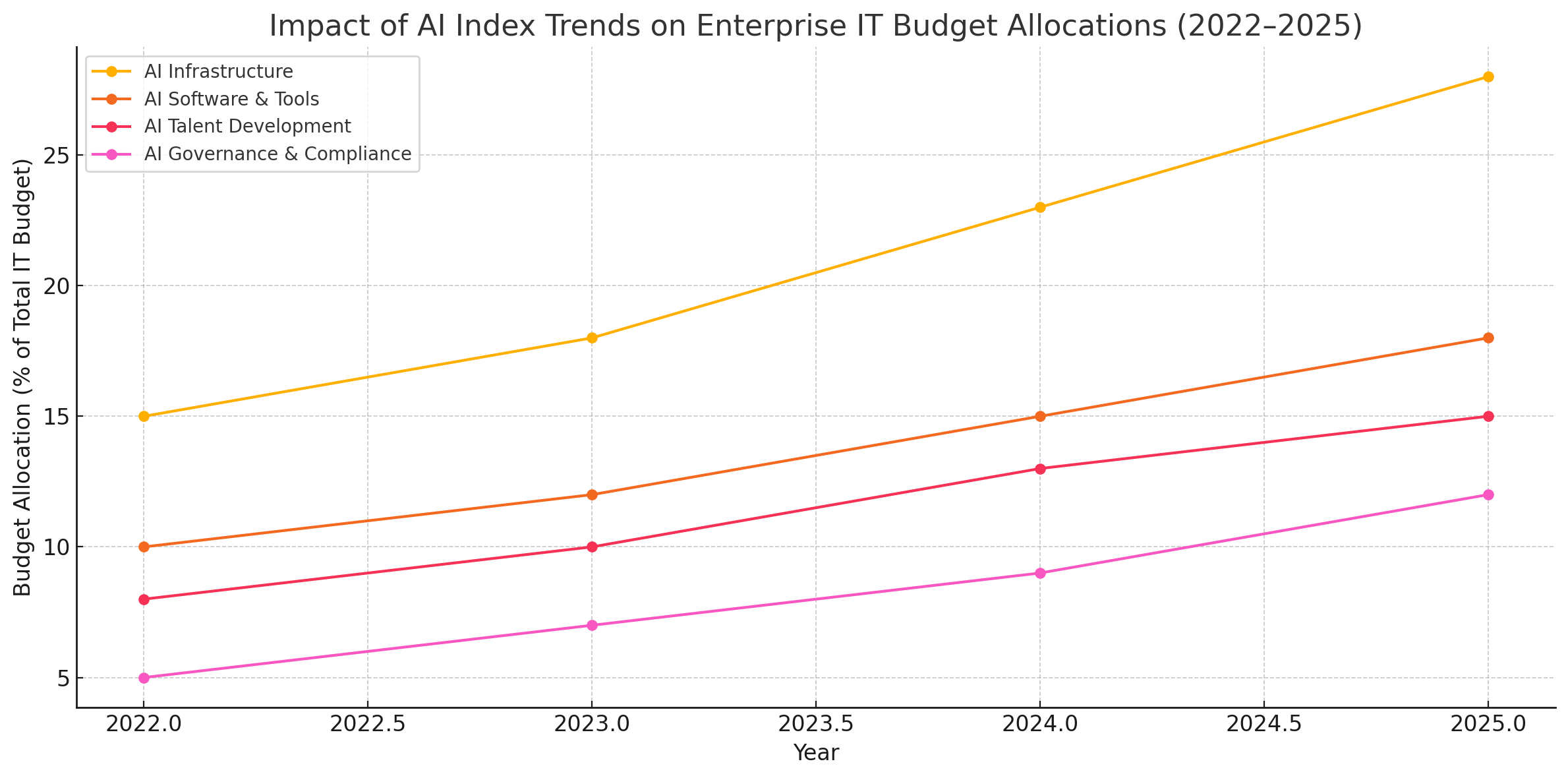

Chart 2 underscores these developments, illustrating the growing percentage of IT budgets allocated to AI infrastructure—from 15% in 2022 to a projected 28% in 2025. This budgetary reallocation signals a strategic shift: AI is no longer a peripheral IT concern but a core driver of enterprise architecture and digital transformation.

Vendor Evaluation Through the Lens of AI Benchmarks

The AI Index also redefines the criteria by which enterprises evaluate their technology vendors. Traditional benchmarks such as latency, uptime, and total cost of ownership are being supplemented by AI-specific metrics, including model accuracy, fairness scores, interpretability, and sustainability impact.

Increasingly, enterprises are integrating AI Index benchmarks directly into their RFP (Request for Proposal) and vendor assessment frameworks. For instance, organizations deploying NLP tools may refer to the Index’s performance rankings on language understanding tasks (e.g., SQuAD, MMLU) to determine whether a vendor’s solution is sufficiently robust for enterprise use. Similarly, for image recognition or recommendation systems, AI Index model comparison charts serve as critical validation tools during procurement cycles.

Moreover, the growing emphasis on responsible AI—highlighted extensively in the Index—means that vendors must demonstrate compliance with ethical and legal standards. Enterprises are prioritizing partnerships with providers that can articulate clear AI governance policies, provide explainability tools, and support auditability. The Index’s reporting on AI incident databases and regulatory movements (such as the EU AI Act) provides invaluable guidance for risk-aware vendor selection.

Ethics, Compliance, and Governance Integration

One of the most consequential areas illuminated by the AI Index is the intersection of AI adoption and corporate governance. As AI becomes embedded in high-stakes decision-making—ranging from loan approvals to patient diagnoses—enterprises face increasing pressure to ensure their AI systems are compliant, transparent, and accountable.

The 2024 AI Index documents a substantial rise in regulatory activity worldwide, with over 30 new national-level initiatives focused on AI regulation, auditing, and transparency. These developments have elevated AI governance from a niche concern to a board-level priority. In response, enterprises are incorporating ethical principles into the core of their technology strategies.

Governance frameworks are being operationalized through:

- AI ethics boards and review committees

- Internal fairness audits and bias detection protocols

- Model documentation standards (e.g., model cards, datasheets for datasets)

- Third-party AI risk assessments

Budget allocations reflect this trend: Chart 2 shows that spending on AI governance and compliance is expected to rise from 5% in 2022 to 12% by 2025. This growth indicates that ethical and legal alignment is becoming an operational mandate, not just a reputational concern.

Enterprises are also turning to the AI Index to track best practices in responsible AI. The Index provides comparative data on governance approaches adopted by leading organizations, enabling companies to benchmark their own policies against those of industry peers and regulatory leaders.

Strategic Resource Allocation and Talent Development

Another area of transformation driven by AI Index insights is enterprise resource planning—particularly in relation to talent development and internal capability building. As the Index shows, the demand for AI-literate professionals is outstripping supply, particularly in areas such as machine learning engineering, data science, and AI product management.

Enterprises are responding with aggressive internal training initiatives, cross-skilling programs, and academic partnerships. Many are using the AI Index to identify emerging skill gaps, forecast demand for specific AI capabilities, and prioritize investment in training platforms or certification programs.

In addition to workforce development, organizations are reallocating resources to build integrated AI development environments. This includes the deployment of MLOps toolchains, model versioning platforms, automated testing systems, and real-time monitoring dashboards. These investments are critical to reducing the time from experimentation to production and ensuring the reliability of deployed models.

Chart 2 captures this shift, showing a steady increase in budget share for AI talent development—from 8% in 2022 to an anticipated 15% in 2025. As AI becomes foundational to enterprise operations, the ability to cultivate and retain a capable internal workforce will determine long-term viability.

AI Index as a Strategic Planning Tool

Ultimately, the AI Index is becoming an integral part of strategic planning processes across leading enterprises. Rather than treating the Index as an annual report, progressive organizations are embedding its insights into quarterly reviews, scenario modeling, and investment prioritization.

For example, a global retailer may use the Index to inform its omnichannel personalization roadmap by identifying breakthroughs in recommendation algorithms. A healthcare provider may leverage trend data on AI-enabled diagnostics to shape its patient care automation strategy. A manufacturing conglomerate could analyze AI Index charts on robotics and computer vision to decide between in-house development and third-party solutions.

By aligning strategic planning with AI Index findings, enterprises ensure that their technology roadmaps are grounded in empirical trends, not speculative forecasts. This approach enables smarter, faster, and more resilient decision-making—qualities that are essential in an environment of continuous disruption.

In conclusion, the AI Index is not simply a repository of data—it is a lens through which the future of enterprise technology can be understood and navigated. From reshaping infrastructure to guiding ethical deployment, from optimizing budget allocations to enabling informed vendor selection, the Index provides a structured, data-driven foundation for AI-first strategy formulation. As AI continues to mature, enterprises that embrace the Index as a strategic resource will be best positioned to lead in innovation, resilience, and responsible growth.

Future-Proofing with AI Index Insights

As artificial intelligence matures from a high-impact innovation into a foundational enterprise capability, the imperative to future-proof AI strategies has never been more critical. Enterprises are no longer solely focused on adoption and integration; they are increasingly seeking ways to ensure resilience, scalability, and ethical continuity in their AI investments. The AI Index serves as a key instrument in this forward-looking strategic orientation.

This section explores how enterprises can utilize the AI Index to build predictive capabilities, engage in scenario planning, enhance internal analytical frameworks, and prepare for long-term competitive positioning in a rapidly evolving AI ecosystem.

Predictive Modeling for Strategic Forecasting

The AI Index offers more than retrospective data; its longitudinal tracking of trends enables the construction of predictive models that inform strategic planning. By analyzing multi-year trajectories in compute costs, model efficiency, ethical incidents, and regulatory developments, enterprises can anticipate key inflection points in AI development and adapt accordingly.

For instance, the sustained acceleration in training compute requirements—alongside diminishing marginal gains in model performance—suggests an approaching threshold where cost-effectiveness will dominate innovation strategies. Enterprises equipped with this foresight may begin prioritizing research in efficient model architectures (e.g., sparse models, distillation) or hybrid deployment models that balance performance with sustainability.

Additionally, the Index's timeline of regulatory proposals provides early warning signals for compliance risks. Enterprises can proactively align their AI governance policies with forthcoming legislative frameworks, such as the EU AI Act or proposed U.S. algorithmic accountability rules. The ability to predict where legal boundaries are headed reduces operational friction and reputational exposure.

By incorporating AI Index data into their strategic forecasting models, companies gain the ability to plan across multiple time horizons—short-term operational optimization, mid-term capability scaling, and long-term innovation trajectories.

Scenario Planning: Navigating Uncertainty with Empirical Signals

In a landscape marked by volatility and rapid technological evolution, scenario planning has become essential for resilient enterprise strategy. The AI Index enables organizations to design more robust scenario models by anchoring potential futures in data rather than conjecture.

For example, the Index’s data on talent scarcity and salary inflation allows HR leaders to model the implications of continued shortages in AI expertise. Scenarios might include:

- Talent bottlenecks requiring aggressive reskilling programs

- Automation of low-complexity AI development tasks

- Geographic relocation of AI hubs to tap into new labor pools

Similarly, data on the rising carbon intensity of AI systems can support environmental scenario planning. Enterprises concerned with sustainability targets may model scenarios where AI usage is constrained by carbon budgets or where regulatory penalties are introduced for inefficient models.

This form of data-grounded scenario planning improves executive decision-making by reducing cognitive biases and enabling quantified trade-offs. Enterprises that embed AI Index insights into their planning processes can develop agile responses to external shocks—be they technological breakthroughs, supply chain disruptions, or policy shifts.

Building Internal Analytics Capabilities Around the AI Index

To fully leverage the strategic potential of the AI Index, enterprises must develop internal capabilities to interpret, analyze, and contextualize its data. This often requires the creation of dedicated AI strategy functions that operate at the intersection of technology, risk, and innovation.

Leading firms are investing in the following organizational enablers:

- AI Intelligence Units: Cross-functional teams that monitor AI trends, analyze implications for core business units, and present findings to leadership on a quarterly basis.

- Custom Dashboards: Visualization tools built on top of AI Index data, tailored to reflect the enterprise’s KPIs, industry benchmarks, and strategic priorities.

- Benchmarking Frameworks: Standardized templates for comparing internal performance with AI Index-reported metrics on model accuracy, training cost, inference speed, and governance maturity.

Such capabilities transform the AI Index from a static reference document into a dynamic decision-support system. Enterprises are able to build internal consensus, measure progress, and adjust course based on objective, transparent signals.

Moreover, by institutionalizing this capability, companies reduce reliance on external consultants and vendors for trend interpretation, thereby gaining autonomy and speed in strategic decision-making.

Talent Strategy and Educational Alignment

Another vital component of future-proofing involves aligning internal talent strategies with the skills and educational pipelines tracked in the AI Index. As the Index shows, the profile of AI talent is evolving—from purely technical roles toward hybrid professionals who combine data fluency with domain expertise, ethics, or policy knowledge.

Enterprises that anticipate this trend are revamping their hiring and training strategies to reflect emerging needs. This includes:

- Collaborating with universities offering interdisciplinary AI programs

- Supporting internal mobility into AI roles through micro-credentialing and mentorship

- Fostering cross-functional teams where data scientists collaborate with ethicists, product managers, and regulatory experts

The AI Index also highlights global hotspots for AI education and innovation. Firms can leverage this intelligence to inform decisions on where to locate innovation labs, R&D centers, or partnership initiatives. By aligning talent acquisition with educational trends, companies ensure a steady supply of relevant skills while enhancing their employer brand in competitive markets.

Positioning for Long-Term Competitive Advantage

Perhaps most critically, the AI Index provides the strategic intelligence needed to position the enterprise for long-term advantage. In a market where differentiation is increasingly driven by data strategy, model effectiveness, and ethical trust, the ability to understand and act upon macro AI trends is a defining capability.

Enterprises that successfully operationalize AI Index insights are able to:

- Identify underexplored innovation frontiers (e.g., edge AI, low-resource languages, AI for scientific discovery)

- Time their market entries and product launches in sync with ecosystem readiness

- Align with policy and social sentiment to avoid backlash and foster legitimacy

- Shape industry standards and participate in governance forums from a position of informed leadership

These outcomes require a mindset shift—from reactive adaptation to proactive orchestration. The AI Index becomes not just a guide, but a lever through which enterprises can shape the future of their industries.

Final Considerations

The act of future-proofing is inherently uncertain, yet the tools available today offer unprecedented clarity. The AI Index stands out as a rare instrument of strategic foresight—empirically grounded, globally informed, and organizationally actionable.

Enterprises that invest in building the capabilities to understand and utilize the AI Index are cultivating more than just technical competency; they are nurturing strategic agility, ethical foresight, and market leadership. In a world where AI continues to redraw the boundaries of what is possible, these attributes are no longer optional—they are existential.

Harnessing the AI Index as a Strategic Imperative

The AI Index has transcended its origins as a monitoring tool and evolved into a strategic asset of profound importance. As artificial intelligence becomes deeply woven into the fabric of enterprise operations, leadership teams can no longer afford to make decisions in a vacuum or rely solely on internal experimentation. Instead, they must navigate an increasingly complex technological, regulatory, and societal landscape with clarity, agility, and foresight. The AI Index delivers precisely the kind of evidence-based intelligence required for this task.

Throughout this blog post, we have examined the multifaceted role of the AI Index in shaping enterprise technology strategy. From illuminating the performance-compute trade-offs of cutting-edge models to mapping global talent shifts, tracking investment patterns, and spotlighting ethical considerations, the Index provides a holistic view of the AI ecosystem. This panoramic perspective enables enterprises to identify both risks and opportunities across every dimension of AI deployment—from infrastructure and software to governance and talent.

Strategically, the AI Index serves as both a diagnostic and a compass. It empowers organizations to benchmark their internal capabilities against global best practices while guiding long-term planning with trend-based forecasting. By embedding the Index into scenario planning, resource allocation, vendor evaluation, and compliance frameworks, enterprises are transforming it into a foundational pillar of their AI operating models.

Crucially, the AI Index supports future-proofing—not through speculation, but through rigorous empirical analysis. In a time when the AI landscape can shift dramatically in the span of a single fiscal quarter, having a stable yet adaptable reference point is invaluable. Enterprises that systematically incorporate AI Index findings into their strategic reviews are better equipped to make high-confidence decisions that anticipate, rather than react to, disruption.

The road ahead for enterprise AI will be defined not only by technical innovation but by strategic coherence and ethical responsibility. In this context, the AI Index is more than an annual report; it is a strategic intelligence system that aligns technological ambition with organizational purpose.

As artificial intelligence continues to redefine industries and competitive paradigms, the organizations that thrive will be those that treat the AI Index not as a static publication but as a dynamic tool—one that informs their strategy, enhances their agility, and elevates their capacity to lead in an intelligent, accountable, and future-ready manner.

References

- Stanford HAI – AI Index Report

https://aiindex.stanford.edu - McKinsey & Company – The State of AI in 2023

https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai - Gartner – Strategic Technology Trends

https://www.gartner.com/en/information-technology - MIT Sloan Management Review – AI and Business Strategy

https://sloanreview.mit.edu/tag/artificial-intelligence - OECD – AI Policy Observatory

https://oecd.ai - World Economic Forum – Artificial Intelligence and Machine Learning

https://www.weforum.org/topics/artificial-intelligence-and-robotics - Accenture – Responsible AI for Enterprises

https://www.accenture.com/us-en/services/applied-intelligence/responsible-ai - PwC – AI Predictions and Trends

https://www.pwc.com/gx/en/issues/analytics/artificial-intelligence.html - IDC – Future of Digital Infrastructure

https://www.idc.com - AI Now Institute – Algorithmic Accountability and Policy

https://ainowinstitute.org